ISO-NE’s new day-ahead ancillary services market added about $258 million in incremental costs between March and August, equal to 7.6% of total energy market costs, according to the RTO’s Internal Market Monitor (IMM).

The volatility and incremental costs have alarmed some consumer advocates and load-side participants, who have expressed concern that the market costs have been significantly higher than initial expectations.

Launched in March, ISO-NE’s new day-ahead market is intended to optimize the procurement of energy and 10- and 30-minute reserves, and ensure the region has procured enough supply to meet forecasted demand. (See FERC Approves ISO-NE’s Day-Ahead Ancillary Services Initiative.)

In its 2023 filing of the changes, the RTO wrote that the new combined day-ahead energy and ancillary services market “will clear energy and ancillary services jointly in a way that maximizes the efficient use of the region’s resources to meet day-ahead energy demand and to satisfy both the load forecast and day-ahead reserve requirements (ER24-275).”

Dónal O’Sullivan of the IMM discussed the performance of the new day-ahead market with the NEPOOL Markets Committee on Dec. 9.

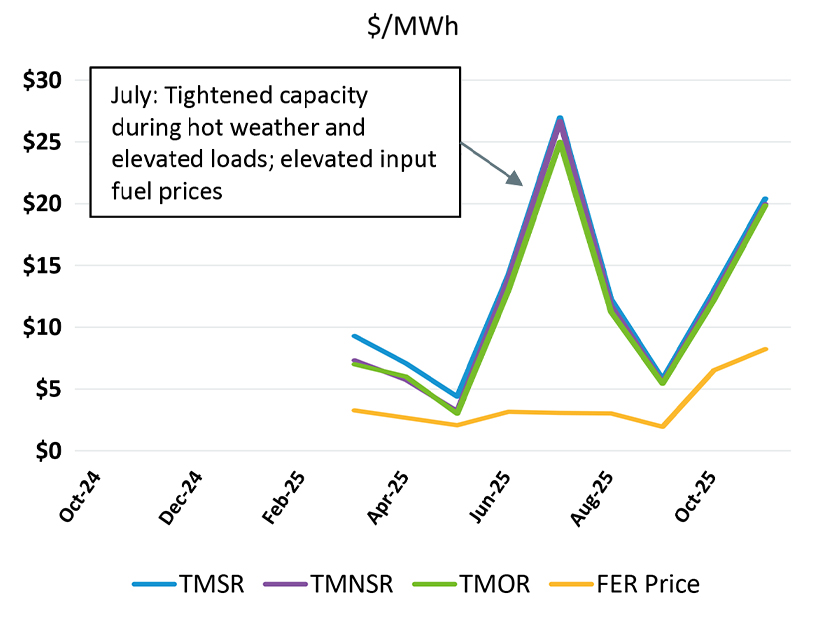

He noted that meeting the day-ahead 10- and 30-minute reserve requirements was “the significant cost driver,” with these needs accounting for about $210 million of the incremental costs. These flexible response service (FRS) costs were themselves driven by high opportunity costs during the tightest days on the system, he said.

Over half of incremental costs were incurred during 10 high-load days during the summer, he noted.

“Periods of elevated FRS clearing prices occurred during high-demand periods that also had high energy market prices,” the IMM wrote in its summer markets report. “Opportunity costs can be highly impactful to FRS clearing prices during periods like this as the magnitude of the inframarginal energy market rents foregone by units that are ‘redispatched’ to satisfy reserve requirements can be large.”

The day-ahead energy and ancillary service clearing prices incorporate opportunity costs associated with selling other day-ahead products. ISO-NE wrote that this is needed “to avoid creating an incentive for suppliers to submit offer prices inconsistent with their costs in an attempt to clear for a ‘more profitable’ product.”

The high costs have not been isolated to summer price spikes. After prices dropped in September, monthly costs rebounded in October and November. ISO-NE has said this was due in part to an increase in resource outages.

‘Serious Concerns’

O’Sullivan also discussed the impacts of the new Forecast Energy Requirement (FER) constraint, which is aimed at procuring enough load to meet the day-ahead demand forecast.

This design is intended to help prevent gaps between the energy forecast and the amount of supply cleared in the day-ahead energy market. Physical resources participating in the day-ahead market earn both the clearing price — subject to closeout charges — and a separate FER price.

The IMM estimated that, without the FER constraint, the total incremental costs of the new day-ahead ancillary services market would have been about $48 million lower over the six-month period.

The day-ahead ancillary services market’s $258 million in incremental costs are well beyond ISO-NE’s initial estimates; the RTO forecast in an impact analysis that the new day-ahead products would increase energy and ancillary services costs by about $140 million annually, based on a 2019-2021 study period.

“Our office has serious concerns about the magnitude and volatility of DASI [day-ahead ancillary services initiative] costs to date, including the degree to which these costs have exceeded the ISO’s original impact analysis,” a spokesperson for the Massachusetts Attorney General’s Office wrote in a statement.

“We have and will continue to advocate for additional analysis and clarity surrounding the various components of DASI to ensure that consumers are not unfairly burdened by unnecessary or inefficient costs and to ensure that all market products and components are delivering benefits commensurate with their costs,” they added.

In response to consumer concerns about higher costs associated with the new market design, ISO-NE representatives have said they are closely following market performance but have stood by the market design and urged the need to accumulate a full year of data on the new day-ahead design before considering changes.

“We still think some time is helpful to go through the winter cycle to see how it performs in the winter,” ISO-NE COO Vamsi Chadalavada said at the NEPOOL Participants Committee meeting in December. “The objectives are not going to change. It is, for us, I think the best way to secure those services.”

ISO-NE has expressed confidence the new day-ahead market has improved grid reliability, though these benefits can be difficult to quantify.