The sponsors of the Southeast Energy Exchange Market (SEEM) urged FERC on Wednesday to approve their proposed expansion of bilateral trading and reject calls for a technical conference to consider broader market changes.

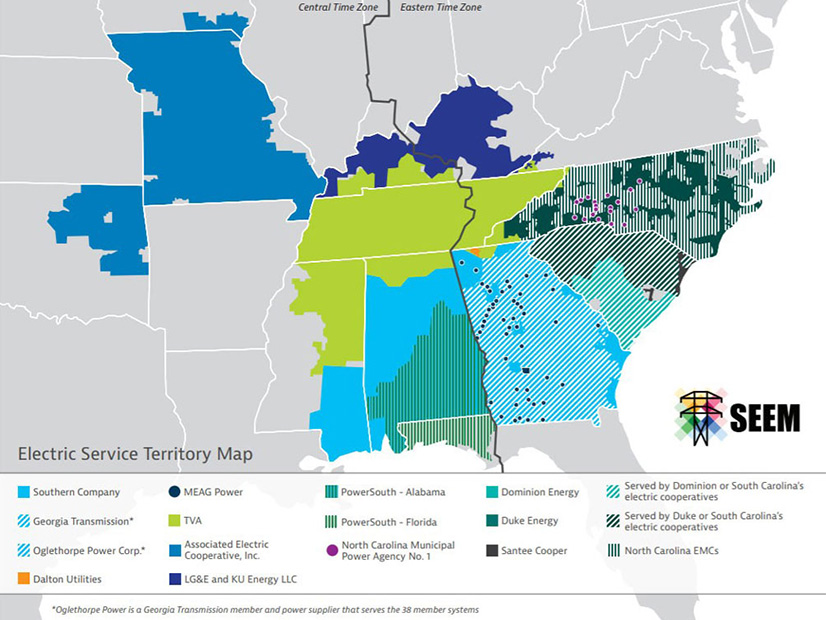

The sponsors made their arguments in response to comments filed in June by clean energy advocates, who said the proposal to automate bilateral trading in 11 Southeastern states would offer a fraction of the benefits of an organized market and undermine decarbonization efforts (ER21-1111, et al.). (See Clean Energy Groups Pan Southeast Utilities’ SEEM Proposal.)

The sponsors, led by Southern Co. (NYSE:SO), Duke Energy (NYSE:DUK) and the Tennessee Valley Authority, have asked FERC to act by Aug. 6 on their proposal, which they said would use free transmission capacity to eliminate transmission rate pancaking and allow 15-minute energy transactions.

They said the critics’ comments on the sponsors’ response to a FERC deficiency letter “largely say nothing new regarding the Southeast EEM proposal, and most seek merely to delay the proposal’s implementation or supplant it entirely with a full-fledged regional transmission organization or energy imbalance market.”

Due Process not at Issue

The sponsors rejected critics’ allegation that the SEEM agreement’s proposed process for addressing complaints would not protect participants’ “due process” concerns, saying it “is not meant to create an extrajudicial tribunal of some sort” but would be a way to consider potential changes to market rules.

“The Southeast EEM is not a government entity,” they said. “Due process, if desired, may be obtained in the usual ways: through the commission or the courts.”

However, the sponsors provided clarifications to allay concerns that SEEM might not act promptly on complaints and prevent parties from filing a complaint with FERC under Federal Power Act Section 206. They pledged to respond to most complaints within 60 days and post the responses publicly on the SEEM website. The response would state whether SEEM will investigate the complaint or not or if it needs more time to make a decision.

They also agreed to provide “pro-competitive” market information to the public if the commission orders it. But they said they “are deeply concerned about the public release of information meant to allow the commission to monitor for exercise of market power or market manipulation. Even with masked identities it is not clear that identities could not be guessed, especially given that this is a bilateral market, and it is not clear that a time lag would provide significant additional protection.”

They also provided assurance that the proposed market auditor would be an independent third party and not a SEEM member or an affiliate of one, as defined under the commission’s Standards of Conduct regulations.

Incentives to Cut Costs

The sponsors rejected allegations that their proposal is intended to prevent competitors from selling power in the region.

“The blanket and unfounded allegations that the Southeast EEM member utilities do not have incentives to lower costs ignores the foundational principles that enabled this diverse group of utilities to come together in the first place,” they said. “To put it simply, the Southeast EEM proposal would not have even been developed if the Southeast EEM members were not incentivized to lower costs for customers, nor would it have been designed as it has if the objective was to foreclose competition. … Furthermore, these so-called ‘monopolies’ are comprised of thousands of men and women who dedicate themselves to lowering the cost of electricity to their customers while maintaining unparalleled levels of reliability.”

They defended their position that the commission use both the public interest standard and the just-and-reasonable standard in reviewing the proposal, saying the SEEM agreement contains elements of both contract rates and tariff rates. They said the commission has taken such an approach in the past, citing the ISO-NE Transmission Operating Agreement.

‘No’ to RTO

SEEM members contend FERC must either approve or reject their proposal as filed and not consider intervenors’ suggestion that it hold a technical conference or joint hearing with states under FPA Section 209. “Replacing the current bilateral market in the Southeast with a RTO is not the subject of this Section 205 application,” they wrote.

“There can be no legitimate argument that the record somehow remains insufficient for the commission to act on the Southeast EEM proposal. Moreover, a Section 209 proceeding is not appropriate here because no state commission has protested the Southeast EEM filings,” they said. “Implementation of the instant proposal in no way will impede or restrict a broad market restructuring if the appropriate federal and state policymakers elect to go in that direction. Consequently, there is no reason to delay the gains proposed here while such extraneous issues and broader suggestions are considered.”