With data centers contributing to “staggering load growth” for Western utilities, a new report suggests that more utilities adopt clean transition tariffs for data centers or even make the tariffs mandatory for certain large customers.

The proposal is one in a set of recommendations from Western Resource Advocates, which released its report, “Data Center Impacts in the West,” on July 22.

The report examines seven of the eight largest utilities in the Interior West: Public Service Company of Colorado, Public Service Company of New Mexico, NV Energy, PacifiCorp, Arizona Public Service, Salt River Project and Tucson Electric Power. These utilities are seeing a surge in large-load interconnection requests, and data centers are the largest factor in their load growth, the report says.

“Data centers are driving staggering increases in electricity demand,” WRA says in its report.

And the surge in demand is a threat to climate progress, unless it can be met with clean energy resources, according to WRA. That’s where clean transition tariffs can play a role.

“If properly designed, these tariffs can enable data centers to do more than just mitigate their climate impacts with conventional clean resources like solar, wind and battery storage; they can help drive innovation by scaling new clean technologies,” the report says.

The report notes that companies such as Google, Meta and Amazon have corporate climate and clean energy goals — along with “expansive financial resources.” Under a clean transition tariff, a utility may develop new, clean resources on behalf of a large-load customer, with the large customer paying any premium cost of the clean resource.

For example, Nevada regulators in March approved NV Energy’s clean transition tariff, a framework developed in partnership with Google. NV Energy added to its integrated resource plan an enhanced geothermal energy project from Fervo Energy that will help power Google’s northern Nevada data center. Without Google’s involvement, the utility would not have included the project because of its cost. (See Nevada Regulators Give Nod to NV Energy Clean Transition Tariff.)

WRA said clean transition tariff structures should be developed before a data center asks for interconnection and clean resources, because fast interconnection typically is a priority for the centers.

Only zero-carbon resources should be eligible for the tariff, the report says. One approach for finding resources would be for the utility to issue a request for proposals based on its completed IRP, select resources to serve customer loads and then make any resources not selected available to customers under its tariff. Utilities also could solicit bids for resources under their tariffs between IRP cycles.

Regulators should encourage utilities to develop clean transition tariffs, WRA says, and they could even consider making them mandatory for larger loads or those that are steady around the clock.

Surging Demand

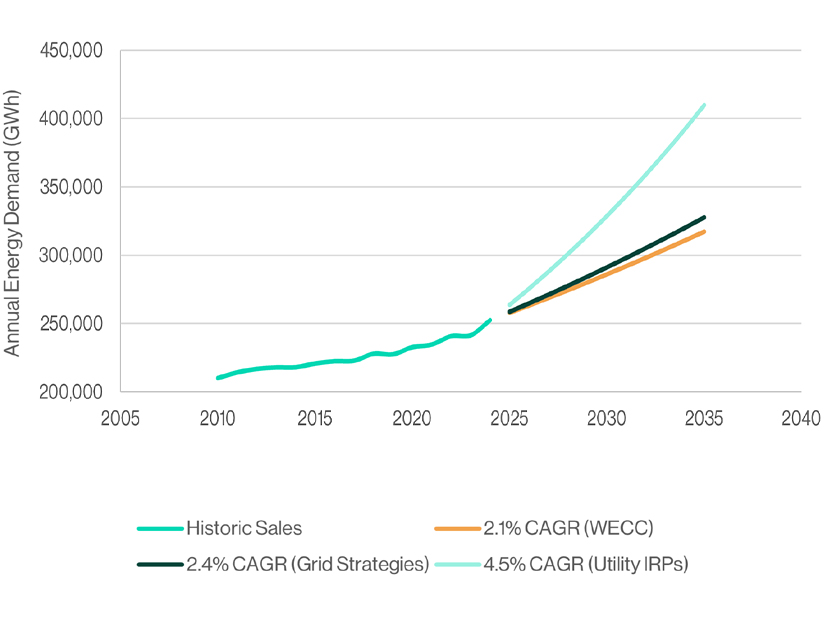

The seven utilities’ energy demands are projected to be 32% higher in 2030 and 55% higher in 2035, compared to 2025 levels, representing a compound annual growth rate of 4.5%. Those figures are significantly higher than what utilities predicted just a few years ago.

The growth rate also is higher than the rates projected by WECC (2.1%) and Grid Strategies (2.4%), which looked at regional and national trends, respectively.

The difference among the forecasts could mean that utilities in the WRA study are overestimating their load growth, the report says, or that they are “burgeoning hubs” for data centers with concentrated load growth.

As for peak demand, the utilities now expect a peak of 9,500 MW in 2030, 19% higher than in 2025, and 16,900 MW in 2035. The projected compound annual growth in peak demand is 2.9%.

The WRA report makes other recommendations for utilities and regulators, including:

-

- establishing best practices and requirements for utility load forecasting;

- revising IRP processes to better accommodate the rapid and uncertain nature of data center growth;

- allowing data centers to install behind-the-meter clean resources and storage systems; and

- developing interconnection standards that allow for load interruption in exchange for faster interconnection.