Fuel-cost Policy Standards Proposal Endorsed

Stakeholders endorsed a joint PJM/Independent Market Monitor proposal regarding fuel-cost policy standards at last week’s Market Implementation Committee meeting.

The proposal, which was developed at the Cost Development Subcommittee, received 221 votes in favor (95%) and won 192 votes (95%) favoring it over the status quo.

PJM’s fuel cost policy form. | PJM

PJM’s fuel cost policy form. | PJMMelissa Pilong, senior analyst in PJM’s performance compliance department, reviewed the proposal clarifying fuel-cost policy standards in Manual 15 and Operating Agreement Schedule 2 penalty language. The proposal was first presented at last month’s MIC meeting. (See “Fuel-cost Policy Standards and Penalties,” PJM MIC Briefs: Nov. 3, 2021.)

Pilong said the proposal includes a combination of clarifications and language for more elaboration on PJM’s fuel-cost policies resulting from the RTO’s examination of the fallout from the February winter storm in Texas and other parts of the South and Midwest.

It would have market sellers of generation units verifying that all intraday offer triggers are specified in the unit’s fuel-cost policy. Market sellers will also have to verify that weekend or holiday natural gas estimation practices match either the default assumptions in the PJM Fuel Cost Policy Guidelines contained in Manual 15 or specify estimation practices in the unit’s policy.

“This takes the burden off the market seller to have to update their fuel-cost policy to clarify what their estimation practice is,” Pilong said.

The Manual 15 updates include changes to the intraday update triggers. Pilong said market sellers need to have a one-time trigger to update the maximum allowable cost offer to opt into intraday offers.

Paul Sotkiewicz, E-Cubed Policy Associates

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”Sotkiewicz-Paul-2013-10-15-RTO-Insider-FI.jpg” align=”left”>Paul Sotkiewicz, E-Cubed Policy Associates | © RTO Insider LLC

Paul Sotkiewicz of E-Cubed Policy Associates said he wished the issue would have been discussed in a different venue, calling attendance of the Cost Development Subcommittee “spotty at best.” Sotkiewicz said most stakeholders don’t have the ability to attend all PJM meetings, and many of the issues discussed at the CDS are “extremely down in the weeds and esoteric.”

Sotkiewicz requested that PJM find a way to bring some of the issues discussed at groups like the CDS to the MIC for broader discussions before they’re voted on.

“These are potentially pretty substantial changes that are happening that affect all generation owners,” Sotkiewicz said.

PJM will seek final endorsement of the proposal at the Members Committee in February and issue a FERC filing following approval by the Board of Managers.

Virtual Combined Cycles Regulation Endorsed

A proposal from Vistra addressing regulation for virtual combined cycles received unanimous stakeholder support in an acclamation vote.

Michael Olaleye, senior engineer with PJM’s real-time market operations, reviewed the proposal to revise Manual 12. The issue charge was originally endorsed at the May MIC meeting and worked on during committee meetings. (See “Virtual Combined Cycle Regulation Issue Charge Endorsed,” PJM MIC Briefs: May 13, 2021.)

Olaleye said units that are modeled virtually by PJM can sometimes receive varying regulation awards from the market clearing engine, which Vistra has been experiencing with some of its units. When a combined cycle unit is modeled as multiple virtual units, there is a possibility for unbalanced or unequal regulation awards to each unit by the engine.

Vistra’s proposed enhancement to performance group scoring calls for calculating the “hourly” score and extending it to each market resource with an assigned regulation for the given hour. It also called for PJM to calculate the “historic” performance score and extend it to each market resource in the performance group.

Becky Robinson, Vistra

” data-credit=”Vistra” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Becky-Robinson-(Vistra)-FI.jpg” align=”right”>Becky Robinson, Vistra | Vistra

Olaleye said the enhancements would ensure that all resources of the performance group have the same historic performance score, which should fix the regulation clearing calculation problem in the software.

Becky Robinson of Vistra said the proposal should solve the identified problem that only impacts a “handful” of market participants while having “no negative effects” for other market participants not impacted by the regulation for virtual combined cycle units.

Capacity Offer Opportunities

Jason Barker of Exelon provided a first read of a problem statement and issue charge in conjunction with Brookfield Renewable to address the treatment of generation with co-located load and to examine capacity offer opportunities.

