ERCOT's blossoming clean energy sector has been threatened by bills that would dampen its growth and future investment, but many of those laws appear to have fallen by the wayside in the Texas legislature's closing days.

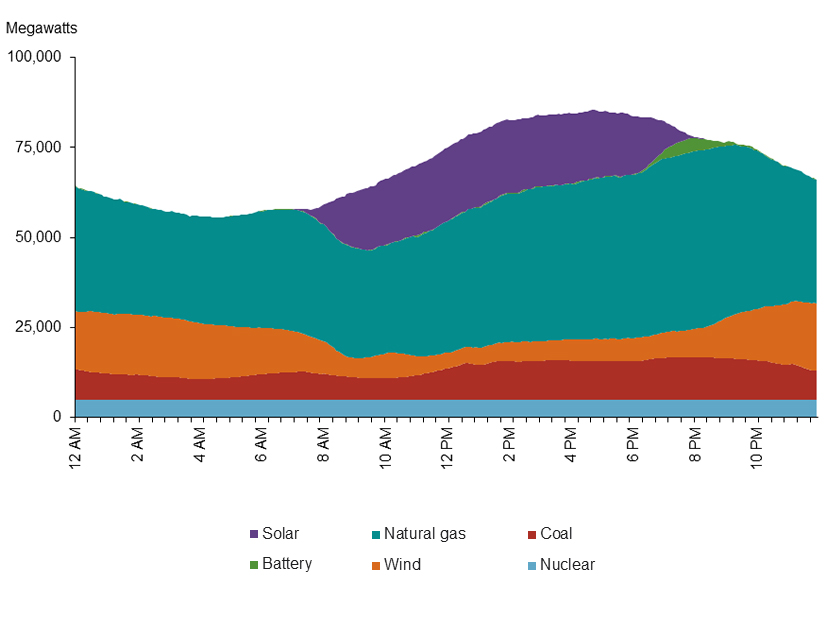

ERCOT breezed through its first heat wave of the season recently using the same valuable resources that helped it survive last year’s record-breaking summer in Texas: wind, solar and batteries.

The most extreme bills targeting those same renewables appear to have died in the Texas State Legislature.

Thanks to a heat dome settling into position and sending temperatures into triple digits from Dallas to Austin, ERCOT projected demand to threaten its all-time peak of 85.5 GW on May 14. The forecast was off. Demand averaged 77.8 GW during the hour ending at 5 p.m., still a record — for the fourth straight month — for May.

Wind and solar accounted for 47% of the demand during that time, when total available capacity was nearly 108 GW. As was the case last summer, batteries began discharging as the sun set on solar resources. Storage provided less than 1 GW in May 2024. A year later, storage can provide nearly 6 GW of energy.

According to the Federal Reserve Bank of Dallas, solar output averaged nearly 17 GW between 11 a.m. and 2 p.m. during the summer of 2024, compared to 12 GW during the same hours in 2023. Between 6 and 9 p.m., storage facilities’ discharge averaged 714 MW in 2024 after averaging 238 MW for those hours in 2023.

ERCOT CEO Pablo Vegas has not been shy about praising renewables’ contribution to the Texas grid, especially that of solar and batteries.

“We’re really continuing to see the benefit of increased resources from the solar and battery perspective,” he told reporters during ERCOT’s Innovation Summit in early May. “That made a very significant difference last summer. I think that we’ll see the benefit of that this summer.”

Thomas Gleeson, chair of the Texas Public Utility Commission, agrees. He said in November 2024 that solar and storage “saved” ERCOT during the summer and prevented emergency conditions like those in 2022. (See ERCOT Continues to Feel the Heat.)

“Solar and storage are key for reliability in this state. … We need them to be successful,” he said during an industry conference.

Texas leads the 49 other states in wind energy and trails only California in solar and batteries. The latter two resources dominate ERCOT’s interconnection queue.

Yet, lawmakers have stuffed the state legislature’s 89th session with bills that would place firming obligations and new interconnection requirements on renewable resources. Other legislation excludes batteries as a dispatchable energy source, contrary to ERCOT’s own contention that storage is dispatchable and is valuable in providing ancillary services and energy arbitrage. Still another law would prevent offshore wind power from gaining a foothold in the Gulf of Mexico.

If cheap renewable energy is so important in helping ERCOT meet ever-increasing demand, why are state lawmakers — framed by The Hill as a “red-on-red” civil war — doing all they can to essentially stifle an industry that helps keep prices around the national median?

“It’s often said, ‘No one’s life, liberty or property are safe when the legislature is in session.’ And this time around, it’s no different with energy,” said Chris Reeder, a partner with Husch Blackwell leading its Texas energy regulatory practice.

“There used to be a time when they just didn’t do much on energy,” he added during an April webinar. “Those days are past us.”

Judd Messer, Texas vice president of the Advanced Power Alliance, told RTO Insider that some lawmakers’ opposition to renewables stems from a “fear of competition and allegiance to a narrow set” of political allies that benefit from limiting clean energy’s growth.

“As technology advances and renewables continue to deliver when the grid is strained, their value becomes increasingly undeniable and opponents find it harder to justify their stances,” he said. “What’s more troubling is that many of their proposals this session directly contradicted long-held conservative values — private property rights, limited government and free markets — suggesting that clean energy has become such a political flashpoint that this small band of lawmakers are willing to abandon the very principles they typically champion.”

