Ontario environmental groups panned the Canadian government’s inclusion of small modular reactors among infrastructure projects selected to receive fast-track regulatory treatment, saying renewables would be a far cheaper way to expand generation capacity.

Ontario environmental groups panned the Canadian government’s inclusion of small modular reactors (SMRs) on its list of infrastructure projects to receive fast-track regulatory treatment, saying renewables would be a far cheaper way to expand generation capacity.

Prime Minister Mark Carney on Sept. 11 identified four SMRs planned at Ontario’s Darlington nuclear power plant as one of five “nation building” projects he said are needed to bolster the country’s economy in response to U.S. President Donald Trump’s escalating tariffs.

Speaking at a union training facility in Edmonton, Carney called Trump’s actions “not a transition [but] a rupture.”

“They are closing markets, disrupting supply chains, halting investments and pushing up unemployment. Canadians are over the shock, but we must always remember the lessons,” said Carney, who took office in March. “From now on, Canada’s new government starts by asking ourselves, for major projects, ‘how?’ How can we do it bigger? How can we do it faster?”

The Canadian and Ontario governments have leapt ahead of other regions in embracing SMRs, touting their zero emissions and economic development potential. But environmentalists say the province would be better served by building more renewables and storage to fill electricity demand projected to grow by 75% by 2050.

“Ontario risks being left behind by failing to embrace the faster, cheaper, cleaner alternatives already powering economies around the world,” Ontario Green Party Leader Mike Schreiner said in response to Carney’s announcement. “Right now we could create good-paying jobs using Ontario steel to build steel racking for solar and wind turbines and generate low-cost power.”

Tim Gray, executive director of Environmental Defence, and Jack Gibbons, chair of the Ontario Clean Air Alliance, were also critical.

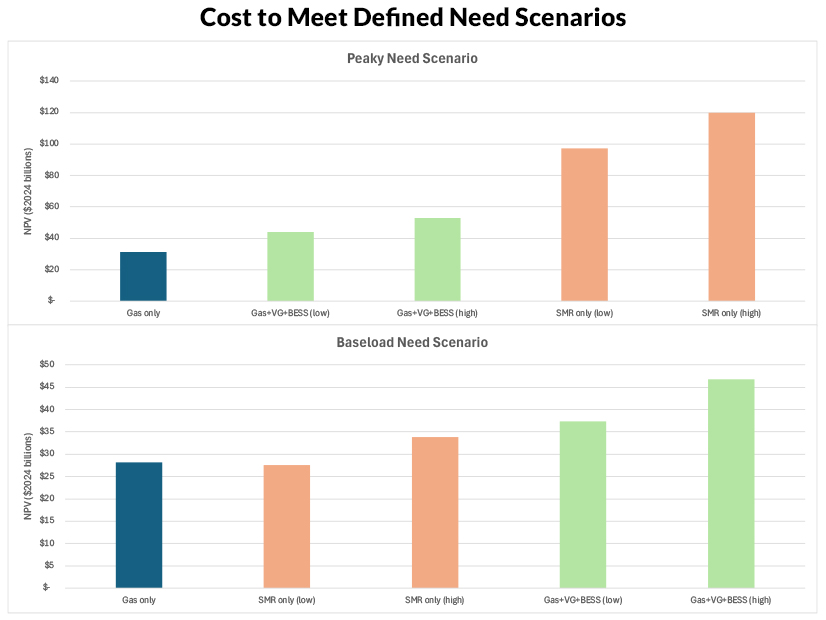

Gibbons cited a recent analysis by IESO that he said showed that renewables and storage can meet the province’s peaking and baseload demands at a far lower cost than SMRs.

Wind and solar power, combined with four-, six-, eight- and 10-hour lithium-ion batteries can meet up to 99.98% of the province’s peaking electricity needs and up to 99.9% of its baseload needs under all weather scenarios, the alliance said in a briefing note. “Demand response resources and/or our existing gas-fired power plants could meet our remaining electricity needs,” it added.

