Portland General Electric’s need for more resources by 2030 has grown by 16%, according to updated modeling, largely because of a decreased capacity contribution from batteries, particularly in winter.

The figures are in an update to PGE’s 2023 integrated resource plan the utility presented to the Oregon Public Utility Commission (OPUC) on July 8.

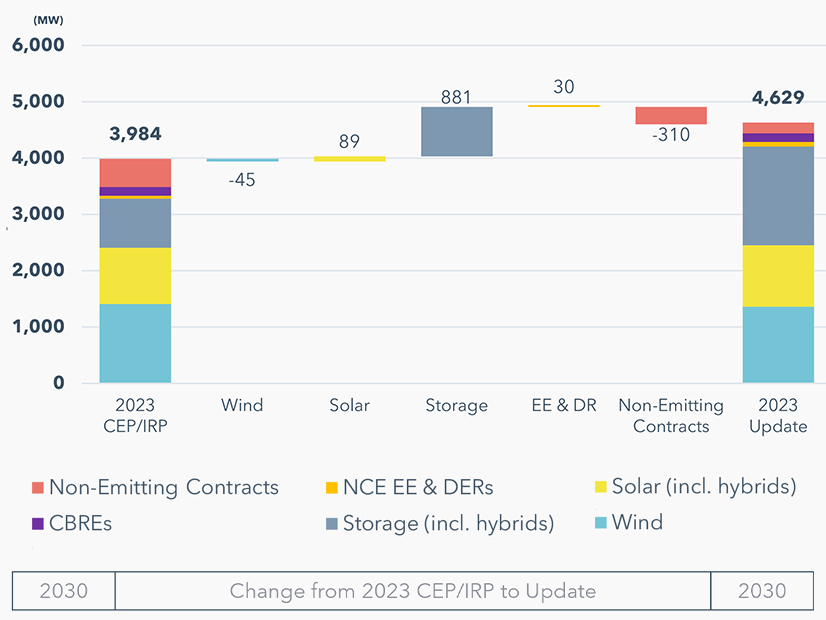

Updated modeling led to changes in PGE’s preferred resource portfolio, which includes 4,629 MW of new resources by 2030 compared to 3,984 MW in the 2023 IRP — a 645-MW increase.

While the amount of resources such as wind and non-emitting energy contracts decreased in the updated portfolio, the biggest change was the addition of 881 MW of battery storage.

New modeling in the IRP update found the effective load-carrying capability for four-hour battery storage would be 46% in summer and 22% in winter — compared to roughly 70% in summer and 45% in winter modeled in the 2023 IRP for 100 MW of nameplate capacity.

“The reduced capacity contribution of storage resources, particularly in winter, highlights a critical planning challenge regarding the interaction between storage and energy resources in a system with growing demand and thus energy deficits,” the IRP update states.

Jimmy Lindsay, director of resource planning at PGE, attributed the decreased capacity contribution in part to “a saturation issue,” as the utility is planning “a significant quantity” of four-hour lithium-ion batteries in its portfolio.

But he said another factor is increased load forecasts during the winter, when demand can surge for several days in contrast to shorter peaks in the summer.

“That is an issue that we had anticipated would emerge … that the models weren’t necessarily capturing the challenge around recharging on a multi-day event,” OPUC Chair Letha Tawney said.

The IRP update said it didn’t look at including long-duration storage in the preferred portfolio “due to the lack of commercially proven projects.” Long-duration storage will be explored further in the 2026 IRP.

The presentation was informational only; PGE is not seeking formal acknowledgement of its update from the commission.

Tax Credit Implications

Existing plus new resources in the updated preferred portfolio total about 10,000 MW in 2030, about double the amount of resources in 2026. A large jump in resources is expected in 2029, as resources procured through requests for proposals come online.

Another jump in resources is expected in 2032, when new transmission will support imported power.

In particular, PGE is working with the Confederated Tribes of Warm Springs on a 500-kV upgrade of the 230-kV Bethel-Round Butte line. They secured a $250 million Grid Resilience and Innovation Partnerships program grant from the U.S. Department of Energy that will allow survey work to begin.

Another challenge for PGE is changes in federal policy — and the cost impacts to the utility’s renewable energy transition. The elimination of federal tax credits could increase renewable costs by 30% to 50% or even more, according to the IRP update.

Most recently, tax credits were targeted in an executive order President Donald Trump issued July 7. (See Trump Executive Order Targets Renewable Energy Tax Credits.)

“The change in the federal landscape cannot be underestimated,” said Kristen Sheeran, PGE’s vice president of policy and planning.

Rapid Industrial Growth

The IRP update predicts a 20-year average annual growth rate of 2.8%, an increase from the 1.2% growth rate forecast in the March 2023 IRP. For industrial customers, the 20-year average growth rate now is expected to be 5.2% a year, compared to 3.5% in the 2023 IRP.

“Growth is driven primarily by unprecedented industrial sector expansion, especially in semiconductor manufacturing and data centers,” PGE said in the update.

After the PGE update was released, chipmaker Intel, Oregon’s largest private employer, announced it was laying off almost 2,400 of the 20,000 employees in the state as the company struggles to remain competitive. Intel’s operations in Hillsboro are served by PGE. It’s unclear what effect Intel’s difficulties might have on future load growth.

PGE hit a record summer peak load of 4,498 MW in August 2023 and a record winter peak of 4,113 MW in December 2022.

The IRP update projects a summer peak of about 5,500 MW in 2030 and 8,000 MW in 2044, taking into account electrification of vehicles and buildings. Winter peak is expected to grow to about 4,500 MW in 2030 and 7,000 MW in 2044.