Stoic Energy principal Doug Lewin, who has kept close tabs on this year’s legislative session, allows that while politics may play a role with the idealogues capturing the headlines, many elected officials have embraced an “all-of-the-above” approach to Texas’ power needs.

“I think what we have really seen emerge this session is … kind of pragmatism over ideology, really led by the business community,” he said in an interview. “Sure, renewables have some challenges, but we’re going to work to integrate them and overcome those challenges. … Otherwise, all of our electric bills are going to go significantly higher without it.”

Case in point: Three Senate bills (SB715, SB388 and SB819) never made it to the House of Representatives’ calendar in time to get a vote before the session ends June 2, effectively killing them.

SB715 would require existing wind and solar facilities in the ERCOT region to back up their energy production with gas generation or be subject to fines. SB388 would update the Texas Utilities Code to reflect the legislature’s intent that 50% of generating capacity installed in ERCOT after Jan. 1, 2026, “be sourced from dispatchable generation other than battery energy storage.”

Both bills would dampen further investment in clean energy — renewable companies have made plans for $64 billion in new projects in Texas since 2022, mostly for solar and battery storage — and cause existing sites to shut down, industry insiders said. Aurora Energy Research said in a May report that about 25 GW of capacity would require contracts for backup generation, leading to a 14% increase in wholesale prices over the next 10 years and cause capacity shortfalls that could result in more than 3 GW of load shed during an extreme weather event.

“If you rely on gas as your sole fuel, your sole source of power, it would be hard to overstate how incredibly stupid that would be,” Lewin said. “That just absolutely makes no sense. You absolutely need a diverse set of resources.”

As for SB819, it would have placed some of the most onerous permitting conditions for wind and solar resources. Clean energy advocates called the bill “an industry killer.”

“We need policies that support an all-of-the-above approach to meet the expected surge in power demand,” said Olivier Beaufils, Aurora’s head of USA Central. “Embracing renewables alongside flexible generation sources will help maintain grid stability, lower costs, and sustain Texas’ economic momentum.”

Mark Stover, executive director of the Texas Solar + Storage Association, memorably said earlier in the session that he couldn’t recall “legislation as damaging to our industry and to the energy market” as SB715 and its companion House bill (HB3356).

Stover declined comment about the clean energy sector possibly dodging a bullet, as it did during the 2023 session, until after June 2. (See Clean Energy Escapes Texas Legislature’s Wrath.)

Perhaps that’s because of the danger of “zombie bills” and “frankenbills.” Zombie bills refer to legislation that is reintroduced or revived in subsequent sessions after failing to pass in a previous session. Frankenbills are those measures attached to another living bill either through a committee substitute or a final-hour compromise in a conference committee where members meet to resolve their differences.

Lewin said the final days of the session can be an “eternity in legislative time.”

“Strange things happen,” he said. “There are still some pretty big bills in play … what we do know is that the worst of the anti-energy bills as standalone bills are dead.”

“For two consecutive sessions, cooler heads have prevailed in blocking some of the most extreme anti-energy proposals,” Messer said. “Without a competitive, diverse energy mix, Texas risks not only missing out on significant economic development but also struggling to keep the lights on. These legislators recognize renewables for what they are: a vital part of the Texas economy, particularly in rural communities.”

The attention now turns to SB6. Its low number denoting it as one of the Senate’s top priorities, the measure addresses the potential wave of large-load additions. ERCOT has more than 150 GW of new standalone and co-located projects in its large-load queue, adding nearly 20 GW in its most recent month alone.

SB6 requires developers to put down a $100,000 fee for a screening study and to notify ERCOT whether they’re considering multiple sites in Texas, giving the grid operator a more accurate read on load growth. It also gives ERCOT and utilities the ability to reject the co-location of data centers with existing generation and hands the grid operator a “kill switch” to shut off large loads if needed.

The measure was preliminarily approved by the House on May 26. It was returned to the Senate with an amendment that allows water utilities to use their rates to fund power infrastructure that can participate in the market and also stripping out HB3970, a load-flexibility bill. The two versions must be reconciled.

Several other power-related bills are still in various phases of the legislative process:

-

- HB14 would use up to $2 billion in taxpayer money to help build advanced nuclear reactors, provide grants and fund development research. It also would create an office under the governor to “lead the transition to a balanced energy future by advancing innovative nuclear energy generation technologies.” The measure has cleared both houses, but the Senate has asked the House to return the bill.

- HB3556 still is alive in the Senate. The bill was amended to give the Texas Parks & Wildlife Department the ability to review coastal wind projects and removed its ability to stop projects.

- SB383 has been approved by the Senate and passed out of a House committee, but it did not get a vote by the full membership. It would prohibit offshore wind turbines in the Gulf of Mexico from interconnecting with ERCOT through state waters (extending 9 nautical miles from the coastline), effectively killing Texas offshore wind.

- Two bills related to utility ratemaking have passed the House but have not advanced in the Senate. HB3157 would allow utilities to use interim rate hikes before a proposed increase is approved by the PUC. HB2868 would require the commission to assume a utility’s debt-to-equity ratio is reasonable if calculated using certain metrics as recorded in the books and records for the most recent available financial quarter before the applicable rate proceeding begins.