NYISO staff presented more of their initial ideas for improving the Demand Curve Reset process, centered on alternative shapes, slopes and points of the curve.

The ISO’s goal is to simplify the process for both staff and stakeholders. (See Resetting the Reset: Demand Curve Reform Discussions Begin.)

“The demand curve is at the core of aligning system reliability needs to market fundamentals,” Michael Ferrari, market design specialist for NYISO, told the Installed Capacity Working Group on Jan. 21. “Modifying them can enhance the efficiency of market signals to improve capacity market outcomes.”

The DCR shape and slope govern the value of capacity under different market conditions, sending price signals for new resource development and retirement of old units. The more installed capacity that is on the grid, the less any given megawatt is worth, and vice versa.

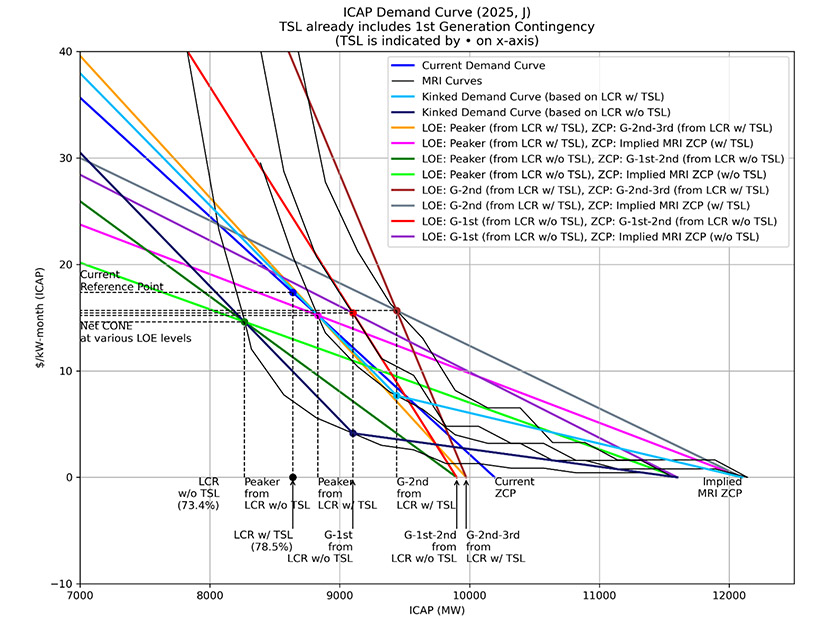

The curve is drawn from the zero crossing point (ZCP) to a reference point set by the cost of new entry and locational minimum capacity requirement. The ZCP is where the marginal price of an additional megawatt of capacity is equal to zero.

Currently, the curve slopes downward from the maximum clearing price plateau in a straight line to the reference point and the ZCP. Ferrari said NYISO had investigated “kinking” the demand curve into multiple slope segments, increasing the steepness of the curve to change prices more rapidly and increasing the ZCP. The ISO also discussed pinning the loss-of-load expectation reliability criteria to losing the largest generation unit in each location, similar to the N-1 contingency analysis in transmission planning.

“We are not trying to indicate an endorsement of any particular change or option,” Ferrari said, explaining that the presentation reflected “early analysis” of reform options.

Stakeholders said adjusting the ZCP might be difficult. Howard Fromer of Bayonne Energy Center said the first time the ZCP was set was a heavily negotiated process. Doreen Saia, of Greenburg Traurig, agreed.

“All of our locality curves have to work within the [New York state] curve,” she said. “If you extend out some of the curves too far, it eats into the ‘Rest of State’ price. … If you go too tight, then New York City gets problematic very quickly.”

Saia said that she welcomed looking at the demand curve and ZCP “with fresh eyes” because the situation has become much more complex, from both a regulatory and market player standpoint. More entities of more types are in the market trying to sell power.

One stakeholder mentioned that in the current DCR process, there are provisions to revise the shape and slope of the curve, but in practice this does not happen regularly. Ferrari said that the last time he recalled discussing changes to the ZCP was in 2014.

“Mike, I think you’re absolutely right,” Saia said. “We could have always looked at shape and slope, but for the first six or seven reset processes, the only thing that was even slightly considered was moving to a combined cycle gas facility” for the reference point.

Pinning the LOLE to a contingency analysis based on the largest generator also stirred discussion among stakeholders. Some said this would establish an incentive to build “really large generators” by essentially announcing that the demand curve would shift to accommodate them. One said that a contingency in the capacity requirement created uncertainty in developer cost-benefit calculations.

A NYISO staffer argued that using the largest generator had the benefit of greater clarity and transparency for understanding how the market would behave and would not necessarily increase market complexity.

Time-differentiated Transmission Congestion Contracts

NYISO is also considering alternative ways to divide transmission congestion contracts into more granular products.

Currently, TCCs are a 24-hour product only. NYISO is the sole RTO/ISO to offer only 24-hour financial transmission rights. This has been criticized by stakeholders as limiting the effectiveness of TCCs to serve as hedging mechanisms against congestion because they cannot distinguish between congestion patterns that change during the day or over the course of a week.

NYISO considered time-differentiated TCCs in 2021, proposing products for on-peak workdays, off-peak weekends and holidays, and off-peak “all other hours.” In 2025, Calpine proposed a system that broke TCCs into on-peak and off-peak hours. (See Calpine Sees Support for TCC Auction Proposal.)

The ISO is planning on finalizing a proposal in 2026, building off both its 2021 design and Calpine’s. Tariff language will not be pursued until it passes the annual project prioritization process.

Champlain Hudson Power Express Integration

NYISO provided stakeholders with an update on the Champlain Hudson Power Express integration process.

CHPE is a 1,250-MW HVDC line that will run between Quebec and New York City. It is expected to go into service in 2026, but the exact date is unknown. (See NYISO Proposes ICAP Changes for New Entry Ahead of CHPE.)

The capacity market is predicated on annual inputs with limited seasonality, and the capability year starts in May. If CHPE’s integration into the grid is mistimed, it could have major implications for capacity market parameters, such as the transmission security limit for the New York City-area capacity zones.

To accommodate this uncertainty, the ISO created two sets of market parameters, one assuming CHPE is operating and one assuming it is not. This creates two sets of TSLs, locational capacity requirements, capacity accreditation factors, unforced capacity demand curve parameters and load-serving entity minimum capacity requirements.

If CHPE provides notice by March 2 to participate in the ICAP market in May, NYISO will set the market to reflect its participation. The ISO intends to issue a notice by March 9 to market participants as to whether CHPE will be in the market.