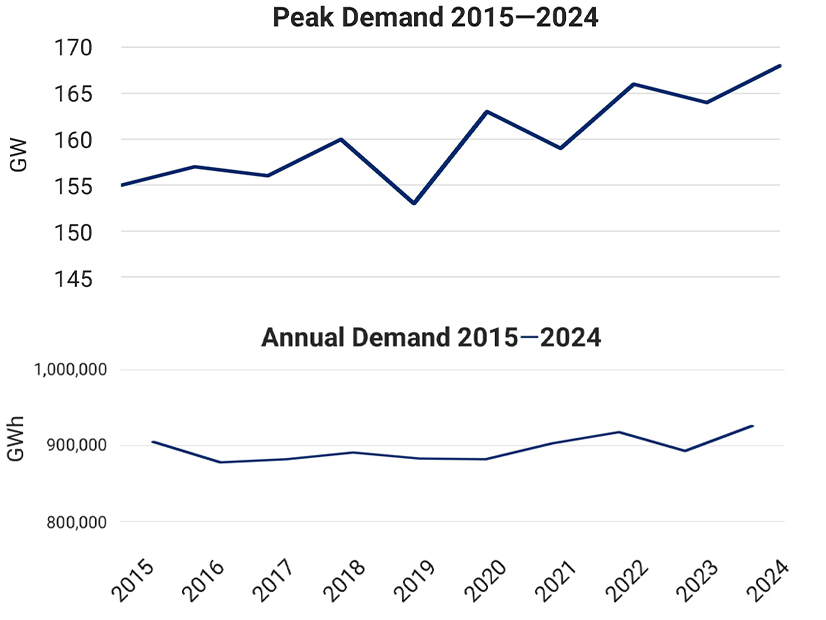

Peak demand in the Western Interconnection hit a record high of 168.2 GW in 2024, reflecting “early effects” of the growth in large loads such as data centers, according to a new WECC report.

Peak demand in the interconnection has grown 8.5% since 2015, when it was 155 GW. The 2024 peak demand, reached on July 10, was the fifth time in the past 10 years that a new record has been set.

Annual demand also set a new record in 2024 of 926,000 GWh.

“Demand growth is higher today than at any other time in the last 20 years,” WECC said in its 2025 State of the Interconnection report, released May 22.

Large-load challenges have been the topic of WECC webinars in recent months, and the organization commissioned a report from Elevate Consulting on large load risks in the Western Interconnection. (See IBR Lessons Can Guide Data Center Challenges, WECC Report Finds.)

WECC’s State of the Interconnection report highlights the large load experience of Arizona Public Service (APS), which expects its annual energy needs to grow by almost 24 GWh between 2023 and 2038. The utility attributes nearly 80% of that growth to data centers and large industrial and manufacturing facilities, especially semiconductor chip factories.

From 2023 to 2031, APS expects nearly 40% growth in its annual peak demand.

Forecasting Issues

The unprecedented growth in demand is creating forecasting challenges, WECC said.

At the interconnection-wide level, annual demand forecasts have been close to actual demand for the past five years, WECC said. But some balancing authorities seem to be better at forecasting than others, according to the report, which pointed to an unnamed BA that had forecasts averaging 32% over its actual demand in all forecast years. And forecasts from other BAs sometimes turn out to be less than actual demand.

“It could be a concerning indicator that demand forecasting practices vary widely,” the report said.

To meet the growing demand, resources are being built at a faster rate. More than 24 GW of new resources were added in 2024, far more than the 10-year annual average of 7.4 GW. The 24 GW represented 80% of the new resources planned to be built last year.

“The West will have to build at the 2024 rate at least to meet forecast demand,” the WECC report said.

Of the new generation added last year, 5.5 GW was natural gas. About three-quarters of the new additions were inverter-based resources: 8 GW of solar, 3 GW of wind and 7 GW of battery storage. That brought the interconnection totals for solar, wind and battery storage to 44 GW, 39.3 GW and 16.7 GW, respectively.

The WECC report also tallied system events across the Western Interconnection.

The number of energy emergency alerts (EEAs) rose sharply, from 21 in 2023 to 30 in 2024. Last year’s total included 18 Level 3 EEAs, the most serious of the three levels in which rolling blackouts may be deployed. Nearly half of those events took place in January 2024 during winter storms Heather and Gerri.

EEAs also lasted longer in 2024. EEA-1 events, in which energy conservation is called for, averaged 4.47 hours last year compared to 1.94 hours in 2023.

The average duration for all EEAs was 4.28 hours in 2024 compared to 2.47 hours the previous year.

“Extreme weather (variability and extreme temperatures) continues to be the biggest driver of EEAs across the interconnection as it leads to surging demand and the potential to impact generation,” WECC said in the report.