SPP last week laid out the clearest explanation yet of its plan to expand its presence and establish an RTO in the Western Interconnection.

“We’re currently … seeking opportunities to expand existing services in the West,” Bruce Rew, SPP’s senior vice president of operations, told the Strategic Planning Committee during a discussion of its new five-year strategic plan Wednesday. “If you look at a couple of years from now, our goal is to be viewed as an attractive market service provider in the West.”

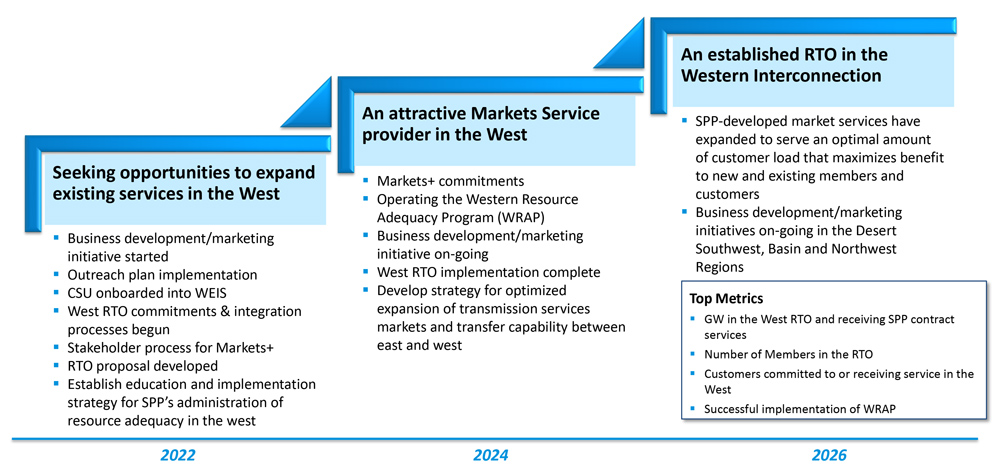

Under its five-year plan, SPP will first grow its existing services in the West, which include its real-time Western Energy Imbalance Service (WEIS) market, its role as a NERC-certified reliability coordinator and its RTO West proposal, which has attracted nine entities and is expected to become operational in 2024.

By then, SPP plans to be operating the Western Resource Adequacy Program, evaluating commitments to its Markets+ service and developing a strategy for the best expansion of transmission markets and transfer capability between the Western and Eastern Interconnections. Markets+ offers centralized day-ahead and real-time unit commitment and dispatch and “hurdle-free” transmission service to those not ready for full RTO membership. (See Implementation Underway for NWPP’s Western RA Market.)

In 2026, SPP plans to have an established RTO in the West, with business development and market initiatives ongoing in the Desert Southwest, Basin and Northwest regions.

David Kelley, director of seams and tariff services, said the plan is a living document, noting “themes are evolving quite rapidly.”

“As that continues to play out in the West, we’re going to need to be able to adapt, so this is certainly not written in stone,” Kelley said.

Board Chair Larry Altenbaumer said the plan’s metrics should focus on value created for both legacy members and the Western members. “I think it is certainly equally important that we focus on the value that our existing membership is deriving from the expansion in the West,” he said.

Several SPC members pointed out the challenges SPP may encounter in the West from entities leery of RTO membership. They also warned staff to counter fears that the Board of Directors will favor its Eastern members over the West.

“Certainly, there are concerns and challenges [in the West] and it’s dependent upon each party that you talk to and what their position is,” Rew said. “Part of the overall strategy and approach is to work through those challenges as we move forward, whether it’s the RTO expansion to expansion of the existing WEIS market or even working with the WRAP.”

Counterflow Optimization on Hold

Committee members sided with stakeholders and staff in deciding to keep the current market construct, rather than adding counterflow optimization to the congestion-hedging process, as recommended three years ago by the Holistic Integrated Tariff Team (HITT). (See SPP SPC Takes on Congestion Hedging Issues.)

The HITT’s recommendation to add counterflow optimization — limited to excess auction revenue — to SPP’s market mechanism that hedges load against congestion charges has become an issue with no solution since its board approval in 2019. The proposal, which would essentially keep system transmission flows between two points balanced, was meant to address stakeholders’ and staff’s concerns about how congestion rights instruments are awarded and the current process’s efficiency.

The Market Working Group was tasked with developing a policy paper. Education workshops were held for the board and SPC, which created an advisory team to move the recommendation forward. Last year, consulting firm Nexant was charged with providing a root-cause analysis that found it to be the “latitude and pattern of nominations submitted to the annual allocation.”

An SPP 2025 future study found market participants’ hedging positions will change in coming years thanks to new topology, HITT initiatives and the changing generation mix. The study indicated a net positive value for all load-serving entities with counterflow optimization.

SPP’s Market Monitoring Unit weighed in during the MWG discussions, saying it does not endorse counterflow optimization and the grid operator and stakeholders should identify alternatives to congestion-hedging issues that carry less risk.

“There are other options that are less complex, less risky, and easier to unwind to address counterflow optimization,” MMU Executive Director Keith Collins said.

