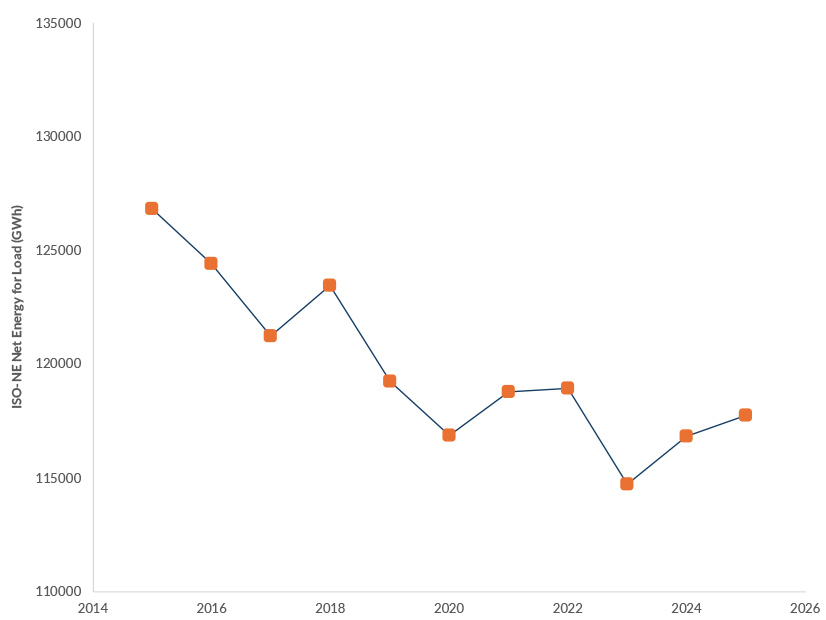

After years of declining or stagnant power demand in New England, annual energy demand ticked up for the second straight year in 2025, potentially indicating the start of a broader upward trend.

Total system demand grew by about 0.8% in 2025, while in-region power production increased by about 2.8%, according to RTO Insider’s review of data recently released by ISO-NE. Over the past two years, total energy demand has increased by about 2.6%, and in June 2025, the region experienced its highest peak load since 2013.

From the early 2000s through 2023, net energy for load in New England steadily declined because of energy efficiency investments and the growth of behind-the-meter solar. But ISO-NE expects electrification of heating and transportation to reverse this trend and predicts that annual energy demand will increase by 11.4% from 2025 to 2034, accompanied by a more than 2-GW increase in peak load. By 2050, ISO-NE forecasts peak load reaching up to 57 GW. (See ISO-NE’s Final 10-year Demand Forecast Tapers Expectations and ISO-NE Prices Transmission Upgrades Needed by 2050: up to $26B.)

These forecasts generally do not account for potential data center demand growth, which could add an additional significant source of demand growth. While high power prices have largely kept developers of large-scale data centers away from the region, its largest electric utilities have indicated an uptick in interest in large load interconnections from developers.

