The North Carolina Utilities Commission held hearings over several days examining how utilities plan to reliably serve large loads including data centers and adapt to the changes they’re bringing to the industry.

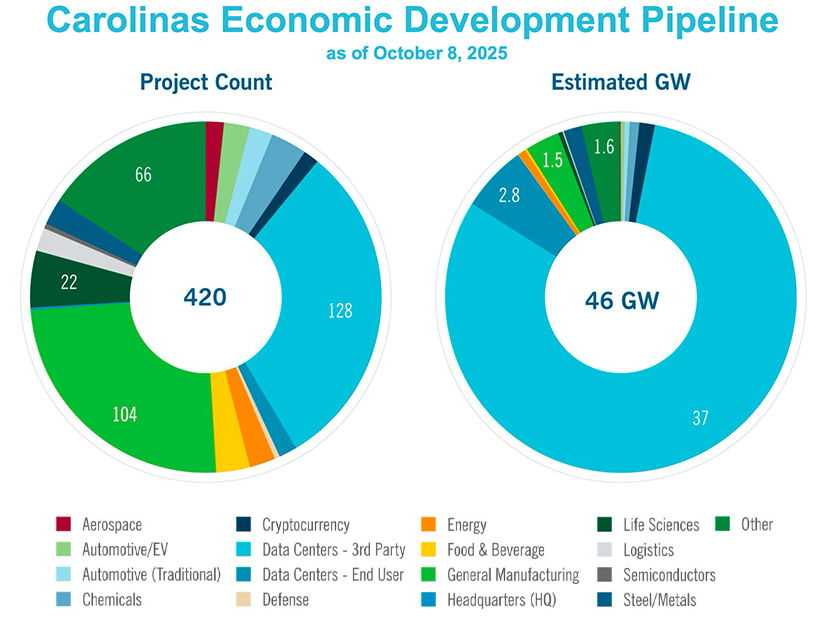

“We are experiencing a lot of growth in the Carolinas, and that is not restricted just to large loads; it’s across residential, commercial, industrial and manufacturing sectors,” Jonathan Byrd, managing director of rate design for Duke Energy, told the commission Oct. 15. “And that said, we certainly acknowledge that these large loads present unique challenges and opportunities. The growth we’re seeing reflects the state’s favorable business environment, which includes constructive energy policies and affordable and reliable electricity.”

Duke updates its rules as the new load paradigm has become apparent, and fine-tuning is going to continue as it gains experience serving new customers, he added.

The utility, which serves most of the state, has received inquiries from 420 projects totaling 46 GW in total possible demand. Of those projects, 128 are data centers representing 37 GW of demand, said Andrew Tate, Duke’s managing director of economic development.

“We acknowledge that only a fraction of these will ever progress to actually receive service,” Tate said. “We receive new project inquiries every week, and every week we have projects that advance to either terminate or loss, or successful outcome.”

Large load projects can be a challenge for utility planners, but they bring major economic benefits, including jobs and tax revenues for communities that sometimes have been overlooked in past economic expansions, he added.

“The large load customers that we work with daily value certainty in generation resources, as opposed to the uncertainty that can exist in some markets when it’s uncertain who’s building the generation,” Tate said. “Our customers expect us to provide the load to serve their needs.”

While on-site backup generation is common, Duke has seen relatively few large load customers interested in co-location, and that usually relates to speed-to-market concerns when they want to locate in an area with transmission constraints, he added.

Duke has arrangements with the new large load customers that are designed to hold existing customers harmless while helping the sites get online in the name of economic development, said Alex Castle, the utility’s deputy general counsel.

“Protecting existing customers remains our central priority, but we’re always conscious of the balance that’s required to ensure that the risks and accountability that we’re asking new large load customers to carry are reasonable,” Castle said. “We intend to check and adjust over time in order to refine our approach to right-size these financial and operational requirements.”

Duke starts by studying the project’s impact on its grid and resource adequacy, which are laid out in a “letter agreement” that the prospective load has 30 days to sign once issued. That signals an intent to proceed and comes with preliminary financial commitments. That is followed by an electric service agreement (ESA) that must be signed within 120 days and lays out the long-term conditions for service, Castle said.

Dominion’s Experience with Data Center Alley

The NCUC also heard testimony from Dominion Energy, which has long-term experience with data centers, as its Virginia utility serves the largest market for them in the world.

