PJM has introduced its initial proposal to address issues with its capacity market model and the expanded minimum offer price rule (MOPR), suggesting to shift the burden of determining what resources are subject to the rule away from the RTO and the Independent Market Monitor to FERC itself.

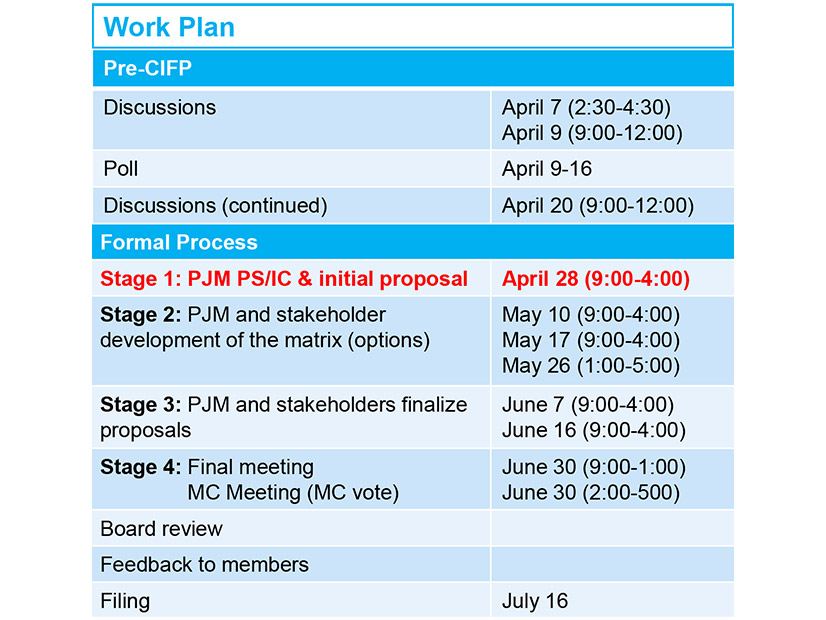

Stakeholders engaged PJM for hours on Wednesday during a special meeting to fast-track a solution to the MOPR. A letter from the PJM Board of Managers on April 6 initiated the critical issue fast path (CIFP) accelerated stakeholder process mechanism contained in Manual 34 to modify the MOPR and have capacity market reforms in place before the 2023/24 Base Residual Auction is run in December.

Wednesday’s Stage 1 special meeting in the CIFP process came two days after final comments were due to FERC regarding questions surrounding the capacity market design and the expanded MOPR, highlighting stakeholder’s desire to do away with the current MOPR. (See related story, Comments Come into FERC on PJM Capacity Market.)

Adam Keech, vice president of market design and economics for PJM, highlighted the RTO’s draft problem statement and issue charge, along with a draft matrix comprising the design components and status quo.

Keech said PJM’s proposal looks to directly address several topics cited in the board’s letter, including:

- implementing changes to the MOPR to ensure the capacity market accommodates state policy choices related to resource mix, as well as long established self-supply business models, while adequately mitigating buyer-side market power;

- evaluating all aspects surrounding the appropriate level of capacity procurement;

- examining the need to strengthen the qualification and performance requirements on capacity resources;

- considering clean capacity/energy auctions as an option to allow for procurement of clean resources; and

- evaluating the need for PJM’s procurement of additional reliability-based services, with a particular focus on reliability needs in the face of the changing resource portfolio and increased penetration of intermittent resource technologies.

“We took a lot of the narrative here from the technical conference comments that FERC had and also the board letter initiating the critical issue fast path,” Keech said.

The Proposal

PJM’s proposal specifically seeks to define the entities who will determine if buyer-side market power exists in the capacity market. Keech said the RTO wants to put the responsibility of examining state policies regarding MOPR determinations with FERC.

PJM believes states have the right to support resources though policy initiatives, Keech said, and interpreting state statutes is not the RTO’s area of expertise. He said the interaction of state and federal authority is better resolved by the commission and not PJM or the Monitor.

