The results of PJM’s 2022/23 Base Residual Auction were not competitive, according to a report released last week by the RTO’s Independent Market Monitor.

The 141-page report, coming nearly eight months after PJM announced the results, concluded that the noncompetitive nature of the auction came from “economic withholding by resources” that used offers consistent with the net cost of new entry (CONE) times the “expected average balancing ratio” offer cap, but not consistent with competitive offers based on the “correctly calculated” offer cap.

The Monitor concluded that market prices were “significantly affected by other flaws” in the capacity market rules and in PJM’s application of the rules, including the shape of the variable resource requirement (VRR) curve, the “overstatement” of the capacity of intermittent resources, the treatment of demand response, the minimum offer price rule (MOPR), the inclusion of energy efficiency and EE addback rules.

It also found that, although it played a smaller role in the 2022/23 auction compared to previous auctions, the rules “permitted the exercise of market power” without mitigation for seasonal resources “through uplift payments for noncompetitive offers, rather than through higher prices.”

“Although the impact was small in the 2022/23 auction, the issue should be addressed immediately in order to prevent the impact from increasing and because the solution is simple,” the Monitor said.

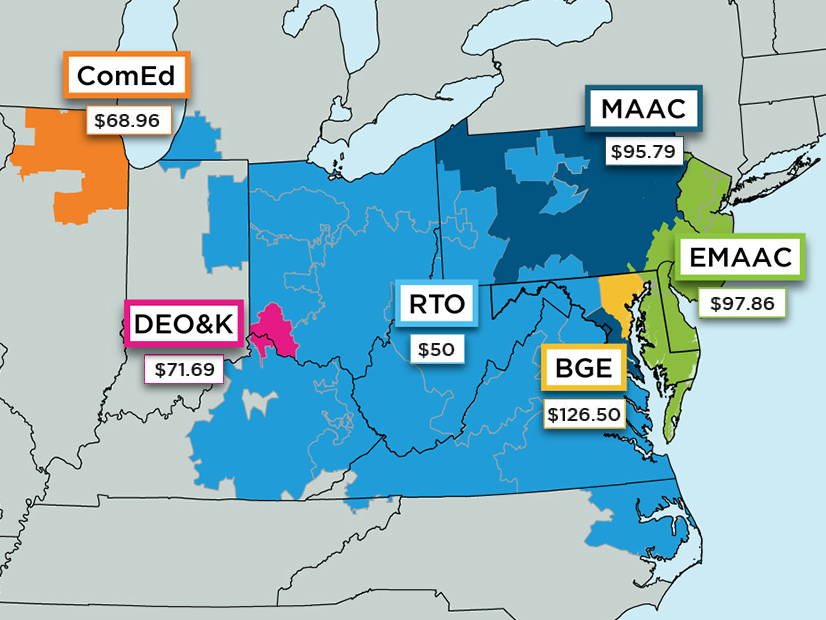

PJM’s capacity prices dropped significantly for delivery year 2022/23, falling by nearly two-thirds to $50/MW-day. Overall, the BRA, held May 19 to 25, cleared 144,477 MW of resources for the June 1, 2022, through May 31, 2023, delivery year, costing $3.9 billion, which was $4.4 billion less than the 2018 auction for 2021/22, after an adjustment for an increase in entities choosing to skip the auction by using the fixed resource requirement (FRR). (See Capacity Prices Drop Sharply in PJM Auction.)

Findings

The Monitor found that the 139,666.7 MW of cleared and uplift generation and DR for the entire RTO resulted in a reserve margin of 21.1% and a net excess of 7,660.2 MW over the reliability requirement, which is adjusted for FRR and price-responsive demand (PRD) of 132,006.5 MW. The net excess decreased by 530.1 MW from the net excess of 8,190.3 MW in the 2021/22 BRA.

A scenario summary of RPM revenue in PJM’s 2022/23 Base Residual Auction | Monitoring Analytics

A scenario summary of RPM revenue in PJM’s 2022/23 Base Residual Auction | Monitoring Analytics

The downward sloping shape of the VRR curve had a “significant impact” on the auction results, the IMM said, resulting in more capacity cleared in the market than would have cleared with a vertical demand curve. If PJM had used a vertical demand curve, it said, total capacity market revenues for the 2022/23 BRA would have been $2.65 billion, a decrease of $1.25 billion (32.1%) compared to the actual results.

“From another perspective, clearing the auction using a downward sloping VRR curve resulted in a 47.3% increase in RPM [Reliability Pricing Model] revenues for the 2022/23 RPM BRA compared to what RPM revenues would have been with a vertical demand curve set equal to the reliability requirement,” the Monitor said.

Accuracy of the peak load forecast also had a significant impact on the results, the IMM said, showing that the forecast for the third incremental auction has been on average 4.3% lower than the peak load forecast for the corresponding BRA for the auctions between the 2017/18 and 2021/22 delivery years. Using the lower peak load forecast, the total capacity market revenues for the 2022/23 BRA would have been $3 billion, a decrease of about $900 million (22.4%) compared to the actual results.

A scenario summary of cleared UCAP in PJM’s 2022/23 Base Residual Auction | Monitoring Analytics

A scenario summary of cleared UCAP in PJM’s 2022/23 Base Residual Auction | Monitoring Analytics

The IMM said an increase in the Commonwealth Edison capacity emergency transfer limit (CETL) of 1,265 MW, or 22.7%, from its 2021/22 level also resulted in an increase of $128 million (3.3%) in revenues.

Dominion Energy Virginia’s election of the FRR lowered PJM’s reliability requirement by 18,233.8 MW. The IMM said that if Dominion had participated in the BRA, total capacity market revenues would have been $4.38 billion and that, excluding FRR resources, total revenues for the rest of the PJM capacity market would have been $4 billion, an increase of $92 million (2.4%) compared to the actual results.

Finally, the Monitor said that if no offers for DR were included in the BRA, total capacity market revenues would be $750 million higher, a 19.2% increase compared to the actual results.

Recommendations

The report included nearly two dozen recommendations for changes to the capacity auction.

The Monitor said PJM should evaluate the shape of the VRR curve because the current shape “directly results in load paying substantially more for capacity than load would pay with a vertical demand curve.” Excess capacity procured in a BRA should not be sold back in any incremental auction “at much lower prices,” it said, asserting that the sales suppress prices in IAs and “provide inefficient incentives for demand resource offer behavior.”

“Given PJM’s assertions of the benefits of over-procuring capacity, it has never been explained why load should pay a high price for capacity in a BRA and sell it back at very low prices in an IA,” the Monitor said. “Such sales are inconsistent with PJM’s assertion that additional capacity purchases have value.”

The IMM said an “enforcement of a consistent definition of capacity resource” is needed by PJM. It recommended that the tariff requirement be “enhanced” to require a capacity resource to be a physical resource and “should apply at the time of auctions and should also constitute a commitment to be physical in the relevant delivery year.”

The requirement to be a physical resource is not currently applied to DR and EE, the Monitor said, both of which are permitted to submit marketing plans rather than evidence of physical resources in the BRA. “The requirement to be a physical resource should be applied to all resource types, including planned generation, demand resources, energy efficiency and imports.”