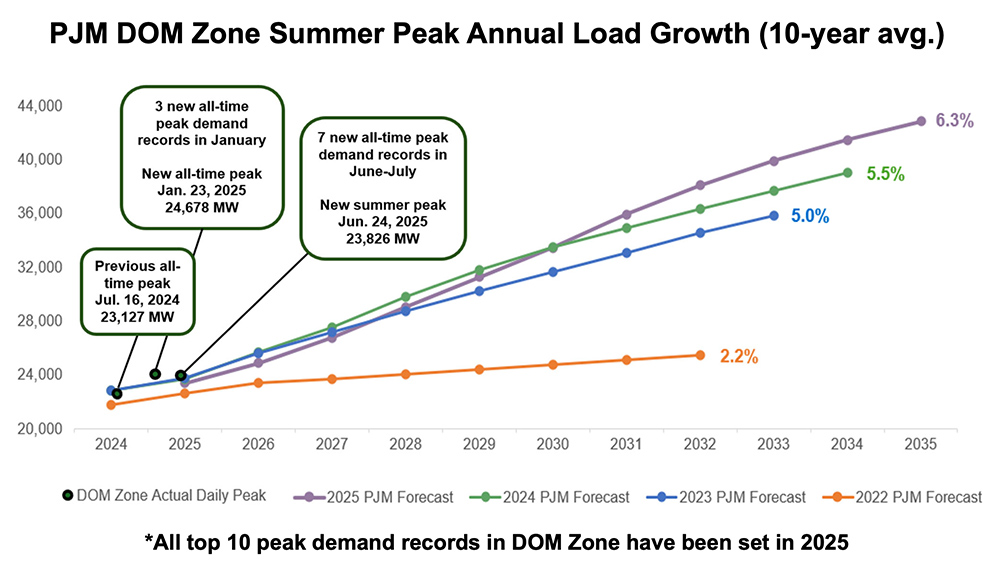

Data centers make up 25% of the utility’s total demand, which is expected to rise to 50% in 2035, said Vice President of Regulatory Affairs Scott Gaskill.

Dominion has set up an internal “Data Center Practice” to help manage its service of the key customer group, said its director, Stan Blackwell.

“If you add up the next five large U.S. markets — add them together — they’re not as big as our Virginia market,” Blackwell said. “In fact, it’s [just] Loudoun County. It’s about 30 square miles. It’s the largest market in the world.”

Just seven customers make up 72% of that market, and Dominion is able to base its forecast around their future growth individually, while putting the other 28% in an eighth category for forecasting. The main market in Loudoun runs an average of about a 90% capacity factor, and curtail-ability of that load is limited. It serves as a constant baseline of demand while small customers drive the peaks, Blackwell said.

Dominion is seeing data centers expand beyond Loudoun, which is the wealthiest county per capita in the nation with expensive land. The new wave of data centers built to train artificial intelligence is leading to more sites being located in cheaper areas of Virginia.

“In AI, there’s kind of two modes of it, if you will,” Blackwell said. “One is, you train a model. So, your data center cycles up and down to train a model. Once it’s trained, you take it out of that [and] put it in what’s called an inference data center, and that’s the one that runs like a chainsaw. So, once you have a model train, it runs all the time. You don’t tend to want to curtail that, because that’s what customers access.”

The utility has so much experience with data centers that it is able to build statistical models based on past experience to forecast future demand from the sector.

“We do it statistically by our largest customers and look at their past behavior and then make an assessment whether that will continue in the future,” Blackwell said. “And we haven’t seen a change in the behavior over the whole time period: 2013 to today.”

Dominion has a pending proposal at the Virginia State Corporation Commission to set up a new large load tariff that will separate out the customer class, offering data centers and others transparency while ensuring fair cost allocation, Blackwell said. (See Citing Inflation and Load Growth, Dominion Asks Virginia for Higher Rates.)

Are Large Load Tariffs Necessary?

Neither Dominion nor Duke were in favor of setting up similar large load tariffs for North Carolina, but NCUC public staff urged commissioners to get ahead of the issue and start working on constructs for both companies now.

