CHARLOTTE, N.C. — Renewable developers said last week they don’t expect much from the controversial Southeast Energy Exchange Market (SEEM), saying it falls far short of the transparency and competition found in RTOs and ISOs.

The developers reacted coolly to representatives of Southern Co. (NYSE:SO) and Duke Energy (NYSE:DUK), who defended SEEM at the Infocast Southeast Renewable Energy Conference.

Proposed by more than a dozen utilities and cooperatives including Southern, Duke and the Tennessee Valley Authority, SEEM would automate bilateral trades, allowing 15-minute energy transactions, and use free transmission to reduce rate pancaking. The SEEM agreement took effect Oct. 12, after FERC deadlocked 2-2 on the proposal. (See SEEM to Move Ahead, Minus FERC Approval.)

Critics of the proposal say it would only perpetuate the utility monopolies of the Southeast and produce a fraction of the savings that could come from an RTO.

Utilities’ Control

“I think there’s a lot of concern that participation — controlling who participates — is in the hands of the people developing SEEM. And so whether or not we get the chance to actually participate, we’ve got a lot of questions about that,” Blan Holman, vice president of regulatory affairs for solar developer Pine Gate Renewables, said during a panel discussion at the conference.

Blan Holman, Pine Gate Renewables | © RTO Insider LLC

Blan Holman, Pine Gate Renewables | © RTO Insider LLCNoel Black, vice president of federal regulatory affairs for Southern, responded that SEEM’s sponsors are seeking wide participation.

“Participation and liquidity [are] really important for SEEM and how much benefit it brings to customers, so we are eager and excited to have more participants. I want to be clear on that,” he said. “The opportunities I believe are fantastic. If you get a giant footprint … 160,000 MW, 50 million customers, 1,000 miles between Savannah and Springfield, Mo., with zero transmission [cost] … the more participants, the more liquidity, the more opportunity we have to bring value … to our customers. So if we buy something, in SEEM, it’s cheaper than something we would have run … that goes straight to our energy costs, to our customers. If we [make] short-term opportunity sales, the margin we make flows back through to our customers, either through lower rate base or energy clauses.”

Cost, Speed

Black said the cost of establishing SEEM — $5 million to $6 million — is “extraordinarily inexpensive” compared to alternatives such as an RTO.

Molly Suda, associate general counsel for Duke, also touted the speed at which SEEM will be launched, with hopes to begin operations by the end of 2022. “For other market designs, there are substantially longer lead times,” she said.

In response to questions, Black and Suda acknowledged SEEM will not offer LMP or provide a clearinghouse for environmental attributes.

SEEM’s sponsors said an independent third-party consultant estimated the market will provide members a total of $40 million to $50 million in annual savings in the near term, potentially growing to $100 million to $150 million annually “as more solar and other variable energy resources are added.”

Noel W. Black, Southern Co. | © RTO Insider LLC

Noel W. Black, Southern Co. | © RTO Insider LLC“By the utilities’ own admission, [comparing SEEM to an RTO is] sort of like comparing a flea to a basketball,” Chris Carmody, executive director of the Carolinas Clean Energy Business Association (CCEBA), said in a separate session at the conference. “The projected savings that the entire SEEM project would do across these many, many utilities is $40 million a year [and] I think $10 million for North Carolina. … Ten million is less than half of the salary of a significant CEO.”

In September, the American Council on Renewable Energy released a report that found an energy imbalance market (EIM) would reduce total resource costs from $64.7 billion in 2020 to $42.1 billion in 2040, a 35% savings, versus a more modest reduction to $53.1 billion (18%) under SEEM. (See Report: SEEM’s Benefits Beaten by Other Models.)

Black said SEEM’s sponsors considered an EIM but rejected it because of its “command-and-control nature” and the cost and time to stand it up. “So the question becomes can you get the same benefits at a much lower cost without the bureaucracy and burdens of some of the other structures? And right now, the answer, in our minds and in our hearts and on paper seems to be ‘yes.’ [We] can effectuate scope and scale without the bureaucracy and burdens of more complex structures.”

Transparency

Transparency is another concern of renewable developers, said Pine Gate’s Holman. “If you have a full-blown RTO, you get visibility in the pricing. And here, I think there’s concerns about whether or not you can be able to … see the transactions in a way that helps send signals to the market for further investment,” he said.

