ISO-NE updated stakeholders on its methods for assessing the impacts of its proposed capacity market overhaul on Feb. 11 as it prepares to release the initial results of the long-awaited analysis in March.

The RTO’s Capacity Auction Reform (CAR) project includes significant changes to resource accreditation and the timing and format of capacity auctions. ISO-NE aims to implement the changes for the 2028/29 capacity commitment period.

Given the significant effects the changes could have on market outcomes, the impact analysis is eagerly awaited by a wide range of stakeholders. Resource owners and developers are particularly interested in the potential effects of the accreditation changes on how much capacity they can sell in the market.

ISO-NE requested input on its plans for the CAR impact analysis in January and said it has made several changes in response to the feedback it received. (See ISO-NE Details Inputs for Capacity Auction Reform Impact Analysis.)

Chris Geissler, director of economic analysis at the RTO, told the NEPOOL Markets Committee that the feedback showed “strong interest” in better understanding the drivers of changes to the net installed capacity requirement (ICR) and the impacts of a risk split that more heavily weights summer risks. There was less consensus around what future resource mixes ISO-NE should study, he said.

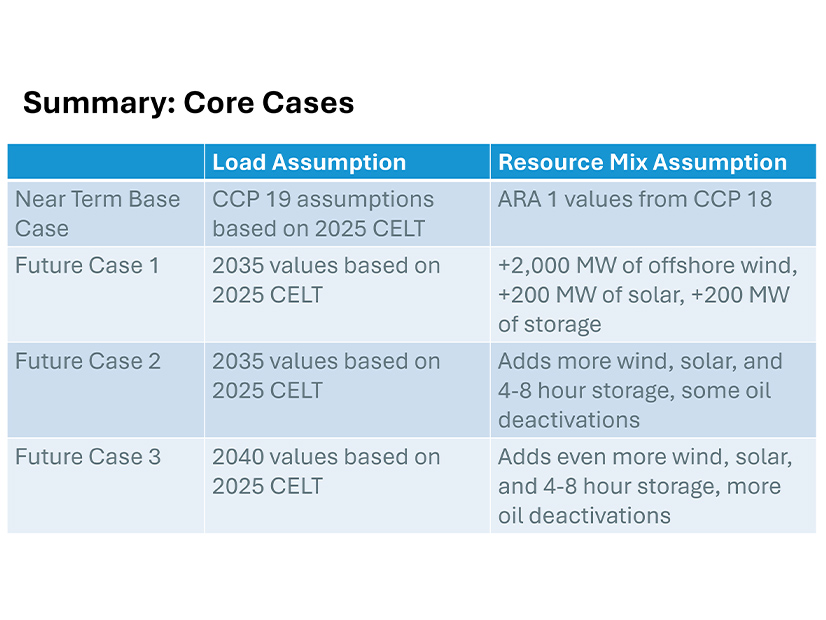

ISO-NE in January outlined plans for a “near-term base case,” relying on its most recent forecast for the 2028/29 CCP, and a future case relying on its most recent forecast for 2035 and assuming additional wind, solar and battery capacity.

Geissler said ISO-NE now plans to develop two more future cases that vary based on how much wind, solar and storage capacity are added and how much oil capacity is deactivated.

Key outputs for each case will include net ICR values; demand Marginal Reliability Impact (MRI) curves for each year and season; winter gas MRI curves for gas-fired resources without firm fuel commitments; and relative MRI values for resource types.

ISO-NE also plans to provide information on expected unserved energy, the value of different storage durations and “additional information on the breakdown of MRI hours.”

The impact analysis will also include model sensitivities building on the near-term base case and three future cases. Using the base case, ISO-NE plans to study a seasonal risk split shifted toward the summer; changes to the storage dispatch methodology; and changes to the total available gas supply. Using the future cases, the RTO plans to study higher annual and winter load levels.

It plans to present results from the near-term base case and the first future case to the Markets Committee in March, followed by results on the two additional future cases in April.

ISO-NE plans to run a separate analysis to estimate the effects of CAR on market clearing outcomes. This analysis is intended to “present ranges of clearing prices, capacity award amounts and revenues to approximate the impacts” of the market changes.

It requested feedback on the proposed modeling assumptions in advance of the March meeting, and it plans to present the initial results of this analysis in May.

Hybrid Resource Accreditation

Also at the Markets Committee, Ben Chenault of ISO-NE discussed the RTO’s proposed approach for accrediting co-located resources, which typically consist of solar and storage components.

Under the new framework, ISO-NE plans “to model each component of a hybrid resource separately, using a framework consistent with the component’s technology type.”

ISO-NE would model the resource facility limit “using the existing interface limit modeling capability” of its accreditation modeling software, Chenault said.

He noted that, if the facility limit reduces the amount of energy a hybrid resource can supply during MRI hours, the resource would see a reduction in its accreditation value.