The Monitor said the proposal doesn’t give participants a say in the amount of counterflow they receive and there is no way for them to avoid being affected by optimization even when they opt-out. It also said auction participants will adapt to the market changes, which will affect auction revenue. It also said auction participants will adapt to the market changes, which will affect auction revenue.

Arkansas Electric Cooperative Corp.’s Andrew Lachowsky recalled an MWG meeting at which the MMU’s John Luallen referred to the proposal as “a risky, expensive redistribution of wealth.”

“I hope I [got] the quote verbatim,” Lachowsky said.

In the end, the MWG was unable to reach consensus to approve counterflow optimization and voted in 2020 to keep the current market construct. Although they acknowledged that counterflow optimization would benefit LSEs, staff also recommended keeping the current construct, noting some market participants want to review the transmission service process for efficiencies.

Although the HITT recommendation was brought back to the MWG “time and time again,” SPP’s Micha Bailey said staff were unable to gather membership support.

“We can’t get the majority there, so that’s why we said we need to keep the current market construct,” Bailey said. “We need to move on and see what other efficiencies we can garner.”

“It was a pretty tough, complex subject,” the Nebraska Power Review Board’s Dennis Grennan, a member of the advisory group, told the SPC.

“This process is a stream of different processes,” Nexant’s Joseph Bright said.

SPC Chair Mark Crisson called for a “cooling-off period” to rethink counterflow optimization.

“I would request [that] sometime this year, we put our heads together … to talk about how we consider examining this issue again, and whether there are issues besides or in addition to counterflow optimization that we consider,” he said.

“We see the issues there. We just haven’t seen where the organization over the last couple of years has been able to coalesce around a solution or a change that would be agreeable to the organization,” Rew said. “We’ll probably be [able to reach consensus] at some point a year from now because that’s what the goal for this was.”

The SPC endorsed two other HITT recommendations: an effectiveness study of SPP’s new three-phase generator interconnection process that began in 2019, and a working group’s tariff language establishing cost allocation and rates for energy storage resources (ESR).

The new GI process addresses overwhelming demand for service by providing incentives to accelerate the study process and avoid multiple restudies. (See FERC OKs New SPP Interconnection Process.)

However, staff said only one cluster study of interconnection requests has been partially completed after restudies of previous clusters delayed full implementation. A second cluster is expected to finish its first phase this month.

Staff compared the three most recent clusters that went through the legacy process with the three-phase process’s first two studies. Principal engineer Steve Purdy said multiple restudies were avoided, with 41% of the IC requests remaining after two iterations, compared to 65 to 77% in the three legacy clusters.

“It appears the three-stage process had the desired effect,” Purdy said. “We were able to get a more stable group of requests in the cluster quicker, and we were able to move on to these later studies more efficiently.”

That said, the two studies currently being evaluated may be the only ones that go through the three-stage process. Purdy said the GI queue backlog mitigation procedure docket before FERC and SPP’s transmission-planning improvements will eventually supersede the three-phase study.

The Regional State Committee is reviewing tariff language for ESRs’ cost allocation and rates developed by the Cost Allocation Working Group

The Markets and Operations Policy Committee earlier approved a revision request (RR476) that will treat ESRs as transmission assets. The SPC conditioned its endorsement upon the RSC’s approval of RR476 in July.

Task Force Addressing Winter Storm Recs

COO Lanny Nickell told the committee that a task force has begun working on recommendations from SPP’s report on last year’s winter storm, when thermal plant outages forced the grid operator to order its first-ever load sheds. (See “Grid Operator Releases Report on Performance During Winter Storm,” SPP Board of Directors/Members Committee Briefs: July 26-27.)

The Improved Resource Availability Task Force (IRATF), comprising members and state regulators, is working to recommend policies that address the report’s 26 Tier 1 recommendations as well as fuel assurance, resource planning and availability issues. The group has completed two of the recommendations and another 17 are in progress.

“This effort is going to take a lot of work, and there’s a lot of debate. A lot of it has already begun with the task force,” Nickell said.

Southwestern Public Service’s Bill Grant asked that the group consider force majeure issues that arose during last February’s winter storm, when natural gas pipeline companies were unable to meet contractual terms and provide fuel to some gas plants. Nickell said the task force will address the issue when it next meets.

“We’re using the IRATF as that platform [between the electric and gas industries], as it touches both the regulatory committee and our membership,” Nickell said.

“I feel like we’re obligated to do it,” SPP CEO Barbara Sugg said. “If the IRATF is not the right group, we’ll take another tack. We can’t just wait for something to happen organically.”

The report also made 92 Tier 2 and 3 recommendations. Eight of those are complete and 13 are in progress.

Crisson Takes the Chair

The meeting marked the first for Crisson as SPC’s chair and the first for Oklahoma Gas and Electric’s Usha Turner and WAPA’s Sanders as committee members.

Board member Crisson took over the chairmanship role from Altenbaumer, who was quick to point out he left no open action items after his two years leading the committee.

“I just want to let you know I gave you a clean slate,” Altenbaumer said.