California continues to add in-state renewable energy resources, but the transmission upgrades needed to bring those projects online have been lagging behind, according to the California Public Utilities Commission.

About 8.9 GW of renewable and storage resources are expected to be delayed due to transmission delays in the Pacific Gas and Electric (PG&E) and Southern California Edison (SCE) territories, Edmund Dale, CPUC senior regulatory analyst, said at CAISO’s Jan. 28 transmission development forum.

The 8.9 GW represents about 22% of the total 40.5 GW of new renewable generation and storage resources that have signed interconnection agreements in the PG&E and SCE areas.

For PG&E, about 2.5 GW of these resources are delayed due to “bundling dependencies,” which are chain reactions of transmission project delays, Dale said. PG&E said the interconnection customers are responsible for resolving the transmission delays, he said.

One critical delayed transmission project in PG&E’s territory is the Vaca-Dixon Substation 230-kV circuit breakers 442, 452 and 462 project. About 450 MW of new capacity is delayed due to this project’s lag, with an additional 900 MW at risk.

Material problems are a primary cause of transmission delays, with a supply chain issue resulting in an 11-month delay on PG&E’s Gates 230-kV Reactors Bus E-F transmission project, affecting 2 GW of resources. To address the delays, PG&E will shift material from another project to the Gates project, Dale said.

Financing and project redesign delays could also significantly affect renewable and storage resource projects in PG&E’s territory, Dale added.

To submit a commentary on this topic, email forum@rtoinsider.com.

In SCE’s territory, long lead-time materials, such as circuit breakers, transformers and specialized steel structures, are forecast to delay 4.5 GW of new resources, with an additional 2 GW of resources at risk of delay.

To alleviate some of these delays, participating transmission owners (PTOs) should consider allocating more time and other resources to determining more realistic in-service dates and project costs, Dale said.

CAISO is in frequent and close coordination with the CPUC and the transmission owners about transmission project delays, CAISO spokesperson Jayme Ackemann told RTO Insider.

“Delays do not typically result in changes to the transmission studies or approvals, per se, but such delays are considered in the generator interconnection and deliverability allocation processes,” she said.

The ISO does not anticipate impacts to available resources in EDAM, Ackemann added.

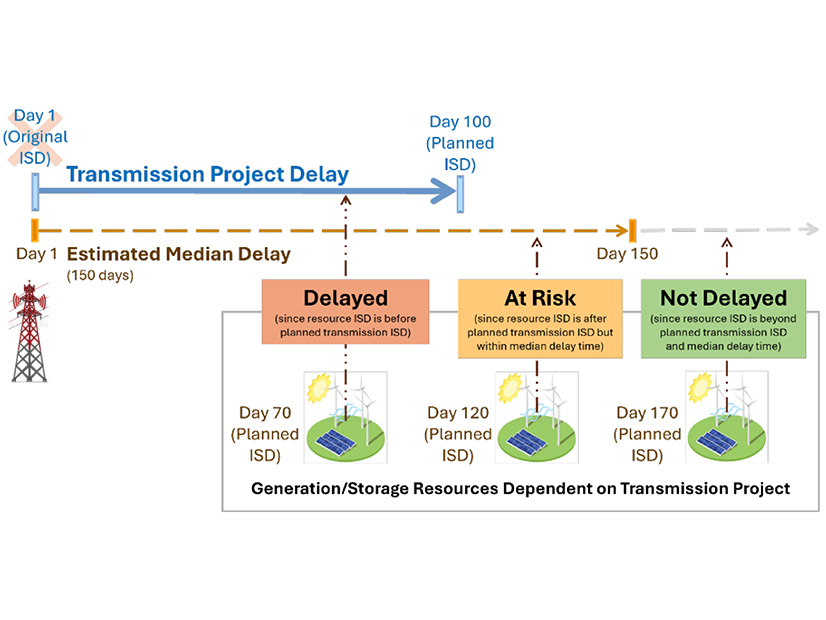

Transmission project delays are now tracked per the requirements of California Senate Bill 1174, passed in 2022. The law requires transmission facility owners to submit a report to the CPUC that shows changes to previously reported in-service dates of transmission and interconnection facilities that are necessary to provide transmission service to certain renewable or energy storage resources.

In November 2025, the CPUC detailed transmission delays in an annual report. It showed 449 delayed transmission projects with associated renewable generation or storage resources.

San Diego Gas & Electric (SDG&E) said it did not have any delayed transmission projects with associated renewable and storage projects.

CPUC staff reviewed SDG&E’s data and “determined it to be incomplete and inaccurate” and requested updated corrections to SB 1174 data from SDG&E, which SDG&E provided, the report says. However, CPUC staff determined that the updated data was “still not sufficient” because SDG&E did not provide data for its in-development transmission projects and provided incorrect original in-service dates, the report says.