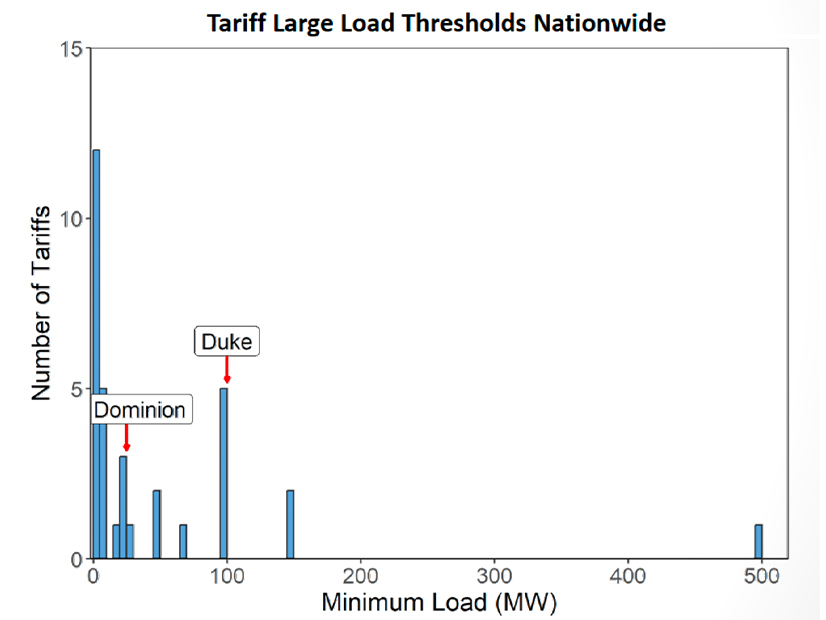

The suggestion comes after staff reviewed 44 tariffs from 28 states, said Dustin Metz, NCUC engineer for public staff.

“Large load has driven electric system growth, but with fewer larger customers than in the past, high-load-factor customers have unique operating characteristics and occupy a different role than traditional large general service or traditional industrial customers,” Metz said. “With careful rate design, reasonable ratepayer protections will allow parties to prosper, support economic development and ensure risks are mitigated.”

Even if large customers do everything right, they still face economic risks that could lead to their early retirement, which risks stranded costs falling to others, said Patrick Fahey, public utilities regulatory analyst for the North Carolina Department of Commerce.

Commissioner Karen Kemerait noted that the utilities do not want specific large load tariffs in North Carolina, arguing their current rate structures allocate costs fairly for any new load, and asked staff members for their response.

“If we decide to do nothing in terms of a new tariff in the next three years, the large load is already going to be here,” Metz said. “They’re going to be under a different tariff design.”

Staff want the commission to start working on large load tariffs now so that they are in place once the new loads start to make a major impact on North Carolina, he added.

“There is this variability in load forecasting that others have touched on — who will and won’t show up — and how that will change even in a relatively short time period means that the earlier we can get ahead of this and establish something that helps set guidelines as to what the large load customers can come in to expect,” Fahey said. “And that gets into potential improvements in forecasting and a better understanding from that customer’s perspective, especially if they’re cross-shopping against different states.”

Lucas Fykes, policy director of the Data Center Coalition, said in testimony Oct. 14 that his group has been involved in the development of large load tariffs around the country, and many start to kick in for customers with demands of 50 to 100 MW, though on the lower end that can start to impact major industrial sites – not just data centers. The main issue is that no group of customers is singled out and that cost allocations are fair to the large loads, he said.

“Certainty is very important for planning and operational purposes,” Fykes said. “We are leaning in as an organization, and many of our members are individually leaning in, in support of taking traditional terms that were usually in ESAs and putting those into tariff requirements that are fair and equitable.”

Large load tariffs vary by utility and states because the facts on the ground are different, but Daymark Energy Advisors consultant Jeffrey Bower (a witness for the Environmental Defense Fund) said some best practices have become apparent.

“Customers don’t want to invest unless they are clear about what their obligations are long term,” Bower said. “Utilities don’t want to invest in new infrastructure unless they’re clear that the customers are going to be there and are going to be contributing meaningfully to the cost of that infrastructure.”

Contract terms need to be shared with prospective customers early in the process, and defined rate classes that acknowledge their specific needs are important for certainty. Termination fees are another important part of the toolkit.

“The next principle, which has been discussed a bit, is the equitable cost allocation,” Bower said. “And so that’s a fundamental principle around cost causation and allocation, which protects existing customers, creates fair rates for new customers and aligns the incentives for efficient utilization of grid resources.”

AEP Ohio’s new large load tariff already has had a major effect on the pipeline of large loads looking to connect to its system. (See PUCO: Data Centers Must Guarantee Power Purchases from AEP Ohio.)

“Just last week, AEP announced that since enacting the tariff, its pipeline of data centers had fallen from 30 GW down to 13 GW,” Bower said. “And so, this is clearly a big impact of the tariff design. It’s up for debate whether this drop signifies a reduction in economic development, or if it’s a decrease in speculative interconnection requests.”

