By Chris Brown, CEO, BHE Infrastructure Group

Since my last commentary[1] several weeks ago, Texas again experienced another alarming moment when ERCOT issued an alert caused by capacity insufficiency, and power prices hit $2,000/MWh. This capacity shortfall is becoming more and more evident, and Texans deserve solutions to this problem. It’s also a safe bet that this will not be the last time this happens, and when summer temperatures reach 100 degrees, there will be further strains on the power grid.

Looking back, there must be one clear takeaway from the postmortem of the catastrophic event that Texas experienced with Winter Storm Uri: Even if every generator that was online the night of Feb. 14 had continued operating throughout the event, the state still would have experienced widespread and lasting outages. Texas families and businesses all want to see changes to ensure it never happens again.

No one will argue that numbers can sometimes be challenging, and there is no doubt Steve Huntoon’s latest commentary[2] is challenged by the ERCOT numbers. Mr. Huntoon takes a simplistic approach that the load shed amount of 20 GW is the incremental amount of generation that would have been needed to prevent blackouts. When you compare this figure to the actual outage of 30 GW, it seemingly indicates that there was 10 GW of excess capacity if all 30 GW were operational. However, this is incorrect, and those two figures are not comparable figures and do not allow one to determine the amount of capacity available.

First, ERCOT estimated the peak demand during Winter Storm Uri to be 76.8 GW, which means this is the amount of generation that would have been necessary to prevent blackouts. I would suspect that Mr. Huntoon would respond by asking how there was 20 GW of load shed yet claim a higher gap for peak demand. The reason the gap is bigger than 20 GW is because the load shed occurred prior to the coldest temperatures. And because energy usage is directly correlated to temperature, ERCOT extrapolated the peak demand based on expectations that energy usage per customer would have grown over time as the temperature decreased. This means the load shed would have been a higher amount if it had occurred later in the week.

Second, we reviewed the capacity projections by ERCOT prior to the event to understand what generation was available to analyze how the outage data fits into the total available generation capacity. ERCOT had 67.5 GW of thermal generation capacity. There was also anticipated to be 7.6 GW from other transmission regions and private capacity, and clearly this did not fully materialize during Winter Storm Uri. ERCOT’s estimated peak without load shed was 76.8 GW, with approximately 70.5 GW of thermal resources pursuant to the same presentation. As a result, even if all thermal units were winterized and 100% available at full load, which is highly unrealistic, there remains a 6+ GW gap. This supply gap was also not available from the intermittent resources.

In an independent study conducted by the Texas Public Policy Foundation, policy director Brent Bennett made the same conclusion, stating, “Weatherization and improving the gas supply would have helped in February, but those measures alone would not have prevented the shortage. The Texas grid is short of reliable generating capacity, and absent market changes, that shortage will grow. There must be one clear takeaway from the postmortem of this event: Even if every generator that was online the night of Feb. 14 had continued operating throughout the event, we still would have had widespread and lasting outages. Based on ERCOT’s demand forecast, the outages would have still lasted more than 24 hours and reached up to 10 GW in this optimal operating scenario. We should not expect to weather an event of this magnitude without any outages, but we must do better than this.”

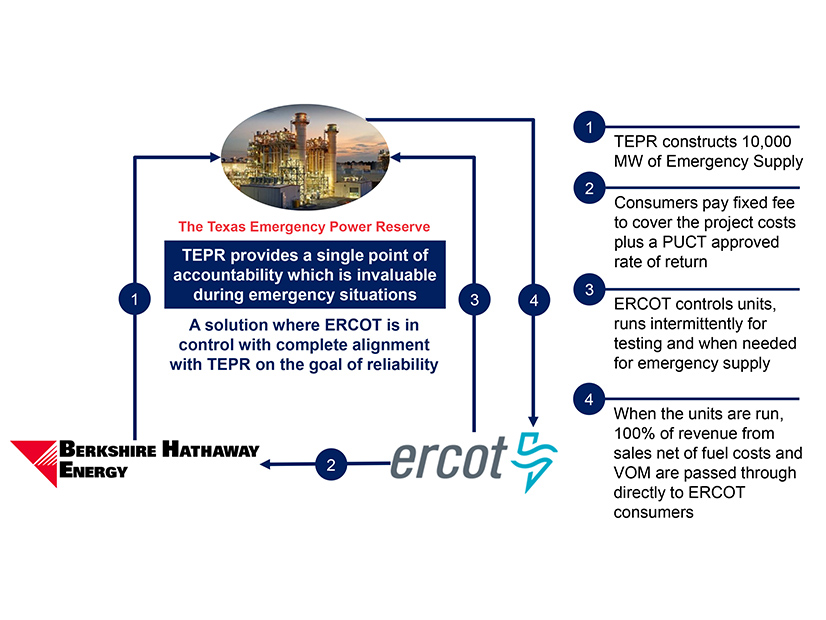

Concerning Mr. Huntoon’s statement about the revenue credits, without any credits from testing, the average cost to residential customers is about $3/month. When the plant operates in the market for testing, to be sure they work and are available when called upon in an emergency, the revenues from such testing can result in significant amounts that will be fully returned to customers. It doesn’t take a significant amount of revenue to partially offset this amount. In addition, Mr. Huntoon is incorrect when he states the plants will run for longer periods to “make the 10 GW free.” First, under the proposal, Berkshire Hathaway Energy will not decide when the plants will run; that decision is left to a regulator chosen by the state legislature. But, 14 days per year of testing is necessary to ensure the plants will be ready when called upon for an emergency. And again, our facilities are backed by a performance guarantee up to $4 billion, whereas no other generator in Texas can make this claim.

Mr. Huntoon’s math related to the $9 billion refund to customers is also mistaken. By his logic, it assumes the Berkshire Hathaway Energy plants would have been in service for 40 years and fully paid for before operating for the Winter Storm Uri emergency. This is unrealistic. In reality, if these plants went into service in say 2015, a reasonable period of time after the 2011 winter event, customers would have only paid a small fraction of the upfront cost of the project before the system would have paid for itself during Winter Storm Uri.

Mr. Huntoon also incorrectly believes that high real-time prices that occur during shortage conditions provide key economic signals that incentivize development of new resources and the retention of existing resources. As outlined in ERCOT’s annual capacity report, there has been absolutely zero net growth in dispatchable capacity, regardless of the fact that high prices exist each and every year in the current market. Clearly this belief has not translated into reality; in fact, ERCOT is losing ground while system demand increases every year.

The Berkshire Hathaway Energy proposal has nothing to do with existing generators not adding dual-fuel capabilities at their plants. Again, the Berkshire Hathaway Energy units would only come online to the extent the market is not responding with electricity after the market’s $9,000/MWh ceiling is hit and a regulator designates an emergency. It is not being installed to depress hourly prices when units are routinely bidding into the real-time market. It certainly will not “crush” those economics.

Lastly, a regulated rate of return is not a subsidy. Just like the transmission and distribution utilities, the designated return on equity is an opportunity to earn a reasonable return for providing a guaranteed service; although again, the Berkshire Hathaway Energy requested return on equity is lower than any other existing transmission and distribution utility in ERCOT.

We continue to be encouraged by the conversations with lawmakers and stakeholders in Texas around our proposal. All of us ultimately want fixes to ensure a reliable grid.