Barker said there’s a “burgeoning consumer interest” in co-locating new, large interruptible commercial loads behind the wholesale meter of existing generation resources. He said interested customers include those engaging in commercial activities like Bitcoin mining, server farms and hydrogen electrolysis that require “very fast” curtailment times of 10 minutes or less in their facilities.

Jason Barker, Exelon

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”Barker-Jason-2019-03-06-(RTO-Insider)-FI.jpg” align=”left”>Jason Barker, Exelon | © RTO Insider LLC

“This is a discreet and novel issue due to the characteristics of the load,” Barker said.

Customers are expressing preferences for a low-cost physical energy supply, Barker said, while others are seeking a carbon-free physical energy supply.

Barker said PJM’s current market rules make customer choices “challenging,” resulting in “unduly costly and inefficient outcomes for the grid.” He said PJM markets don’t offer options for fast-response interruptible customers to select physical supply from their choice of generator technology.

The issue charge includes investigating clarifications and market rule changes to support new interconnection configurations for highly interruptible load that is co-located with generation. Key work activities cited include education regarding current capacity offer requirements for existing generation resources and interconnection requirements for “new, large, fast-response interruptible commercial load.”

The expected deliverables in the issue charge are potential modifications to capacity market rules in the PJM tariff and relevant manuals and potential modifications to cost-based offer rules.

Work on the issue is expected to take six months at the MIC.

Consultant Roy Shanker said he believes state rules on the retail side will be relevant to the discussion, suggesting that the key work activities include education on how the modifications will interact on the retail side.

“There are lots of interesting rules and laws that may or may not apply to these kinds of arrangements based on state franchise laws,” Shanker said.

Erik Heinle of the D.C. Office of the People’s Counsel said he would like to see education included about how other RTOs and ISOs are handing the issue of generation with co-located load.

PJM Monitor Joe Bowring

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”capacity transfer rights ” align=”right”>PJM Monitor Joe Bowring | © RTO Insider LLC

Monitor Joe Bowring said the key work activities listed in the issue charge “make sense,” but he was a “bit skeptical” about how the issue is laid out for discussion. Bowring said the language can be interpreted as providing capacity value to the behind-the-meter customer but requiring other customers to pay for it.

Bowring suggested the issue charge should be revised to be more neutral but that it remains an important topic to discuss.

“It’s fundamentally about how the costs are getting assigned and who’s winning and who’s losing as a result,” Bowring said. “This is a potentially radical change to the capacity market design.”

The committee will be asked to approve the issue charge at the January MIC meeting.

Minimum Run Time Guidance

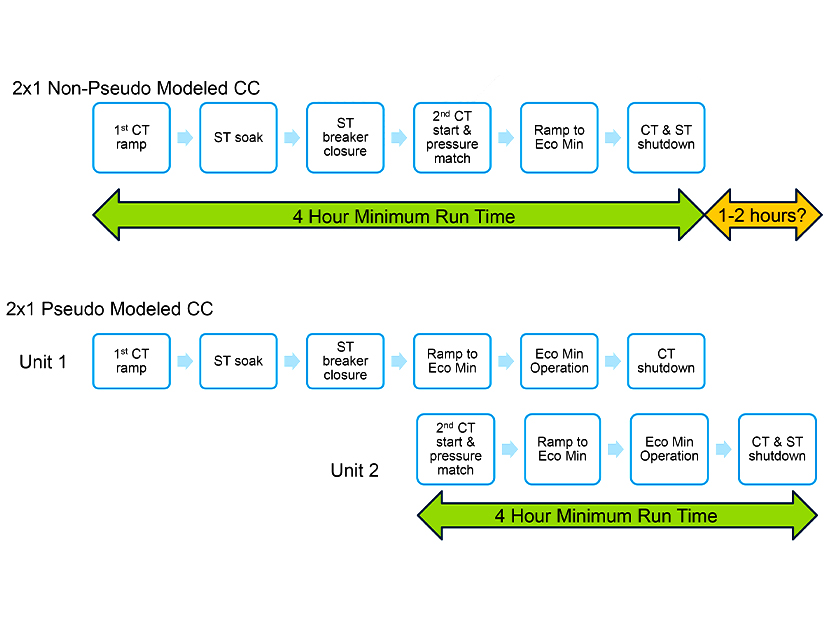

Tom Hauske, principal engineer in PJM’s performance compliance department, provided education and a first read of a problem statement and issue charge addressing pseudo-modeled combined cycle minimum run time guidance.

