2021 Strategic Plan

NYISO held its first in-person stakeholder meeting Wednesday after a hiatus of 615 days, CEO Rich Dewey told the ISO’s Management Committee.

The ISO will continue to assess week-to-week and consult working group committee chairs to determine whether COVID-19 pandemic conditions warrant in-person or virtual meetings, Dewey said.

“My preference by default is we would try to do them in person, but we … definitely want to take feedback from stakeholders if people are comfortable continuing to meet in person or if people have very specific concerns given the current state of the pandemic and local infection rates, which are on the rise again, unfortunately,” Dewey said.

Executive Vice President Emilie Nelson presented the ISO’s 2021 Strategic Plan, which outlines evolving state and federal policy drivers affecting the grid operator.

NYISO’s Board of Directors met with the MC in June to review the ISO’s strategic priorities, substantially informed by input from stakeholders, Nelson said.

“There is a rapid change underway on the electric grid, [partly] due to the electrification of other sectors,” Nelson said.

The change is framed in New York by the state’s Climate Leadership and Community Protection Act and at a national level through efforts such as the substantial infrastructure spending bill and a renewed focus on clean energy legislation, she said. (See Biden Signs $1.2 Trillion Infrastructure Bill.)

“Environmental justice and greater public participation are also a prominent part of policy today with respect to reliability and market considerations for a grid in transition,” Nelson said. “The magnitude of the change requires us to acknowledge that our collective understanding will be shaped through iterative analysis and work across planning, operations and markets.”

OKs Comprehensive Mitigation Review

The Management Committee approved tariff revisions related to the ISO’s Comprehensive Mitigation Review (82.03% in favor) and recommended that the board approve the necessary filing under Section 205 of the Federal Power Act. (See “Mitigation Review Moves Forward,” NYISO Business Issues Committee Briefs: Nov. 9, 2021.)

The MC also recommended that the ISO address capacity accreditation related to buyer-side mitigation (BSM) in the three different phases mentioned throughout the proceeding.

Phase 1 includes tariff changes for the proposed market design and will conclude with FERC acceptance; Phase 2 will discuss the procedures and details of capacity accreditation throughout 2022; and Phase 3 will focus on implementation of the capacity accreditation review.

NYISO intends to implement the updated capacity accreditation rules for the capability year that begins May 2024, said Michael DeSocio, director of market design.

In addition, assessment of financial risk of changes in future revenues is incorporated in the next demand curve reset process beginning in 2023.

The ISO is pursuing BSM reforms in time for the class year 2021 BSM evaluations. The class year study performs a detailed examination of the collective reliability impact of a group of projects, as well as a deliverability evaluation for requested capacity resource interconnection service and identifies and provides binding cost estimates for required upgrades.

2021-2030 Comprehensive Reliability Plan

The Management Committee unanimously recommended the board approve the 2021-2030 Comprehensive Reliability Plan (CRP) as presented by NYISO staff.

The ISO prepares a CRP in alternating years with the reliability needs assessment (RNA). Key updates to last year’s RNA include one to the load forecast — specifically a decrease in the Zone J peak load forecast by as much as 392 MW by 2030, said Kevin DePugh, senior manager of reliability planning.

Con Edison provided local transmission plan updates, including new 345/138 kV PAR-controlled 138 kV feeders for Rainey-Corona, Gowanus-Greenwood and Goethals–Fox Hills. A short-term reliability process solution for addressing a need arising in 2023 included changes to series reactor statuses from summer 2023 through 2030, DePugh said.

“In Zone J we actually had reliability violations until we did the updates, but that’s where we’re close to the margin right now,” DePugh said.

One stakeholder said the CRP report would look much different if it considered the more than 2,500 MW of solar, wind and hydro planned to be brought into New York City.

The state in September selected two transmission line projects to help decarbonize power in New York City, the 1,300 MW Clean Path New York project and the 1,250 MW Champlain Hudson Power Express project, from among seven projects submitted to the Clean Energy Standard Tier 4 solicitation issued in January. (See Two Transmission Projects Selected to Bring Low-carbon Power to NYC .)