IESO’s “Resource & Plan Assessments Technical Paper: Hybrid Resource Portfolio Equivalency Assessment” compared the capability and costs of portfolios of variable generation (VG) wind and solar and battery energy storage systems (BESS) — referred to as a “hybrid resource portfolio” — with combined-cycle gas turbines and SMR options.

It concluded that a hybrid portfolio plus natural gas was the least-cost resource option to meet the 5.1-TWh Peaky Need Scenario, with a cost of $25 billion to $34 billion (net present value in 2024 Canadian dollars), depending on the weather year used. The gas-only option was estimated at $31 billion in seven of the 10 weather years. The Peaky Need Scenario is based on production cost modeling for the 2025 Annual Planning Outlook without capacity expansion, which resulted in unserved energy of about 5.1 TWh in the medium term and a peak need of about 7,300 MW.

The analysis found dispatchable resources were the best solution for the Baseload Need Scenario. “Both SMR-only and gas-only resource options have similar cost profiles when acting as a baseload generator,” it said. The SMR-only option ranged from $27.6 billion to $33.8 billion, with the gas-only option estimated at $28 billion. The renewables-BESS option ranged from $37 billion to $47 billion depending on the weather year, a levelized cost of energy range of $140 to $175/MWh.

The Baseload Need Scenario assumes the addition of 2,000 MW of capacity, akin to a baseload generation facility, or 11,300 to 15,000 MW of installed capacity for the hybrid resource portfolio.

Hybrid Premium ‘Smaller than Expected’

To capture the geographic and temporal ranges in wind speed and solar intensity, IESO’s report considered 13 potential wind sites and 10 potential solar sites across 10 different weather years, assuming no transmission constraints.

“The premium on installed capacity and costs of hybrid resource portfolio solutions required to achieve load served up to 99.98% was smaller than expected,” IESO said in the report. “As performance of VG and BESS technologies improves and costs continue to decline, a non-emitting, hybrid resource portfolio, in theory, shows significant promise. It can provide both baseload and peak nuclear generation.”

‘Excess Generation’ Impact

The IESO analysis noted that wind and solar generation often need to be “overbuilt” to meet system adequacy needs and said that the value of the excess energy should “be considered in any planning study when comparing resource portfolios to meet a specific need.”

The energy that would be curtailed as a result of the overbuild “could potentially provide tens of billions of dollars in system value” by displacing higher-cost resources, IESO said.

The Clean Air Alliance said that when the excess wind and solar energy is included ($17.8 billion in baseload scenarios, $28.4 billion in peaking scenarios), those sources and energy storage can meet peaking needs at a cost of $15.7 billion to $24.5 billion versus $97.1 billion to $120 billion for SMRs. Baseload electricity needs would be $19.5 billion to $29 billion for renewables and storage versus $27.6 billion to $33.8 billion for SMRs.

Questioning SMR Assumptions

The Alliance said IESO’s analysis understated the cost difference because of overly optimistic assumptions regarding SMRs:

-

- IESO’s capital cost estimates for new SMRs ($11,804 to $16,711/kW in 2024 Canadian dollars) are 25 to 50% lower than the cost of Plant Vogtle Units 3 and 4 in Georgia, which went into service in 2023 and 2024, respectively ($22,628/kW).

- IESO assumed the SMRs will have annual capacity utilization factors of 90.9%, well above the historical rates of Ontario’s Pickering (71.4%) and Darlington Nuclear Stations (78.6%).

- Although Ontario Power Generation is spending $12.8 billion to refurbish Darlington Nuclear Station after 26 years of service, IESO assumes the SMRs will operate for 60 years without major refurbishments.

IESO’s report used the U.S. National Renewable Energy Laboratory’s 2024 Electricity Annual Technology Baseline for the low end of the cost range and the Tennessee Valley Authority’s 2025 Integrated Resource Plan’s estimate of an “nth-of-a kind” light-water SMR for the high end.

OPG did not respond to a request for comment.

Not a Recommendation

IESO cautioned that its paper was a modeling exercise and did not consider any “resource build limits” such as supply chain issues that would impact the feasibility of building the resulting resource portfolios.

