CAISO is finalizing a set of changes to its resource adequacy program, with plans to vote on three proposals at an upcoming Board of Governors meeting,

CAISO is finalizing a set of changes to its resource adequacy program, with plans to vote on three proposals at an upcoming Board of Governors meeting, possibly as early as October.

The proposed RA program revisions are part of CAISO’s RA Modeling and Program Design initiative that began in August 2023.

The first proposal, “Track 1: Modeling and Default Rules,” which was published Aug. 25 and presented to stakeholders at a Sept. 17 workshop, updates certain requirements within CAISO’s qualifying capacity (QC) methodology and planning reserve margin (PRM) process.

The proposal provides a default set of RA rules for local regulatory authorities (LRAs) — that is, publicly owned utilities — that have not established their own methodologies and processes. These RA rules also can be adopted voluntarily by any LRA within the CAISO balancing authority area, the proposal says.

CAISO is specifically looking to replace a “longstanding” default PRM requirement of 15% with a new margin that would be determined periodically based on loss of load expectation (LOLE) studies. The new PRM process would ensure a market participant’s energy resource portfolio meets the industry-standard reliability benchmark of 0.1 LOLE when an LRA does not provide a QC methodology, the proposal says.

Stakeholders involved in the initiative questioned whether existing RA programs or CAISO’s default RA rules for LRAs meet a 0.1 LOLE requirement.

Some LRAs said they rely on CAISO’s default RA rules when developing their own requirements, but these rules have not been revisited or “significantly updated since they were established approximately 20 years ago,” CAISO said in the proposal.

In Sept. 12 comments to CAISO, representatives from the Alliance for Retail Energy Markets (AReM) said the group remains concerned about the differences between the CPUC and CAISO’s modeling and market design requirements.

“While AReM recognizes that other LRAs are seeking single monthly default QC values in contrast to the California Public Utility Commission’s slice-of-day paradigm, which adopts 24 hourly values for each resource each month, it is important all LRAs avoid using divergent methodologies,” AReM said. “Unless CAISO can show its proposed methodology results in consistent outcomes with slice-of-day, it should not adopt its Track 1 proposal.”

AReM also asked CAISO to provide greater clarity on how battery durations will be counted in CAISO’s default QC counting rules.

“CAISO’s proposal would, seemingly, lump all battery capacity together, including eight-hour batteries and four-hour batteries even though the CPUC has ordered LSEs under its jurisdiction to procure eight-hour duration storage resources and the CPUC’s slice-of-day methodology assigns greater value to longer-duration battery resources,” AReM said.

Track 2 Proposal

In the second proposal, published Aug. 26, CAISO pitched the formation of a new energy resource substitution “pool.” The pool would allow a scheduling coordinator (SC) to signal when they need to procure substitute capacity because their energy resources are offline due to a planned outage. The substitution pool would also allow an SC to indicate when it is able to offer substitute capacity for other SCs.

Under current rules, CAISO requires an SC with a resource undergoing a planned outage to provide substitute capacity for that resource. However, securing substitute capacity can be difficult due to “mismatches between contract terms and outage durations, as well as inefficiencies in the bilateral procurement process,” CAISO staff said in the proposal.

Additionally, multiple SCs “hold back RA capacity for outage substitution for a partial-month outage. This practice drives artificial tightness in the RA bilateral market,” staff said.

The cost to procure replacement capacity can be greater than the cost to pay a non-availability penalty under CAISO’s Resource Adequacy Availability Incentive Mechanism, staff added. This has led to forced outage rates going higher than those predicted by CAISO and the California Energy Commission.

The pooling approach would improve price certainty because buyers would be able to choose offers aligned with their willingness to pay.

It also would increase visibility into available supply, “giving buyers greater control over their choices and providing direct contact information for sellers.” Benefits of the proposal include “enhance[d] flexibility, transparency and efficiency in managing planned outages,” the proposal says.

On the other hand, SCs that have scheduled, immovable planned outages might want to continue arranging for substitute capacity outside of the proposed substitute pool process, the proposal says. Sellers also might face uncertainty depending on competing bids and might change their offer structure after seeing other postings in a pool, staff said.