“There are resources that we’re not accounting for here because they haven’t met our inclusion rules yet,” said Zachary Smith, the ISO’s vice president of system and resource planning. “There are some that could have a very positive impact, and that’s in the report itself. A lot of the conversation is around that there are a lot of unknowns, and in our opinion the unknowns tip more towards concern than optimism.”

The ISO added a “Road to 2040” section to the CRP to give long-term consideration to generation and transmission issues, DePugh said.

For generation, the study concluded that a grid with significant amounts of intermittent resources will need significant amounts of emissions-free, dispatchable resources that can run for multiple day periods, and that such resources are not yet available or currently in the NYISO interconnection queue.

In addition, more inter- and intra-zonal transmission capacity will be required to deliver a reliable system with a high level of renewables penetration. Transmission additions would not reduce the amount of dispatchable resource capacity but would decrease the volume of energy needed from them, the report said.

MMU Recommendations

The ISO’s Market Monitoring Unit, Potomac Economics, issued a memo on the CRP and presented its findings that NYISO’s markets “are well-designed and generally provide efficient investment signals,” but have room for improvement.

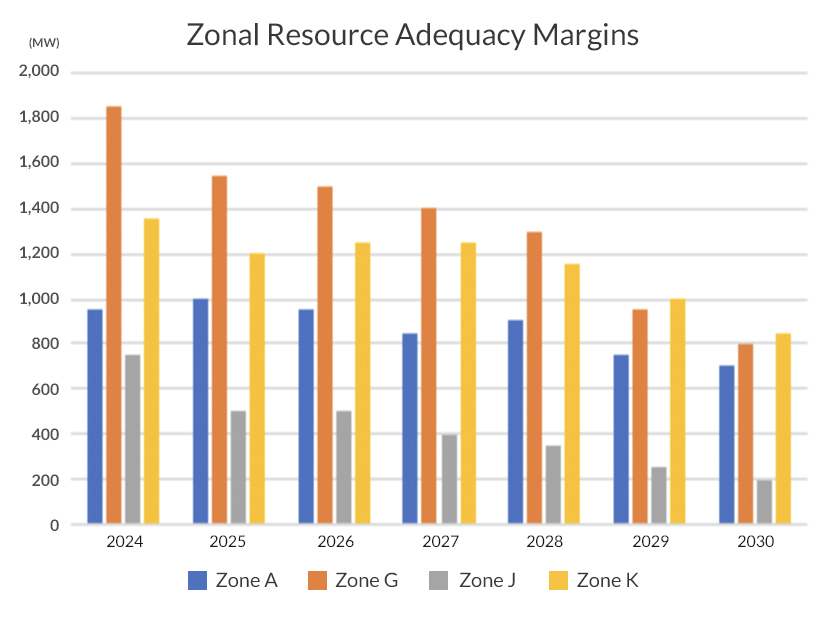

The first of three main recommendations concerns the locational signals provided in the capacity market.

“There are four zones in the capacity market, but naturally the details of the power system are more granular than that, so from time to time there are reliability issues at a smaller level,” said Pallas LeeVanSchaick of Potomac Economics.

To address possibly misleading market signals resulting from transmission constraints between Staten Island and New York City, for example, or between Zones G and H, the monitor recommends implementing capacity locational marginal pricing (C-LMP) to accurately reflect resource adequacy value at each location.

Other recommendations include implementing marginal capacity accreditation for all resource types; using reasonable assumptions for all resource types in transmission security analyses; and considering discounting capacity payments to resources that do not help address transmission security needs.

Asked by one stakeholder what the ISO thinks of C-LMP, Dewey said, “We’ve got concerns about how heavy a lift that is or how radical a change that is, and it just hasn’t bubbled up to meet the criteria of us thinking it’s a good idea moving forward based on the benefits.”

C-LMP is part of the set of recommendations that NYISO is considering and, while not specifically on the list for next year, it is something that the organization will include in the prioritization process going forward, Dewey said.