The RTO’s proposal says a state policy would initially be presumed to be in “good faith” and not an exercise of buyer-side market power and, therefore, not subject to the MOPR. Any stakeholder, including PJM or the IMM, wishing to challenge a state policy would be able to make a Federal Power Act Section 206 complaint to FERC, allowing the commission to decide the merits of the complaint.

The proposal says PJM would not apply the MOPR to a resource that is the subject of state support unless FERC grants a 206 complaint.

“This is an authority issue between the states and FERC in our view,” Keech said.

PJM’s proposal regarding self-supply models, including vertically integrated utilities, municipal utilities and cooperatives, calls for the entities to be subject to net long and net short thresholds.

If the net portfolio is between those thresholds, Keech said, that resource would not be subject to a unit-specific review or the MOPR. If the portfolio is outside of long/short thresholds, Keech said, it would trigger a unit-specific review of the most recent resource additions.

Keech said PJM is still working on the finalized thresholds in the proposal. He said that while using the long/short tests can help identify scenarios where a self-supply entity could exert buyer-side market power, its implementation becomes more complicated when additional supply types are subject to the MOPR and will require further stakeholder discussions.

In the proposal to deal with bilateral contracts between a buyer and seller in the market, PJM used FERC’s request from the post-technical conference comments, which said, “a buyer could contract with a seller outside of the PJM capacity market and direct the seller to submit an offer below the supplier’s cost (e.g., at zero) in the PJM capacity auction to lower the market clearing price. Such a strategy would lower the buyer’s total capacity procurement costs if the savings the buyer achieves from the lower market clearing price paid for the total quantity of capacity the buyer purchased in the PJM capacity market exceeds the losses (excess costs in this example) the buyer incurred from the out-of-market contract with the seller.”

Keech said bilateral contracts instructing a supplier to offer below their cost to lower the market clearing price may be subject to referral to FERC, but PJM would not apply the MOPR. He said the cases are “fact-specific and require investigation.”

Stakeholder Opinions

Reactions to PJM’s proposal by stakeholders ran the gamut. Some challenged the RTO’s idea to hand more responsibilities to FERC.

Monitor Joe Bowring said that although PJM has stated that it does not want to be the entity to identify buyer-side market power, it is the IMM’s job to identify market power, regardless of whether it is seller side or buyer side and that the IMM would continue to do its job. Bowring said that if PJM does turn the determinations over to FERC, the Monitor would still look at individual cases and make Section 206 complaints to the commission if it feels buyer-side market power exists.

“We will not ignore any state policy or program which we believe is an exercise of market power,” Bowring said. “It’s our job to file complaints at FERC when we see that.”

Tom Rutigliano, an advocate with the Sustainable FERC Project at the Natural Resources Defense Council, said PJM’s proposal would allow “clean energy to compete with dirty fossil fuel plants.” The proposal is a “welcome change” from the RTO’s previous stances and helps to recognize the authority of states to make their own energy decisions, he said.

“If it comes down to a choice between addressing climate change and participating in capacity markets, state leaders can and should choose confronting the climate crisis,” Rutigliano said. “This proposal would help sidestep that choice and allow clean energy to thrive in the region.”

Formal Process

Wednesday’s discussion was the first step in the CIFP process.

Discussions continue with Stage 2, in which PJM and stakeholders will develop the matrix options during meetings on May 10, 17 and 26. Stage 3 follows with finalizing proposals on June 7 and 16.

The final CIFP meeting takes place on June 30, with a final vote on the PJM proposal and one or more alternate stakeholder proposals at the Members Committee meeting later that day. The RTO said it plans on making a filing to FERC by July 16 after the board reviews the approved proposal.

“We recognize members want feedback as early as possible after the 30th of what the board determined,” said Dave Anders, PJM director of stakeholder affairs.