Participants at FERC’s workshop Friday on performance-based ratemaking approaches universally support grid-enhancing technologies (GETs), but they disagree on how best to foster their adoption by transmission owners and RTOs/ISOs (RM20-10, AD19-19).

A shared savings incentive proposal by the WATT Coalition and Advanced Energy Economy drew praise from tech providers and regulators but doubts from some grid operators and others. (See related story, WATT Coalition Previews GETs Proposal Before FERC Workshop.)

FERC should mandate grid operators to include GETS in their planning processes, said Mitchell Myhre, manager of transmission planning and regulatory affairs for Alliant Energy. “I don’t think this can be an add-on role that is built on top of existing resources.”

GETs are “the direction that the industry must take,” said Judy Chang, undersecretary of energy for the Massachusetts Executive Office of Energy and Environmental Affairs.

The WATT “proposal is shining a spotlight on the fact that grid-enhancing technologies are available but are not being deployed in our current transmission planning and investment framework,” said Katie Dykes, commissioner of Connecticut’s Department of Energy and Environmental Protection.

Not so fast, said Douglas Bowman, SPP lead engineer for research, development and tariff studies.

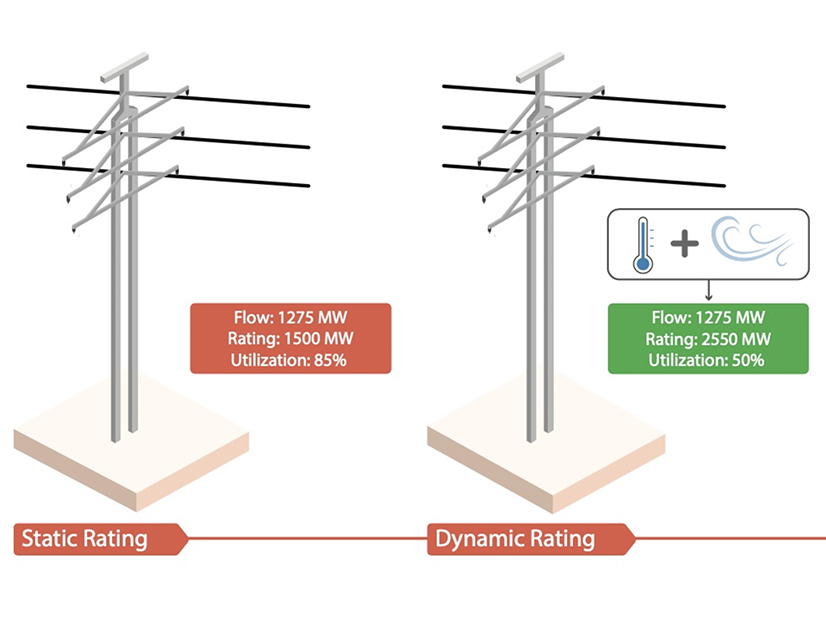

SPP staff have worked on dynamic line ratings, power flow control and topology optimization projects that they believe provide reliability and economic benefits, but the challenge comes in “getting buy-in” for the new technologies from market participants and stakeholders, Bowman said.

“It’s not that we don’t want these devices on our system,” Bowman said. New technologies have “to go through an approval process before we can implement [them], and we have to ensure that we have that long-term technological resilience that’s wired.”

All new technologies need additional study to ensure that an overlapping installation does not introduce adverse impacts on reliability, said Eric Hsia, manager of applied innovation at PJM.

Carrot or Stick

Without an incentive for GETs, utilities would work on projects for which they’re already incentivized: high-capital projects that would have a lot of benefits, NewGrid CEO Pablo Ruiz said. “It’s almost like having to choose between consumers and shareholders and prioritizing your staff resources.”

GETs are simply another solution in the toolbox, said Jeremiah Doner, MISO director of economic policy and planning.

“We should look at it the same way we look at a new transmission line or substation … how to most effectively address the issue that we’re trying to fix,” Doner said. “Focusing on adjusted production costs … is a very narrow metric that’s just focused on congestion relief around production costs. Flow-control devices address reliable issues [and] could be a deferred, more cost-effective way to address a long-term reliability issue.”

The commission should consider market-based approaches that compensate GETs based on the actual value that they generate in the market, rather than forecasting the benefits they may have, said David Patton, president of Potomac Economics, market monitor for ERCOT, ISO-NE, MISO and NYISO.

At present, no RTO or ISO has “the ability to operate these kinds of devices, so the idea of requiring them to quantify the benefits of that sort of device is definitely a cart-before-the-horse idea,” Patton said. “Tremendous work needs to be done with the planning models, modeling a wider array of conditions than they’ve ever modeled before. The planning models, even right now, don’t do a good job of quantifying the value of, for instance, battery technologies.”

Some GETs offer great benefits on the controllability side, enabling grid operators to direct power flows one way or another, but how can one quantify controllability? asked Yachi Lin, senior manager of transmission planning at NYISO.

“I’m struggling with … how do we quantify that additional benefit on top of that performance?” Lin said.

Planning processes at PJM already allow for GETs “to be offered and to be considered and to compete” in wholesale markets, according to Suzanne Glatz, the RTO’s director of strategic initiatives and interregional planning.

PJM’s concern was that the proposed shared savings incentives would not necessarily be “derived directly from the cost but actually are kind of blurring the lines between markets, value and how that would affect the project cost.” As a result, the planning process could be turned into a forum for discussing ratemaking issues,” Glatz said.

End Game

There are limited alternative approaches, said former FERC Chair Jon Wellinghoff, now head of GridPolicy Consulting. “I’ve thought about this long and hard as to how to get these technologies incorporated into a transmission system in our country that is very inefficient and that needs to have efficiency improved drastically.”

FERC could mandate that RTOs and ISOs incorporate GETs into their planning processes, but experience shows mandates are “not the best way” to get RTOs and ISOs to act as quickly and efficiently as possible, Wellinghoff said.

Planners need to make sure not to let perfect be the enemy of the good, said Hudson Gilmer, CEO and founder of LineVision. “I think there is an imperative to take action on the part of the commission: a legal imperative as well as a climate imperative.”

Congress gave FERC a mandate 16 years ago to incentivize technologies that increase the capacity and efficiency of existing transmission facilities and improve their operations, said Rob Gramlich, executive director of the WATT Coalition. Given the successful deployments of GETs abroad, it is time for FERC to act, he said.

European transmission system owners balked at GETs 10 years ago, but now they clamor for “more and more and more,” said Victor le Maire of Elia, the grid operator for Belgium.

What does FERC see as the end game? asked Steve Leovy, transmission engineer at WPPI Energy. “If we institute shared savings, is that going to go on forever? Or are we doing that during an interim period when we’re expecting something else to develop?”

Look to the commissioners’ statements, said Samin Peirovi, FERC analyst who moderated the all-panelists roundtable to close the day.

“I do not speak for the commission, but I think the questions we hit on in every panel kind of speak to our interest in the shared savings approach and transmission technologies in general,” Peirovi said. “If you talk about a paradigm where eventually we see the level of deployment that’s a little more than status quo, that would be great, but how we get there and how we balance the interest between ratepayers and developers is exactly why we’re having this discussion.”