MISO is considering a new type of interconnection agreement for generation built on site and strictly for new large loads.

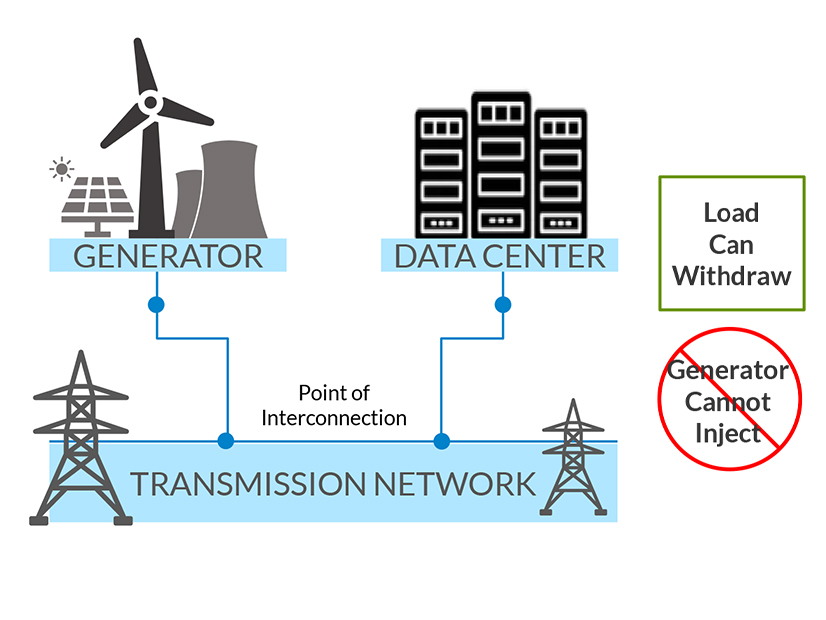

Marc Keyser, with MISO’s external affairs team, said the RTO wants to introduce “zero-injection generator interconnection agreements.” Under the agreements, generators built solely to serve a data center or other large load customer would connect to the grid without the ability to inject power into the grid and serve load solely at the same interconnection point.

“Let’s explore this hypothesis of zero-injection generator interconnection agreements. … We’re hearing our members say, ‘Please move quickly. Please help us facilitate large load interconnections.’ So, this is one way of doing it,” Keyser told stakeholders at a Planning Subcommittee meeting Dec. 3.

Keyser said zero-injection GIAs could benefit large load customers, with MISO recognizing on-site generation in interconnection studies, “potentially reducing network upgrade requirements to interconnect.”

“The intent here is speed,” Keyser said, adding that MISO could “reflect the reality” in its queue analyses that some new generators are built solely to serve a single large-load customer.

Keyser acknowledged the new GIA type would have limits and said a generator that wants full rights on the MISO system still would have to submit to the full-length queue process.

“It’s certainly not a full solution. You have a generator that cannot inject when you come out of the end of this,” he said.

The idea is part of MISO’s larger push to create registration and market participation rules for co-located generation and load.

“As these configurations become more common, we want to make sure our frameworks evolve to serve them,” MISO Director of Expansion Planning Jeanna Furnish said.

Keyser said the new type of GIA could work alongside MISO’s other efforts to incorporate large loads, including its interconnection queue fast lane, its long-range transmission planning, its expedited transmission request process and its ongoing efforts to cut regular queue processing down from about four years to 373 days.

Furnish said MISO would focus on how it can better enable large load integration over 2026.

But stakeholders said implementing the new, limited GIAs might not be as simple as RTO staff made it seem.

WEC Energy Group’s Chris Plante said stakeholders need time to “opine on the merits of such an arrangement.” Plante said he wasn’t sure MISO applying network status to generation barred from injection would square with FERC’s rule against RTOs netting behind-the-meter generation with load.

“I’m not even sure that we know this is feasible from that standpoint,” Plante said. “I’m very concerned that we’ve put something on the table that hasn’t gone through a full stakeholder discussion.”

Keyser said the proposal is in the early stages and that MISO doesn’t intend to “create a netting situation between load and generation.” He said the RTO would contemplate the loss of generation in its interconnection studies so as not to lump load and generation together.

He added that MISO has filed GIAs in the past with zero megawatts of injection service specified in them.

But Plante said MISO should examine what the generation would do without the load. He said if load trips and its dedicated generation does not, the generation would be injecting on the grid, “even if momentarily.”

“Can we sustain the loss of a 1.2-GW data center?” Plante asked hypothetically.

The Sustainable FERC Project’s Natalie McIntire asked MISO to stay focused on the technical details of the proposal, especially how curtailments of generation and load might be handled should either go offline unexpectedly.

“I want to make sure we don’t forget the important technical questions,” McIntire said.

American Transmission Co.’s Erik Winsand said MISO must decide on how it would conduct technical studies, as well as what tariff changes might be necessary to make zero-injection GIAs a reality.

MISO staff committed to refining their plan. Keyser asked stakeholders to bring opinions on whether the RTO should require a contractual link between load and generation or if the load and generation should be allowed to span electrically similar pricing nodes. He also asked for more advice on whether MISO should prepare for planning and reliability risks under the new GIAs.

Hoosier Energy’s Tommy Roberts said the idea was “exceptional” and that the RTO should move quickly to implement it.

“We’re going to get run over if we move slowly,” he said.

However, Roberts said he was concerned that diagrams in MISO’s presentation appeared to show two separate points of interconnection between the load and generation, instead of both behind a single point of interconnection.

“There is some level of injection just between two points on a switchyard out of data center,” Roberts pointed out.

Keyser agreed that the chart MISO presented was flawed and said the intent is for both load and generation to be situated behind the same point of interconnection.

MISO is scheduled to discuss its proposal at a Planning Advisory Committee meeting Jan. 21, 2026, and again during a stakeholder workshop Jan. 30 dedicated to discussing the implications of large loads.

Keyser said MISO would move “rapidly” over 2026 to firm up the proposal.