Black said there is a “fine line between transparency and … exposing commercially sensitive information.”

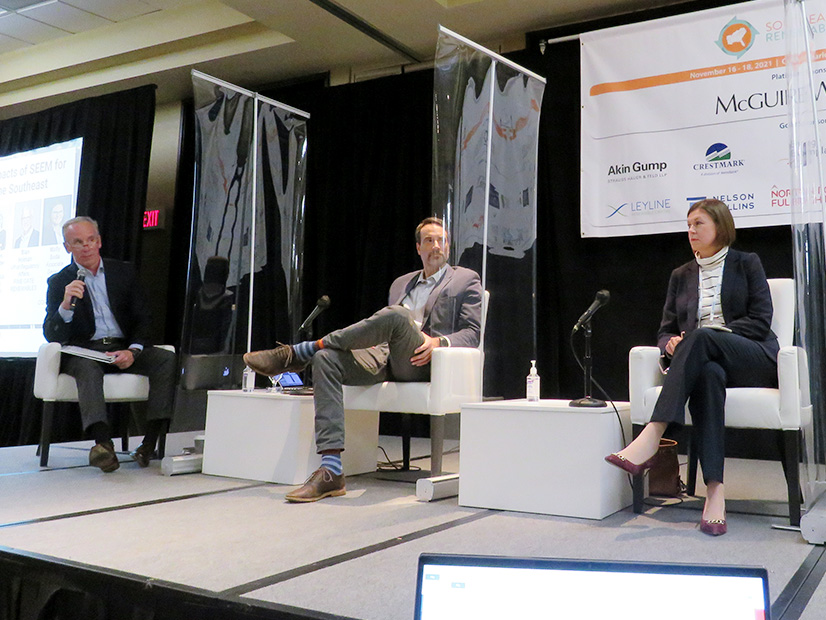

From left: Moderator Weston Adams, Nelson Mullins Riley & Scarborough; Hamilton Davis, Southern Current LLC; Meredith Chambers, EDP Renewables, and Blan Holman, Pine Gate Renewables | © RTO Insider LLC

From left: Moderator Weston Adams, Nelson Mullins Riley & Scarborough; Hamilton Davis, Southern Current LLC; Meredith Chambers, EDP Renewables, and Blan Holman, Pine Gate Renewables | © RTO Insider LLC

“We were trying to thread that needle so that we give enough exposure … to build that trust [and ensure SEEM is] executing the tariff as designed, but also not expose information that participants might find too sensitive. I think we struck the right balance. We’ll see. I think time will tell.”

Black said the cost-benefit study done for SEEM found that 2% of the energy in the region will flow through the market, which he said, “feels defensible, and maybe a little conservative.”

Although only 5% of the Western Energy Imbalance Market’s regional energy flows through the market, BIack said “you get a sort of cost transparency on 100% [of transactions] off that 5% at the top of the stack.”

“I believe that [SEEM] has the potential to bring those sorts of benefits to customers as it grows. And the more participation we have and the transparency and comfort grows, I think we’ll see those sorts of benefits. So I feel comfortable coming out of the gate and looking anyone and everyone in the eye and saying, ‘Here’s what we believe this will do,’ … and then having hopes and dreams that it will be much bigger and amazing as we move down the road.”

In a statement Oct. 20, FERC Chairman Richard Glick expressed concern that because the commission did not issue an order approving SEEM, its sponsors might not honor the promise they made to provide transparency. (See FERC’s Christie Accuses Glick, Clements of Prejudice for RTOs.)

In response to a FERC deficiency letter, the sponsors promised in June to provide confidential weekly submissions of market data to the commission and SEEM’s Market Auditor, “comparable” to the data provided by RTOs under Order 760, including participants, bid/offer prices, quantities and locations. They also agreed to make the “just-and-reasonable standard” the default for most SEEM rules rather than the lower Mobile-Sierra public interest standard. (See SEEM Members Offer Rule Changes.) In Mobile-Sierra, the Supreme Court ruled that when sophisticated parties negotiate at arm’s length, their agreement should be presumed just and reasonable unless it can be shown to harm the public interest.

