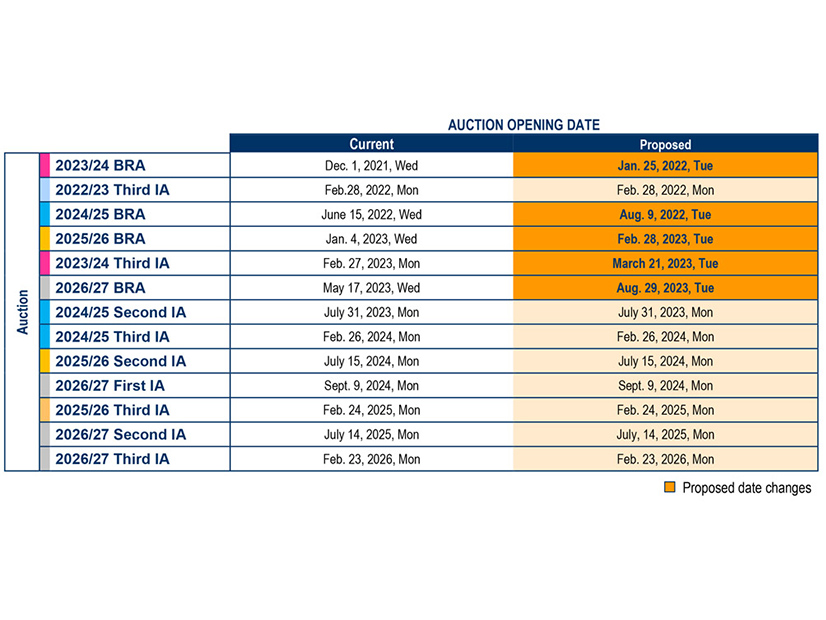

FERC on Monday approved PJM’s request to delay the Base Residual Auction for the 2023/24 delivery year from Dec. 1 to Jan. 25, 2022, in response to the commission’s order in September revising the RTO’s market seller offer cap (MSOC) (ER21-2877).

The commission also granted PJM’s request to delay the BRAs for 2024/25 from June 15, 2022, to Aug. 9, 2022; 2025/26 from Jan. 4, 2023, to Feb. 28, 2023; and 2026/27 from March 17, 2023, to Aug. 29, 2023. The order also delays the third Incremental Auction for delivery year 2023/24 from Feb. 27, 2023, to March 21, 2023.

PJM said in its filing that changing the dates was necessary to maintain the six-and-a-half-month gap between capacity auctions so that market participants “have sufficient time to review the results of each auction before deciding whether to continue offering a resource in the subsequent auction.” (See PJM Proposing 2-month Capacity Auction Delay.)

“We agree with PJM that granting the requested waivers is necessary to ensure orderly auction administration and that, on balance, the benefits outweigh potential harms,” the commission said.

Current and proposed dates for the 2023/24 Base Residual Auction market seller offer cap-related pre-auction activities. | PJM

Current and proposed dates for the 2023/24 Base Residual Auction market seller offer cap-related pre-auction activities. | PJMPJM is expected to return to the normal, three-year forward schedule in May 2024 with the BRA for the 2027/28 delivery year.

The commission is allowing PJM to use the monthly average day-ahead on-peak and off-peak energy prices that the RTO already calculated for the upcoming auction, rather than having it recalculate them to reflect the new date. PJM said the waiver was necessary to allow the pre-auction deadlines unrelated to the new offer cap rules to remain unchanged.

FERC also accepted PJM’s previously proposed pre-auction deadlines impacted by the revised MSOC that relate to the 2023/24 delivery year auction: Oct. 1 for capacity market sellers to request must-offer exceptions and unit-specific offer caps, Oct. 31 for the Independent Market Monitor to review those requests and Nov. 25 for the RTO to make its final determination.

“We agree with PJM that these dates will allow sellers sufficient time to make their requests and preserve the pre-existing review timelines as much as possible,” the commission said.

PJM’s request was prompted by FERC’s Sept. 2 order adopting the Monitor’s unit-specific avoidable-cost rate proposal and requiring the RTO to revise its tariff (EL19-47, EL19-63, ER21-2444). The Monitor’s proposal followed FERC’s March order requiring PJM to revise the MSOC to prevent sellers from exercising market power in the capacity market. (See FERC Backs PJM IMM on Market Power Claim.)

The Public Utilities Commission of Ohio (PUCO) challenged PJM’s filing, arguing that the proposed delays would harm the state’s auction process for default service. Ohio’s regulated electric distribution utilities “rely on a competitive bid auction process,” which occurs after the BRA for the relevant delivery year, to procure generation service for non-shopping customers that “take service from their default electric service provider,” it said.

FERC disagreed with PUCO’s arguments, saying that the potential harm noted by the state commission was “outweighed by the benefits of ensuring the 2023/24 BRA is run under the new offer cap rules.”

“We disagree with the Ohio commission that this waiver will cause additional uncertainty,” FERC said. “To the contrary, granting additional time now will provide certainty to participants that they will have sufficient time to seek remedy from the commission if necessary.”