Hauske said PJM and the Monitor were bringing the issue forward as a result of the “disaggregation of many multiple block combined cycles” into individual pseudo-model market units, or virtual modeled combined cycle units. Market sellers can currently model a combined cycle unit as multiple pseudo units composed of a single combustion turbine and a portion of a steam turbine.

Hauske said if the market units of a pseudo-modeled unit are dispatched at different times on parameter-limited schedules, the potential exists for one or more of the pseudo-modeled units to operate “for some period beyond the minimum run time parameter limit for an identical non-pseudo-modeled combined cycle unit.”

The issue charge includes a key work activity of stakeholders developing guidance for market sellers regarding offering operating parameters for pseudo-modeled combined cycle units through education on the issue. Expected deliverables include revisions to Manual 11 or other relevant PJM governing documents.

Hauske said PJM was looking to use the “CBIR Lite” (Consensus Based Issue Resolution) process in Manual 34 to develop any manual changes and have final endorsements of any changes by the Markets and Reliability Committee’s meeting March 23.

Calpine’s David “Scarp” Scarpignato said the issue was a “little bit complex” to use the CBIR Lite process and that it would be better to conduct discussions under the normal CBIR process. Scarp said he prefers to use the normal CBIR process in stakeholder discussions “unless there’s a real reason to deviate from them.”

“I don’t see a burning reason to go to the lite process here,” Scarp said.

Hauske said the shorter process was suggested because PJM’s unit-specific parameter adjustment process starts on Feb. 28 with market sellers submitting requests. PJM must provide a determination on the requests by April 15.

Scarp said he “doesn’t see a huge reliability” threat if the issue isn’t resolved in time and didn’t want to rush discussions to get imperfect language implemented. He said the prior rules were used last year, and there were no major reliability concerns.

“I definitely want to get the work done, but I want to get it done in due diligence and a conscientious fashion,” Scarp said.

De-energized Bus Replacement

Vijay Shah, lead engineer in PJM’s real-time market operations department, provided a first read of conforming revisions to Manual 11: Energy and Ancillary Services Market Operations as part of five-minute dispatch and pricing. The changes are designed to address enhancements to the dead bus replacement logic for assigning prices to de-energized pricing nodes (pnodes).

Shah said the objective of the revisions are to provide increased transparency in the logic and how it performs replacements for de-energized buses. PJM is required to produce LMPs for all pnodes in the RTO’s network model for all intervals, including de-energized pnodes.

Shah said PJM wants to use new logic based on Dijkstra’s algorithm, an industry standard, to find a suitable replacement for de-energized pnodes. He said the algorithm uses the “least impedance path” to find a suitable source, and it’s to be implemented in both day-ahead and real-time market clearing engines.

The manual changes include updated language to reflect the new logic.

The committee will be asked to endorse the manual revisions at the MIC’s meeting Jan. 12, with final endorsement at the Jan. 26 MRC meeting. The new dead bus replacement logic would be effective March 1.

Manual 6 Revisions Endorsed

Members unanimously endorsed conforming changes to Manual 6 resulting from the endorsement of a proposal to address PJM’s auction revenue rights and financial transmission rights at the October MRC meeting. (See Stakeholders Endorse PJM ARR/FTR Market Changes.) Emmy Messina, senior engineer with the PJM market simulation department, first presented the manual changes at the November MIC meeting. (See “Manual 6 Revisions,” PJM MIC Briefs: Nov. 3, 2021.)

Messina said the changes would only impact Manual 6 and include language for bid limits and the network model user guide. The changes would update section 6.6 to reflect an increase of bid limits from 10,000 to 15,000 per corporate entity, auction round and period in FTR auctions. The February 2022 auction will be the first FTR auction with the updated limits.

Section 9.1 was also updated to direct stakeholders to a new network model user guide on the FTR section of the PJM website to get additional information on the auction.

PJM will now seek endorsement of the manual changes at the December MRC meeting.