A new Grid Strategies report concludes that if the U.S. Department of Energy continues to supersede retirement decisions for fossil-fueled power plants, it could cost consumers an extra $3 billion annually in a little more than three years.

The report, “The Cost of Federal Mandates to Retain Fossil-Burning Power Plants,” said if the DOE’s trend of stay-open orders persists, it could affect the 34.95 GW of large fossil power plants scheduled to retire between now and the end of 2028.

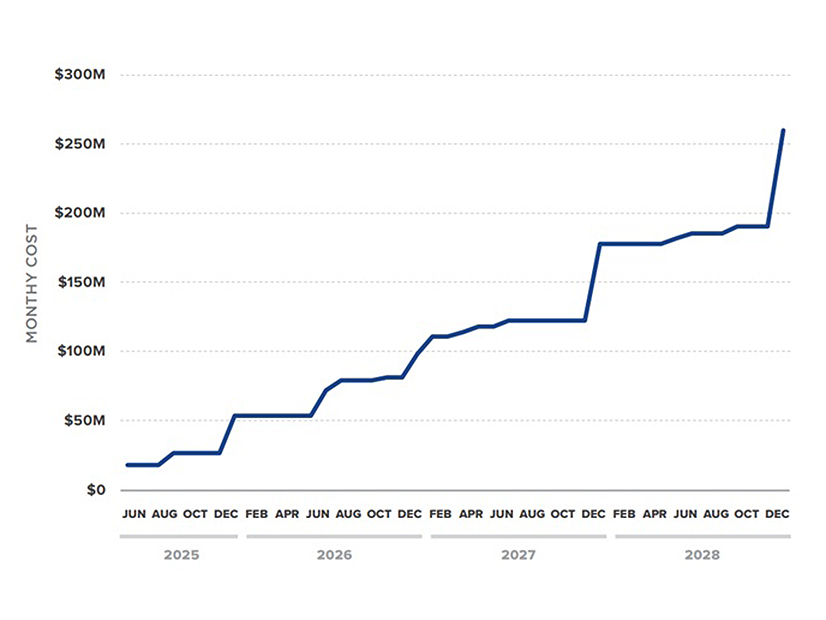

The Aug. 14 report estimated the cost of DOE mandates on the almost 35 GW of generation could climb to $260 million due monthly by January 2029.

Author and Grid Strategies Vice President Michael Goggin said added costs could surge to nearly $6 billion per year at the end of 2028 if owners of other aging power plants, enticed by revenue guarantees associated with the DOE’s mandates, announce earlier retirement dates.

Environmental nonprofits Earthjustice, Environmental Defense Fund, Natural Resources Defense Council and Sierra Club commissioned the report after the DOE in May issued two mandates to keep Constellation Energy’s Eddystone oil and gas power plant in Pennsylvania and Consumer Energy’s J.H. Campbell coal plant in Michigan operating about three months past their announced retirement dates. (See DOE Orders PJM, Constellation to Keep 760-MW Eddystone Generators Online and DOE Orders Michigan Coal Plant to Reverse Retirement.)

“Based on the trend to date and indications that DOE has approached the owners of many retiring fossil power plants about potentially mandating their retention, DOE may attempt to mandate the retention of nearly all large fossil power plants slated for retirement between now and the end of 2028,” Goggin wrote.

The report used the 34.95 GW slated for retirement in a low-end estimate and 66.34 GW in a high-end estimate, in which it assumed other plants would announce accelerated retirements.

To arrive at the 66 GW tally, Grid Strategies combined the 35 GW in confirmed announcements with another 31.39 GW of fossil fuel generation across 36 plants that are at least 60 years old.

The nearly 35 GW figure did not include the little more than 8 GW of retiring fossil plants that have at least some replacement fossil capacity planned on site. It also excluded about 310 MW of retiring fossil plants that are smaller than 50 MW.

