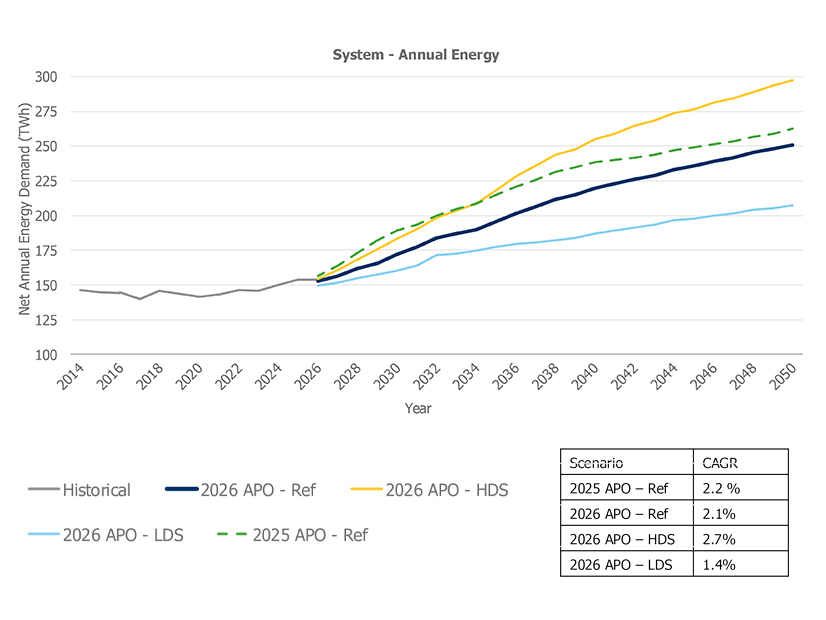

The reference scenario in IESO’s 2026 Annual Planning Outlook indicates net annual energy demand growth of 65% by 2050, from just over 150 TWh in recent years to 250 TWh.

The figure represents “robust” load growth over the next 25 years, according to the ISO, but it is slightly lower than the 262 TWh (75%) predicted in the 2025 APO, released in April.

“While this APO reflects short-term impacts caused by current geopolitical uncertainty, the long-term forecast shows that Ontario is poised to continue growing through the 2030s and beyond — consistent with trends seen in the 2025 APO,” IESO said in a presentation to webinar attendees Nov. 18.

Adam Kliber, IESO supervisor of planning models and forecasts, said there were four main drivers of the lower-than-expected demand. Among them are reduced adoption of electric vehicles and delays in large industrial “step loads” — projects typically over 20 MW that interconnect in large blocks, as opposed to slowly ramping up their growth over time.

IESO officials did not go into details about the delays, saying the underlying assumptions would be released alongside the full APO in the first quarter of 2026. The 2025 APO showed a rapid increase in two types of step loads: data centers, defined as commercial load, and the EV supply chain, including batteries. Data centers still are expected to be the main driver of load growth in Ontario.

But several global situations since have led to delays in an expected ramp-up of EV production in the province. Chief among them is U.S. President Donald Trump’s 25% tariff on imported auto parts, which led Honda to postpone a previously announced $11 billion expansion of its manufacturing plant in Alliston into an EV production hub.

And in late October, Honda slowed production at all its North American plants because of a dispute between the Netherlands and China over the Chinese-owned, Netherlands-based semiconductor manufacturer Nexperia. The dispute has thrown a semiconductor supply chain still recovering from the post-COVID-19 pandemic shortage into disarray. Honda since has resumed normal operations after securing enough chips, but that could change as the conflict continues.

Umicore Precious Metals Canada also had announced plans to build battery components for EVs at its Loyalist Township plant, with the federal and provincial governments contributing a combined $1 billion into the facility. That plan was paused even before Trump re-entered office, and the company has no intention of starting construction any time soon, as lower metal prices and EV demand globally led to reduced revenue.

Another factor leading to the lower growth is IESO’s “new electricity demand-side management framework and its considerable contributions on slowing demand growth by helping families and businesses use electricity more efficiently.” The ISO also projects lower population growth, though Kliber emphasized the data “indicate a very high growth overall.”

The geopolitical uncertainty is reflected in IESO’s high and low demand scenarios, to be included in the APO for the first time to comply with a directive from the Ontario Minister of Energy and Mines. (See Ontario Energy Plan Gives IESO Long ‘To Do’ List.)

While the 2025 APO indicated a 2.2% compound annual growth rate and the 2026 reference scenario shows 2.1%, the high demand scenario shows 2.7%.

The ISO did not go into detail about the assumptions for each scenario, but officials presented how it is developing the 2027 APO’s scenarios, with explanations for each. The reference scenario represents “high-confidence policy, government announcements and continuing trends,” while the high and low demand scenarios vary based on economic growth and consumer-driven electrification trends.

Under the reference scenario, EV adoption would continue to grow but is lower than the federal government’s targets, with the low scenario reflecting even lower adoption rates. Under the high demand scenario, the government’s targets are met.