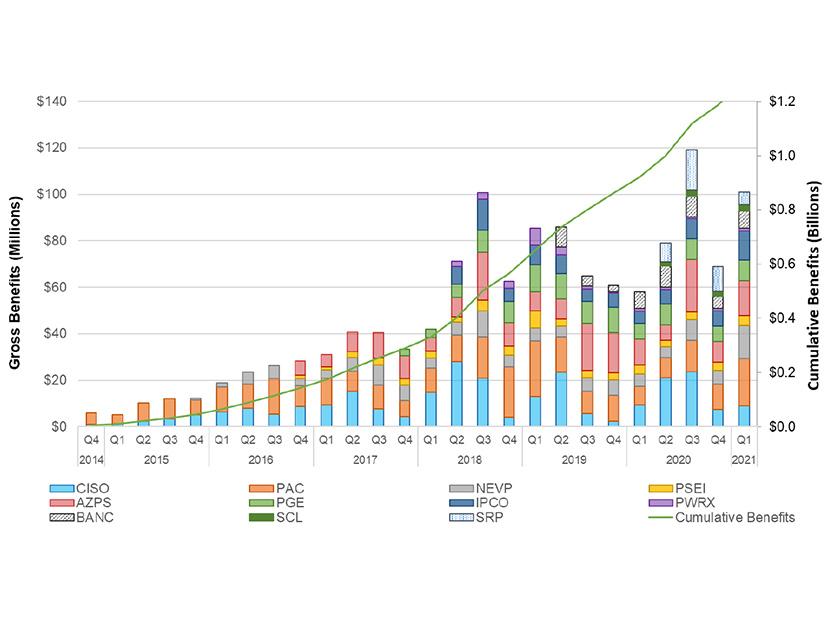

The Western Energy Imbalance Market provided its members $101.01 million in economic benefits during the first three months of 2021, an increase of 75% over the same period a year ago and a first-quarter record, CAISO said last week.

The ISO estimated participant savings of $15.77 million in January, $61.7 million in February and $23.54 million in March.

“The increased benefits observed in February 2021 were largely driven by the extreme gas prices in mid-February that resulted in high electric energy prices,” the ISO said in its EIM first-quarter benefits report. Gas prices were driven higher by a late-winter cold snap that gripped much of the U.S. and brought a wave of ice storms to the Pacific Northwest.

While January-March is typically the period with the lowest estimated volume benefits for EIM members, the most recent first quarter rang in as the market’s third highest on record, behind the third quarters of 2020 and 2018. (See Heat Waves Spur Record EIM Benefits.) The previous first-quarter record of $85.39 million was set in 2019.

The Western EIM’s first-quarter 2021 benefits set a new high for that period and were the third highest on record. | CAISO

PacifiCorp earned the largest share of quarterly benefits at $20.48 million, followed by Arizona Public Service ($15.01 million), NV Energy ($14.14 million) and Idaho Power ($12.54 million).

Rounding out the list were CAISO ($8.91 million), Portland General Electric ($8.8 million), Balancing Authority of Northern California (BANC) ($7.53 million), Salt River Project ($5.52 million), Puget Sound Energy ($4.31 million), Seattle City Light ($2.6 million) and Powerex ($1.17 million).

BANC’s figures include only Sacramento Municipal Utility District through March 24. BANC members Modesto Irrigation District, the cities of Redding and Roseville, and the Western Area Power Administration’s Sierra Nevada region only began participating in the market March 25.

CAISO was both the largest net exporter and net importer of energy during the period at 1,086,844 MWh and 658,486 MWh, respectively, followed by the PacifiCorp-East (PACE) balancing authority area at 442,496 MWh and 391,878 MWh.

Continuing a well established pattern, the NV Energy BAA — which often functions as a transfer point between the CAISO and PACE BAAs — showed the highest volume of wheel-through transfers at 529,312 MWh. The PacifiCorp-West and APS areas followed with 310,315 MWh and 300,603 MWh of wheel-throughs, respectively.

“As the footprint of the Western EIM grows and continues to change, wheel-through transfers may become more common,” CAISO noted in its report. “Currently, an EIM entity facilitating a wheel-through receives no direct financial benefit for facilitating the wheel; only the sink and source directly benefit.”

CAISO estimates that the EIM’s market operations helped to reduce renewable curtailments by 76,147 MWh during the quarter, helping avoid the emission of 32,591 metric tons of CO2, assuming that renewable resources displaced output from other generators emitting at an average rate of 0.428 metric tons/MWh. Under that assumption, the EIM has helped the West prevent 599,144 metric tons since it began operations, the ISO said.

CAISO also calculated that the EIM reduced its members’ overall flexible ramping capacity requirements by 50% during the quarter through more efficient sharing of resources across the market’s footprint.

The EIM has provided participants $1.28 billion in gross benefits since it commenced operation in November 2014 with PacifiCorp as its first member. This spring will have seen its single largest expansion with the addition of Los Angeles Department of Water and Power, Public Service Company of New Mexico, Turlock Irrigation District and the additional BANC members in March, followed by NorthWestern Energy’s scheduled entry in June.