Stakeholders such as the California Community Choice Association and the California Department of Water Resources supported the proposed pooling method.

The Track 2 proposal should be presented only to the CAISO Board of Governors for a decision because the initiative “falls outside the scope of authority of the Western Energy Markets Governing Body,” ISO staff said in the proposal.

Track 3A Proposal

The initiative’s “Track 3A: Resource Visibility” proposal is meant to improve CAISO’s visibility into what resources are available for procurement through the ISO’s backstop measures.

Better visibility into the status of RA-eligible capacity not shown as RA will “help the ISO conduct existing backstop processes more effectively and understand how any emerging trends should be incorporated into backstop program design,” staff said in the proposal.

Backstop procurement helps CAISO find additional energy for the grid when there is a shortage of RA or if conditions require the grid to procure more energy than that supplied by the RA program, staff said.

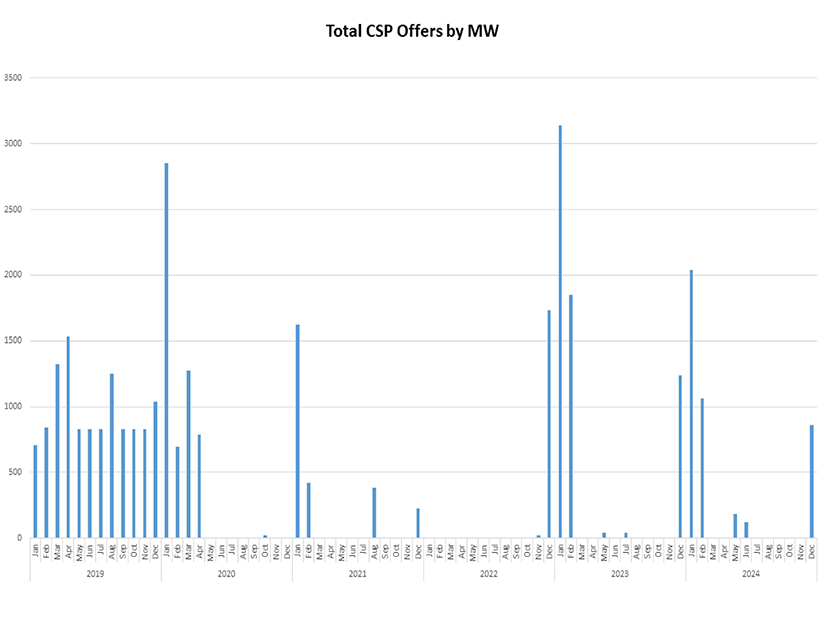

Part of the problem has been that the number of bids into CAISO’s Capacity Procurement Mechanism (CPM) has dropped significantly over the past five years. CPM is within CAISO’s Competitive Solicitation Process (CSP), which is the primary process for identifying capacity available for CPM designation.

“Conducting efficient and effective backstop procurement requires understanding what capacity is still available after accounting for all RA-shown resources,” CAISO staff said in the proposal. “The CSP is designed to provide this understanding.”

In addition to reliability improvements, the increased visibility under Track 3A can “improve policy and modeling for the CAISO system,” representatives with the CAISO Department of Market Monitoring (DMM) said in Sept. 16 comments on the initiative.

“Additional visibility into RA resources internal to the CAISO balancing authority area would improve a system-wide understanding of recent trends in the CPM and CSP, and potential improvements to the CPM,” DMM said.

The Track 3A proposal specifically includes new annual and monthly reporting requirements for all RA-eligible capacity in CAISO that is not shown as RA, the proposal says. Implementing these reporting requirements could make it easier to see what resources are open for procurement within CAISO’s backstop procurement program.

The proposal designates five categories of supply: supply that is sold outside the CAISO BAA; supply not shown due to being reserved for substitution; supply not shown due to potential unavailability; supply contracted to a CAISO LSE but not shown; and supply not contracted.

The new reporting requirements would apply to SCs that have RA capacity and are located inside the CAISO BAA that appears on the ISO’s Net Qualifying Capacity list, the proposal says. Reporting will be part of CAISO’s existing annual and monthly supply plan timeline requirements.