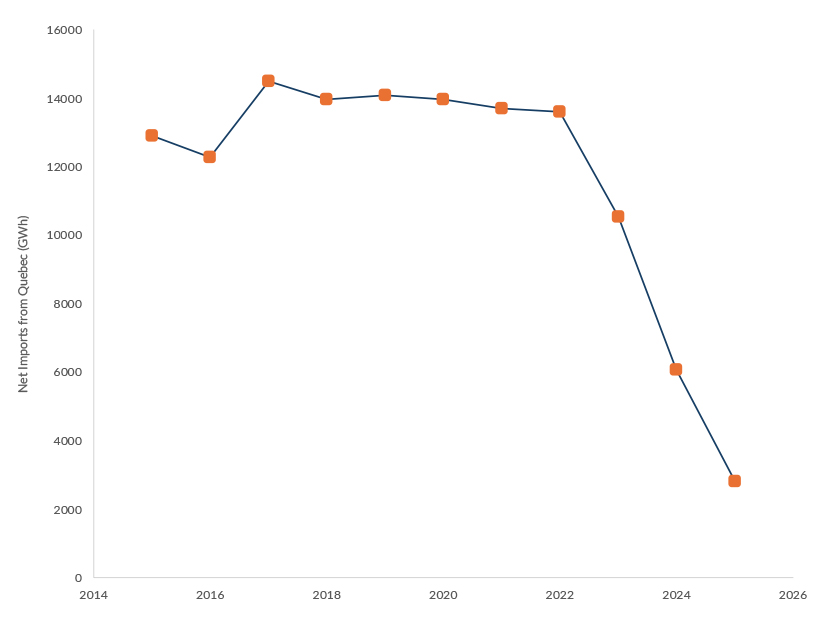

As demand increased in the past year, net imports from Québec declined by about 54%. 2025 marks the third straight year with a significant decline in imports from the province. Net imports accounted for just 2% of energy in the region in 2025, compared to an average of over 11% between 2014 and 2022.

The decline in net imports appears to be driven in part by an ongoing multiyear drought affecting hydropower reservoirs in Québec. According to data from the energy consulting firm McCullough Research, the combined energy content at three of Hydro-Québec’s largest reservoirs entered the winter at its lowest point in the last six years. (See Drought, Climate Drive Uncertainty on New England Imports from Québec.)

Hydro-Québec has said it reduced its exports in the leadup to the New England Clean Energy Connect (NECEC) and Champlain Hudson Power Express (CHPE) transmission projects coming online. Both lines include significant supply obligations for the company. NECEC began commercial operations Jan. 16, while CHPE expects to come online by midyear.

It is unclear how the NECEC line will impact New England’s net imports from Québec. While Hydro-Québec has signed 20-year supply contracts with Massachusetts electric utilities for firm power at a fixed price, it is not prohibited from simultaneously importing power from New England on other lines.

While Hydro-Québec plans to make significant long-term investments to add renewable capacity and increase hydropower production, it has a slim reserve margin for the current winter, and reliability issues in the province have forced it to cut or reduce supply along the line for extended periods over the past five days. The contracted supply is not associated with new capacity supply obligations with ISO-NE, but the company faces penalties by Massachusetts for supply interruptions on the line. (See Hydro-Québec Halted NECEC Deliveries amid Reliability Concerns.)

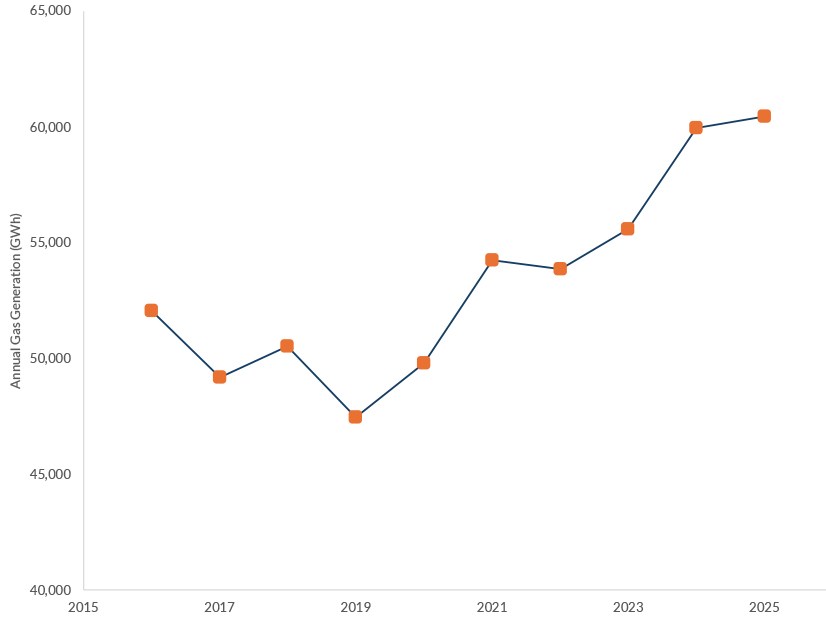

Increased generation from gas, oil, wind, solar and nuclear resources helped fill the gap left by the decline in imports from Québec.