“It should be emphasized that this document is not a plan, nor does it constitute a recommendation or endorsement of any resource, resource portfolio or technology.”

It also noted that to provide “high temporal granularity,” its modeling used deterministic, hourly profiles that did not fully capture the dispatchability (e.g., gas turbines) and storage capability (e.g., hydroelectric reservoirs) of existing resources.

“The study also shows that Ontario would need to build more than five times the baseload need in total capacity in the hybrid scenario, and even then may still not be able to meet the full need,” IESO said in response to questions from RTO Insider.

The ISO also noted that the paper did not consider the land use implications of the alternate portfolios. “A buildout of that scale would have considerable development and transmission costs that have not been factored into the paper.”

Nonetheless, the ISO said the role of renewables and storage will increase, noting that it recently completed the largest battery storage procurement ever in Canada, and that renewables are eligible in its second long-term energy and capacity procurement. (See IESO Officials Deny Favoring Gas Resources in Upcoming Procurement.)

“Ultimately, Ontario’s electricity grid benefits from a diverse supply mix that includes wind, solar, hydro, natural gas, nuclear and energy storage to keep the lights on,” IESO said. “These different resources have different characteristics and responses to weather, and maintaining a diverse supply mix means we always have resources to draw on that are right for the moment.”

The ISO said it plans to seek feedback on the study and rerun the simulation based on updated need profiles.

Ontario Pols Tout Economic Development Potential of New Nuclear

Ontario’s first-ever integrated energy plan, Energy for Generations, endorses an “all of the above” approach to fuel diversity with an emphasis on retaining and expanding nuclear power and natural gas. (See Ontario Integrated Energy Plan Boosts Gas, Nukes.)

Ontario Premier Doug Ford in May approved OPG’s plan to start construction on the first of four SMRs.

The initial 300-MW SMR, targeted for commercial operation in 2030, would be the first grid-scale SMR in the Group of Seven countries. OPG says building all four SMRs, a total of 1,200 MW, will cost $20.9 billion. (See Ontario Greenlights OPG to Build Small Modular Reactor.)

The Ontario government also is supporting the addition of up to 4,800 MW of additional nuclear capacity at the Bruce Nuclear Generating Station.

In a high electrification scenario, IESO says, the province could need up to 17,800 MW of new nuclear generation in addition to its current 12,000 MW, which generates more than half of the province’s electricity.

Carney said the SMR in Clarington will “sustain” 3,700 jobs annually, including 18,000 during construction.

Officials also see their leadership on SMRs having additional economic impact, citing agreements to work with Saskatchewan, New Brunswick and Alberta on the technology.

“We are already seeing results,” Clarington Mayor Adrian Foster told the Toronto Star. “Today, we have a Dutch delegation in town. [Other countries] are coming to see the SMRs. The world is paying attention to what is happening right here, right now.”

Major Projects Office

In addition to the Ontario SMRs, Carney’s five “nation building” projects include one to double the export capacity of the LNG Canada facility in Kitimat, B.C.; an expansion of the Contrecoeur Terminal at the Port of Montreal; a copper mine in Saskatchewan; and the expansion of the Red Chris copper and gold mine in northwestern British Columbia.

The five will be referred to the new Major Projects Office (MPO), which was created under the Building Canada Act.

Carney said the office also will help other, less advanced projects, including the 60-GW Wind West Atlantic Energy Project off Nova Scotia and the Pathways carbon capture project in Alberta.

Environmental Defence’s Gray panned Carney’s selection of the Kitimat LNG facility and the mining projects.

“The federal government promised Canadians that nation building projects would align with our climate goals. This announcement, which begins with the expansion of LNG Canada that will increase climate pollution, is completely inconsistent with this commitment and will threaten Canada’s ability to meet its climate pollution-reduction targets,” Gray said.

He called the carbon capture and storage project “deeply flawed and regressive.”

“Carbon capture and storage has a decadeslong record of failure, delivering only a fraction of promised production emission reductions while locking Canada into higher overall oil emissions and draining public funds,” he said.