A newly published review of utilities serving 81.1 million U.S. customers found $30.5 billion in 2025 rate hike requests — a record high, and twice as much as was sought in 2024.

The report issued Jan. 29 by PowerLines further quantifies what has become a salient political issue: rising energy costs.

“As these costs keep climbing,” PowerLines Executive Director Charles Hua said, “policymakers of all political stripes will face growing pressure to take action and advance solutions to improve our grid and lower utility bills for American consumers and businesses.”

Rate hike requests do not go through unchanged, and state utility regulators of all stripes continually announce steps to protect ratepayers.

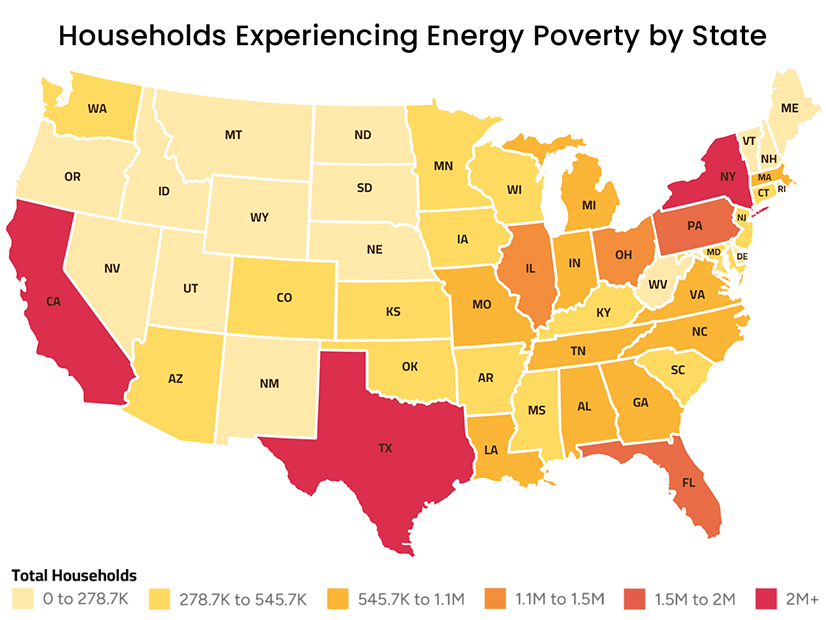

But even with that regulatory effort factored in, the impact of rising prices is being felt. The report notes that an estimated 80 million Americans struggle to pay their utility bills and more than 50 million keep their homes at unsafe or unhealthy temperatures. More than 20% of American households experience energy poverty, spending over 6% of their income on energy bills.

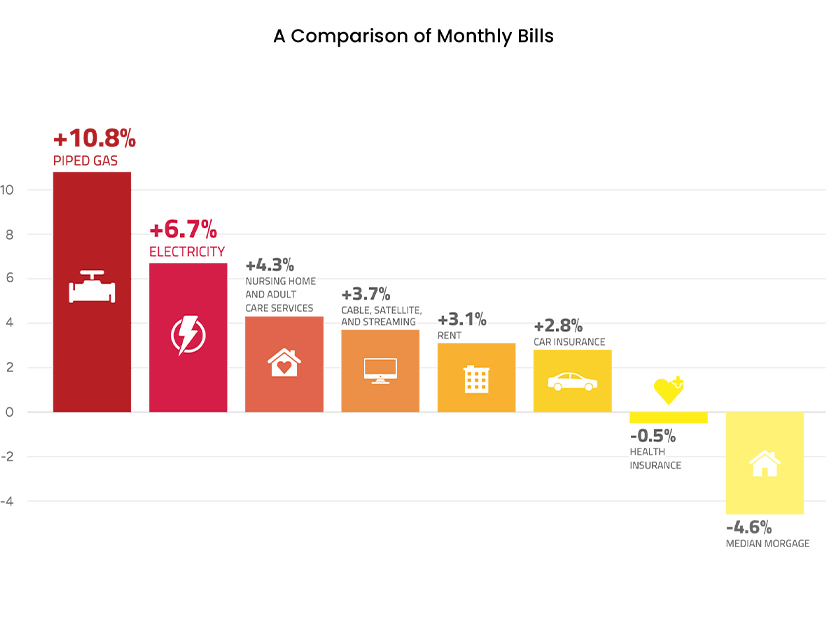

Monthly utility bills — which include charges and/or credits beyond rates — increased 10.8% for piped gas and 6.7% for electricity from December 2024 to December 2025 while the overall U.S. inflation rate was just 3%, the authors write. Since the first quarter of 2021, residential retail electricity prices have increased approximately 40%.

Electricity and natural gas prices have become the fastest drivers of inflation, the report states.

Commercial and industrial electric prices did not increase as sharply as residential prices in 2025, only about 5%. But such increases typically are passed on to consumers through higher costs for goods and services.

A March 2025 poll conducted by Ipsos for PowerLines concluded three in five Americans were not familiar with the public regulatory board that controls their utility bills, three in four are concerned about rising utility bills and four in five feel powerless over these costs.

Against this backdrop, it was inevitable perhaps that rising utility bills would become a leading political issue. PowerLines expects these costs to be a top concern for voters in the midterm elections, particularly in competitive 2026 congressional and gubernatorial races.

The report notes that early projections for 2026 do show some moderation: The Energy Information Administration expects electricity prices to increase about 4%, but that still is much more than the Federal Reserve’s projected 2.4% inflation rate.

Collecting data from public databases, news reports, press releases and utility regulatory filings, PowerLines counted $30.5 billion in 2025 rate increases compared with $15 billion in 2024.

The impact was most intense in the Northeast, where $6.5 billion in rate increases spread across 11.5 million customers were sought. The least intense impact was in the Midwest — $3.2 billion in increases affecting 16.7 million customers.

In between were the South ($14.3 billion across 32.9 million customers) and West ($6.5 billion across 20 million customers).

Each of the rate increase requests is different, but four key factors emerged as PowerLines analyzed the data collected: aging infrastructure that needs to be replaced; repairing damage from past extreme weather or making upgrades to prevent future damage; volatile fuel costs; and rising electricity demand, although some utility markets and some investments are structured so that rising demand can lower electricity prices by spreading costs over a broader customer base.

The authors note also that utility capital expenditures — a key driver of profit for utilities and costs for their ratepayers — increased more than 14% between 2024 and 2025.