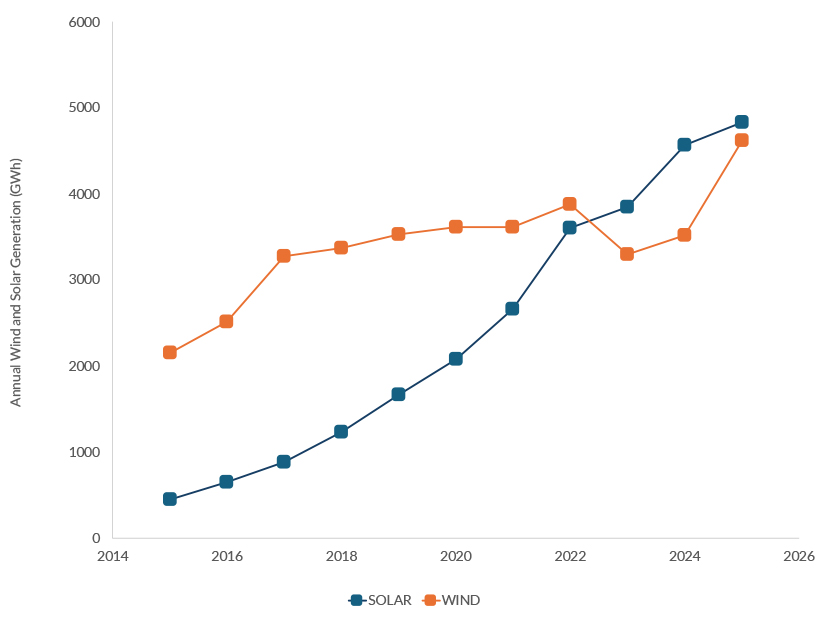

Nuclear and wind power saw the biggest year-over-year growth, both increasing by over 1,000 GWh. The region’s nuclear fleet produced at its highest level since 2019, the year the Pilgrim Nuclear Power Station closed.

Wind power in the region saw a boost as Vineyard Wind ramped up power production in the latter half of 2025. By the end of the year, the 800-MW project had reached about 72% of its production capability. Wind power should be in line for another big year in 2026 if Vineyard and Revolution Wind are both able to complete construction. Revolution is in the late stages of construction but has yet to start producing power. Both projects have obtained stays on the Trump administration’s December stop-work order.

Wind and solar power each accounted for about 4% of total energy in 2025. Solar production increased modestly, by about 6%. This does not include behind-the-meter solar, which has grown significantly in recent years and is the largest category of solar in the region. ISO-NE’s most recent load forecast projected behind-the-meter solar providing 6,316 GWh of energy in 2025, compared to the 4,836 GWh provided by front-of-meter solar during the year.

Oil-fired generation also spiked significantly in 2025. About 80% of this use occurred in January, February or December. The region’s reliance on oil tends to be concentrated during high-demand winter periods when generators have limited access to pipeline gas. Over the past week, sustained cold weather has caused generators to rely heavily on their stored fuel inventories, with oil frequently meeting about a third of energy demand in the region.

Despite the region’s heavy reliance on oil when temperatures drop, oil-fired generation accounted for less than 1% of total energy in 2025.

Gas generation in New England hit another record in 2025, increasing by about 0.8%. Annual gas generation in New England has increased by 21.4% since 2020.

The increased reliance on gas and oil generation contributed to an annual increase in power system carbon emissions. Based on data through Nov. 30, ISO-NE estimates that annual emissions rose by about 2%.