The Role of Flexibility in Meeting Demand

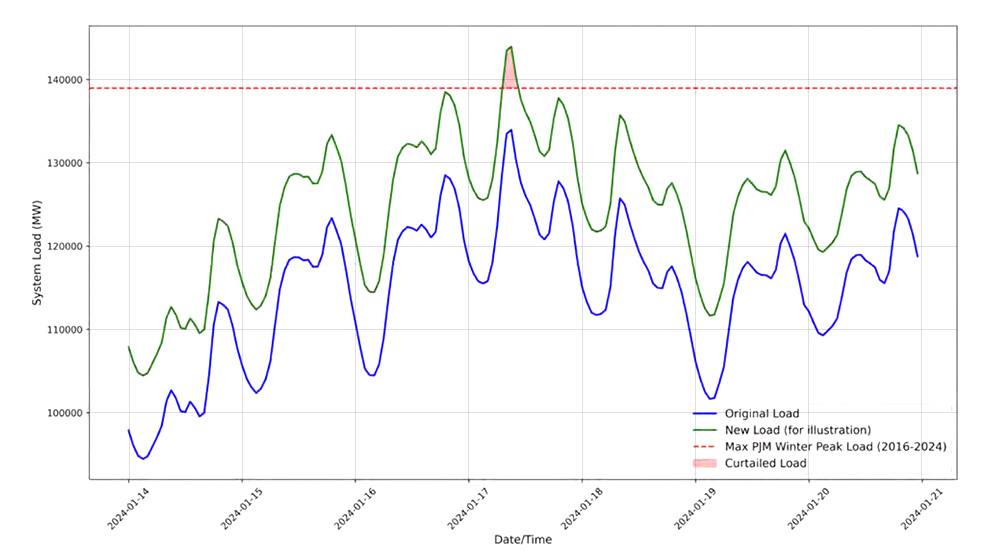

With speed to market and the industry’s ability to meet demand that is projected to grow faster than new, firm capacity can come online, demand flexibility from data centers has been discussed as a way to square that circle.

Duke University fellow Tyler Norris, who authored a widely cited paper on the subject, testified at the NCUC’s technical conference. (See US Grid Has Flexible ‘Headroom’ for Data Center Demand Growth.)

“Our goals for this were to support regulators and stakeholders in identifying strategies and tactics to accommodate this load growth without compromising the reliability, affordability or progress on decarbonization,” Norris said.

The study is based on examining the 22 largest balancing authorities in the country, which account for 95% of its total demand for electricity.

“Current expectations are that AI-specialized data centers will represent the single largest share of U.S. electricity load growth over the next five to seven years, and could represent up to 44% through 2028 alone,” Norris said.

Coupled with the need to maintain reserve margins, the highest forecasts indicate national peak load growth of 180 GW by 2030 alone. Norris said that easily could rise from 700 GW today to 850 GW in the next decade, which would exceed the supply chains for new gas turbines.

“We don’t know exactly how many turbines will be available,” he added. “The current estimate suggests 60 to 80 GW by 2030. Mitsubishi says that they are ramping up production.”

Battery storage can help; solar still is economical; and eventually small modular reactors or other new technologies will become available.

“We’re going to have to get creative with other solutions,” Norris said. “And so that’s why, for us, there’s an emphasis here on bringing the demand side into the equation more, so that we can utilize the existing grid that we’ve already paid for.”

In the Southeast, the bulk power system has an average and median load factor of about 53%, and it is stretched to the limit only on the coldest winter mornings and late afternoons on the hottest days of summer.

“We’re talking in the range of 50 to 200 hours per year that we’re building the system out to,” Norris said.

His study found that just 1% of demand flexibility from data centers could unlock 126 GW of capacity around the country; 0.5% could unlock 98 GW; and 0.25% for 76 GW. Duke’s system in North Carolina could add 4.1 GW of new demand with 0.5% flexibility from data centers.

Data centers can achieve flexibility through on-site resources such as batteries or backup generation, shifting computing load to other facilities in regions not affected by peak demands, or curtailing their activity in response to price signals.

NCUC Chair William Brawley asked whether computing would shift offshore if that policy was adopted nationally.

“There could be the possibility, perhaps, on the non-national security things, where that might actually be somewhere in Asia. Is that not a potential unintended consequence of this policy?” he asked.

That kind of spatial flexibility is an advanced capability for the tech firms building out data centers, and it has not been tested at scale, Norris said.

“It may be worth noting that it’s the policy of this administration to encourage data center development abroad, including in the Middle East, and there’s been major deals announced in terms of chip sales and exports of U.S.-manufactured gas turbines to the Saudis to support data center development there,” he added.

Norris said he is a big believer that winning the “AI race” is important and leveraging grid flexibility here could help.

“We can’t build infrastructure as fast as the Chinese, and so I view this kind of system optimization and using technology to get more out of the grid we already have, or whatever we’re building towards, is actually a critical source of national competitiveness because we’re just going to have constraints on how much we can build very quickly,” Norris said.