Speaking during Southern Co.’s quarterly earnings call Feb. 20, CEO Chris Womack called 2024 “an outstanding year … both operationally and financially” that left the company “incredibly well positioned” to maintain reliable service for its customers.

The company reported net income of $534 million ($0.49/share) in the fourth quarter of 2024 and full-year net income of $4.4 billion ($4.02/share). This represents a drop from the $855 million reported in the final quarter of 2023, but a significant rise in terms of full-year net income from 2023, when the company reported $4 billion.

Operating revenue for the fourth quarter came to $6.3 billion, up from $6 billion for the same period the year before. For the full year, operating revenue grew from $25.3 billion in 2023 to $26.7 billion for 2024.

Southern’s full-year earnings were “at the very top of our EPS guidance range,” Womack said, citing the target of $3.95 to $4.05 set in last year’s fourth-quarter earnings report. (See Southern Looks Beyond Vogtle After Challenging 2023.)

The primary drivers of the year-over-year growth came from the performance of the company’s electric utilities, with Southern noting that retail electricity sales grew 1% — although this figure was adjusted to account for the impact of Hurricane Helene in September 2024.

The company added 57,000 residential customers in 2024, the highest annual addition on record and more than a quarter of the 200,000 added in the region since 2020. Despite the growth in customers, residential electricity sales fell over the 12-month period by 0.5%; the difference was made up, however, by growth on the commercial and industrial side, with sales in each category rising by 2.2% and 0.7% respectively.

The commercial sales growth was supported by continuing rising demand by data centers and other large loads, with data center electric usage up 17% over the prior year. This represents a continued trend: Southern’s leaders reported strong growth among data center customers in the first quarter of 2024. (See Southern Credits Strong Southeast Economy for Earnings Growth.)

“Our objective is to serve as much of this growing electric load as we can sustainably serve,” Womack said. “The vertically integrated, state-regulated service territories that we are privileged to serve are proving well suited to attracting these large-load customers, and thanks to integrated resource plans and the other orderly processes inherent in our regulated frameworks, our market is also perhaps proven to be better suited than the unregulated markets at effectively deploying new resources to serve them.”

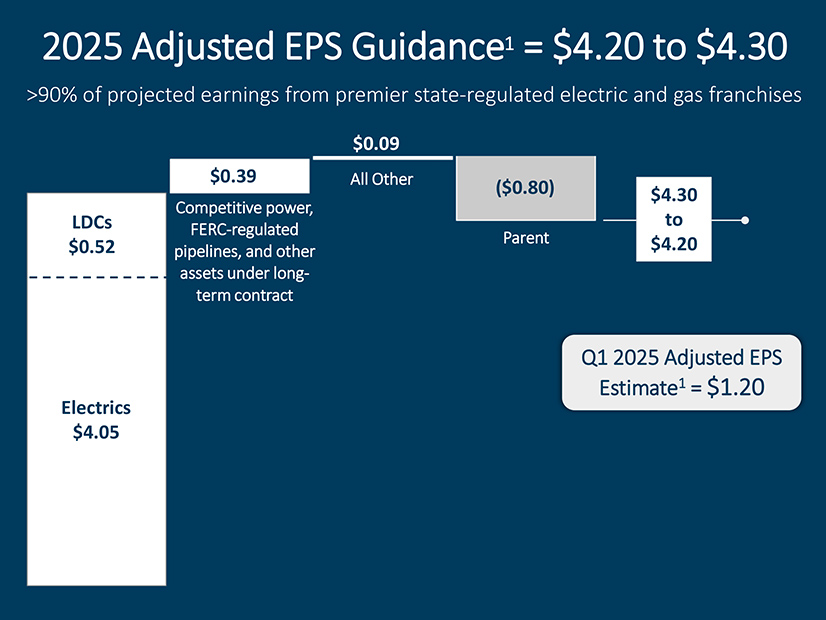

CFO Dan Tucker said Southern expected “strong fundamentals … to support our long-term growth,” setting adjusted EPS guidance for 2025 of between $4.20 and $4.30. At the same time, he acknowledged that the likelihood of higher interest rates could “be a partially offsetting factor.”

Tucker and Womack also highlighted the company’s plans to invest $63 billion in its businesses over the next four years; $50.3 billion of this figure is slated for the company’s regulated electric utilities, with $9.2 billion aimed at the regulated gas utilities and $3.3 billion for interstate gas pipelines, solar construction and maintenance on existing assets.