Black said Glick has no reason to worry. “I would say the SEEM members are all comfortable with those commitments, and highly likely — within the next week or two — to file those commitments with FERC in some form or fashion,” Black said. The transparency provisions “are there to build trust in the system, for not just participants, but members as well. The more trust in the system, the more likely the system will work and [there will be] liquidity. … So we will be filing something to put those commitments in … place, regardless of whether we were ordered to do that.”

No Boon for Solar Developers

Meredith Chambers, general counsel and regulatory compliance officer for EDP Renewables (OTCMKTS:EDPR), said SEEM is unlikely to affect the plans of the Madrid-based company, which is new to the Southeast market, with 60 MW of generation operational and 350 MW under construction.

Meredith Chambers, EDP Renewables | © RTO Insider LLC

Meredith Chambers, EDP Renewables | © RTO Insider LLC“We would like to work with other stakeholders to see a more a more regional approach that includes conversations with all the stakeholders,” she said. “I don’t know that [SEEM] changes what we do at this at this moment. But I think that there are opportunities over time to have broader conversations about ways to integrate.”

Carson Harkrader, CEO of Carolina Solar Energy, which develops utility-scale solar projects in North Carolina, Virginia and Kentucky, said large energy consumers share the frustration of renewable developers that the regulatory and market structure of the Southeast doesn’t allow them the options they have in RTO territories, such as the ability to sign long-term power purchase agreements. Financing solar projects requires a minimum 10-year PPA, she said.

In RTOs, “we’re able to sell for long-term, fixed-price contracts with energy users. … Obviously, SEEM would not enable that kind of transaction. … I think any solar developer would tell you that’s what we’re hoping for,” she said.

“So for new solar, playing in an open market with fluctuating prices, it would be hard, I think, to finance a new solar project,” she added. “Potentially for projects that are coming off an initial PPA, that might be an opportunity.”

Fight not Over?

Moderator Weston Adams, of Nelson Mullins Riley & Scarborough, noted that rehearing requests have been filed over SEEM’s proposal, and that Democrat Willie Phillips has been confirmed as the commission’s fifth commissioner, with the potential to break the 2-2 deadlock. “Certainly there are parties that think this fight is not over — that this is going to be litigated into the D.C. Circuit” Court of Appeals, he said.

Weston Adams, Nelson Mullins Riley & Scarborough | © RTO Insider LLC

Weston Adams, Nelson Mullins Riley & Scarborough | © RTO Insider LLCDuke’s Suda said she doesn’t see legal obstacles to SEEM.

“In our view, given the recent order earlier this month on the transmission tariff changes … really the only issue holding back a three-vote majority on this is [a dispute over the application of] Mobile-Sierra.”

Suda was referring to FERC’s Nov. 8 order accepting revisions to four SEEM utilities’ tariffs that implement the special transmission service used to deliver the market’s energy transactions. Chairman Glick, who had opposed the market’s creation, sided with Commissioners James Danly and Mark Christie, saying the parties’ filings, unlike the SEEM agreement, do not apply Mobile-Sierra provisions that would limit FERC’s authority to require changes.

Integration, Transmission Costs

Hamilton Davis, vice president of markets and regulatory affairs for Southern Current, a developer of large-scale solar and energy storage projects, said SEEM does not address independent power producers’ concerns over increasing curtailments and rising integration costs in the Carolinas.

Hamilton Davis, Southern Current LLC | © RTO Insider LLC

Hamilton Davis, Southern Current LLC | © RTO Insider LLC“What Duke and Dominion [Energy] [NYSE:D] both said in their recent [integrated resource plans] is that SEEM is not actually going to help with integration costs. There are big opportunities to improve the design of this market so that it actually does at scale; some of what Noel has pointed out is nothing more than aspirational right now.

“I don’t think from an IPP standpoint [that] we’re anticipating participating in that market; the business model is not structured in a way where you would go finance a project based on the ability to sell. … From an IPP standpoint, it looks pretty limited.”

CCEBA’s Carmody also said SEEM will do nothing to address the “black box” of transmission costs in the Carolinas.

“It is becoming harder to understand. The information is becoming less accessible rather than more accessible,” he said. “We’ve spent a lot of time talking about generation in both states over several years … but if we don’t have a transparent and objective process for determining investments in transmission, then we are really in big trouble in a lot of ways, economically and environmentally.”