A new draft study evaluating ways to decarbonize New England’s power sector finds multiple advantages for carbon pricing, but also significant tradeoffs that underscore the tough choices facing policymakers.

The draft of the Pathways Study, commissioned by ISO-NE and written by the consulting firm Analysis Group over the last year, was presented to the NEPOOL Participants Committee on Tuesday.

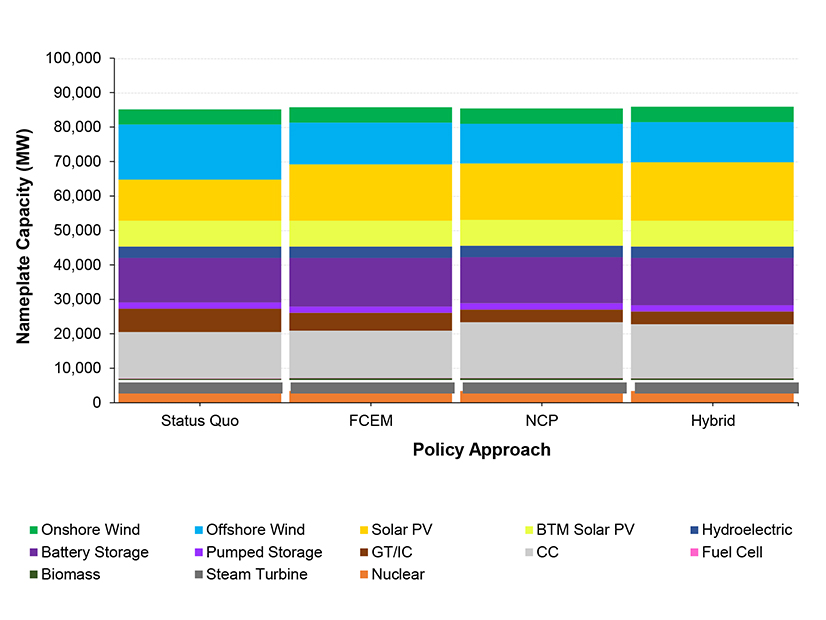

It looked at four policy approaches: a status quo scenario in which the New England states continue their unilateral clean energy policies; a forward clean energy market (FCEM) to compensate non-emitting resources; a net carbon pricing plan to price emissions from generators; and a hybrid approach which combines the latter two.

In theory, all four approaches can achieve “substantial” levels of decarbonization, the draft report says, but they come with unique challenges and costs.

The differences between the policy approaches laid out in the study | Analysis Group

The differences between the policy approaches laid out in the study | Analysis Group

Net carbon pricing would be cost-effective, a standard which the report says the other solutions fall short of. It would “create price signals that incent all substitutions that can reduce emissions,” it says.

Carbon pricing would also result in the lowest social cost, a 28% decrease from the cost of the status quo. Importantly, however, it wouldn’t be the cheapest option for consumers; that prize goes to the hybrid plan, which would reduce customer payments, unlike the others.

Carbon pricing would also be the most feasible approach to develop, the report says, because policymakers have more experience creating that type of design than something like the FCEM.

“While there is experience with market-based systems for environmental attributes … the FCEM would involve certain policy design elements that have not been used previously and would likely require significant time and effort to develop,” the report says.

However, carbon pricing is less well-suited to coordinating individual state policies and clean energy targets.

ISO-NE has been a supporter of carbon pricing but has struggled to find consensus in the stakeholder process and particularly among state policymakers. (See ISO-NE: States Must Lead on Carbon Pricing)

NESCOE, representing the New England states, has opposed the concept of incremental carbon pricing administered by the grid operator, arguing in 2020 comments to FERC that “consumers could be exposed to costs exceeding several billions of dollars each year.”

The distribution of locational marginal prices under each of the possible policy solutions | Analysis Group

The distribution of locational marginal prices under each of the possible policy solutions | Analysis Group

The hybrid approach involves combining a carbon price sufficient to provide revenue adequacy for existing clean energy resources (like the Millstone nuclear plant, used as an example in the report) with an FCEM that provides incremental compensation only to new clean energy resources. It’s a “completely novel” approach and the report raises questions about its feasibility for that reason.

One other issue found with the FCEM and hybrid approaches is storage “churning,” in which battery owners “consume otherwise-curtailed variable renewable energy and earn net revenues through energy losses,” the report says. The conditions leading to that inefficiency would be caused by frequent and large negative LMPs, which occur in those two scenarios.

In effect, the storage resources would be being paid to generate clean energy credits for clean energy resources even though the energy wouldn’t be replacing carbon-intensive generation.

Another advantage the report finds for carbon pricing is that it would provide incentives for fossil fuel generators to reduce their carbon-intensity when it’s cost-effective to do so, although the scope for those emissions reductions is “limited given current technologies,” it finds.