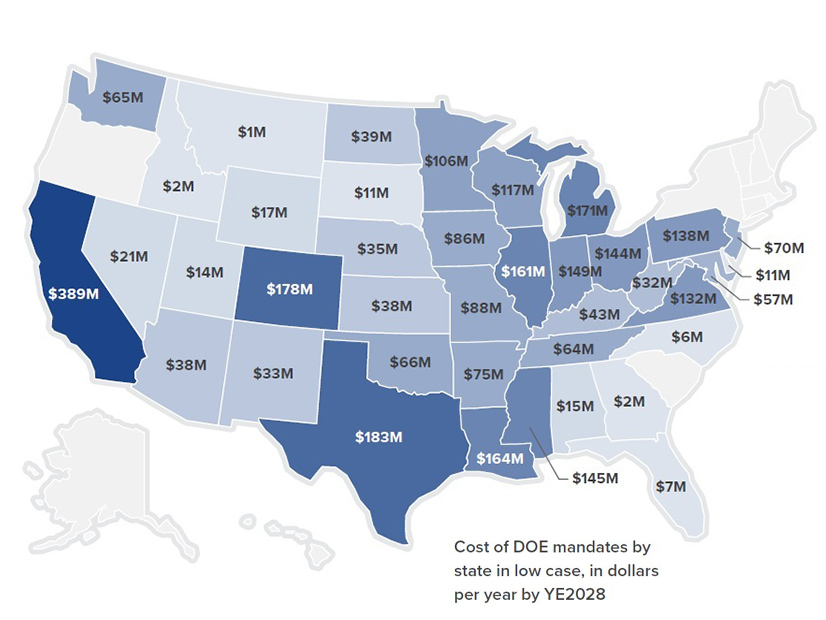

The report said in all, the DOE could deliver mandates to 90 aging power plants across the country.

Grid Strategies noted that MISO’s median retirement age for its coal plants is around 60 years, while data from the U.S. Energy Information Administration pins the median age of coal plant retirement at 54 years in 2024. Goggin wrote that the 60-year age screen “should provide a conservative estimate of the total fossil capacity that is likely to retire.”

Grid Strategies used an average $89,315/MW-year cost of keeping a plant open, bringing the total annual ratepayer cost by the end of 2028 to $3.121 billion in the low gigawatt estimate and $5.925 billion in the high estimate.

The consulting firm calculated a weighted average cost of recent reliability-must-run (RMR) contracts across the country to come up with the $89,315/MW-year value. It reviewed RMR contracts for Brandon Shores, Wagner and Indian River in PJM; Lakefront Unit 9 and Rush Island in MISO; Braunig Unit 3 in ERCOT; and six units including Midway in CAISO. Contract costs ranged from $49,858/ MW-year for Wagner to $167,619/ MW-year for Lakefront Unit 9.

Goggin said the contract costs should provide a reasonable proxy for ratepayer subsidies paid out under DOE mandates. However, he acknowledged that the first two plants to be kept online are in uncharted territory, with “scant precedent for determining ratepayer subsidy costs for keeping plants open past their scheduled retirement date” due to DOE intervention.

Consumers Energy reported that the J.H. Campbell plant accumulated $29 million in costs after a little more than a month of extended operations. (See DOE Extension of Michigan Coal Plant Cost $29M in 1st Month.) Goggin said if that “cost trend were to persist, that would translate to $279 million in annual cost or $178,559/MW-year, almost exactly twice our estimate.”

The report also noted that the Citizens Utility Board estimates the cost for the Campbell and Eddystone plants at a weighted average annualized cost of $181,200/MW-year, more than twice the report’s estimate.

Grid Strategies determined that California has the most to lose in the low-end estimate, at an annual cost of $389 million by the end of 2028. Texas and Colorado follow at $183 million and $178 million, respectively, per year. Michigan, Louisiana and Illinois — all MISO states — also would register noteworthy costs at $171 million, $164 million and $161 million, respectively.

The report assumed that states that don’t contain plants slated for retirement, including the six New England states, New York, Hawaii, Alaska, Oregon and South Carolina, would be unaffected by DOE stay-open mandates in the low-end scenario. In all, it said ratepayers in 39 states and the District of Columbia stand to incur costs if the DOE doles out mandates to all plants currently counting down to a retirement date.

The analysis assumed plants don’t begin receiving funds to stay open until a month after their scheduled retirement. Goggin noted that the DOE could issue mandates earlier than that.

Grid Strategies said it chose to include potential plants that aren’t yet slated for retirement in the high estimate because the DOE’s actions could create a “perverse incentive” for plants to declare earlier retirements, so they’re paid to remain open.

“This perverse incentive is what economists would call a moral hazard,” Goggin wrote.

Goggin wrote that the report’s eye-popping cost estimates conflict with the April presidential executive order that charged the DOE with issuing mandates, which emphasized rising demand from AI data centers and domestic manufacturing and protecting the “the national and economic security of the American people.” Goggin said it’s “intuitive and inherent” that the DOE keeping plants operating would drive up customer bills.

“Power plants have been slated to retire because their owners and state regulators have determined they are no longer economic or needed. DOE mandates override those well-informed decisions, inflating electric bills for homeowners and businesses and undermining the competitiveness of U.S. factories and data centers,” the report said.