Eversource Energy CEO Jim Judge said Wednesday that the utility posted profits of $1.2 billion ($3.55/share) in 2020, even as it dealt with “the highest level of storm activity ever for our company.”

The figure represents about a 33% increase over 2019’s earnings of $909.1 million ($2.81/share).

Despite severe damage from Tropical Storm Isaias and other weather-related events, Eversource, which supplies electricity, natural gas and water service to 4.3 million customers in Connecticut, Massachusetts and New Hampshire, also reported net income of $271.9 million for the fourth quarter last year, a nearly 9% increase over the same period in 2019. The quarter-over-quarter increase was off a comparable increase in total revenue, which the company said was led by gains in its transmission and distribution segments.

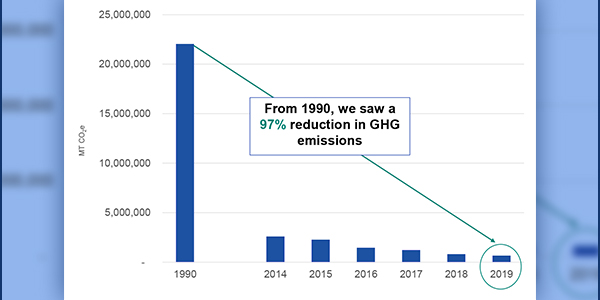

Judge also detailed Eversource’s long-term strategy of being “the principal catalyst to greenhouse gas reductions in New England.” He said that Eversource has divested all its fossil-fuel generation, reduced methane leaks in the distribution system and improved “the efficiency of our delivery system, our facilities and our vehicles.”

“This has enabled us to be in sync with all the states of New England, which are targeting greenhouse gas reductions within their borders of at least 80% by year 2050,” Judge said. “Our long-term strategy is built around being a principal enabler of that reduction.”

Judge said Eversource has set a goal of net-zero emissions. The company invested more than $500 million in custom energy efficiency initiatives in 2019 that will reduce emissions by 3.2 million metric tons, he said.

“Efforts to significantly expand our zero-emissions vehicle charging infrastructure and reduce the number of homes heated with oil offer very significant additional opportunities to reduce the region’s emissions,” Judge said.

Eversource’s “most significant initiative,” Judge said, is its partnership with Ørsted, which the company expects to result in the construction of 4,000 MW of offshore wind facilities off the coast of Massachusetts. It expects that will annually reduce GHG emissions by approximately 6 million tons.

Judge added that all the steps in the South Fork Wind Farm review process in New York have either been met on or ahead of schedule since the U.S. Bureau of Ocean Energy Management established its revised schedule last summer.

Judge said that recent action at the federal level underscores the “government’s support for these projects” like South Fork, Sunrise Wind and Revolution Wind.

President Biden signed an executive order in January requiring that the Department of the Interior to conduct a full assessment of OSW siting processes to align with the administration’s renewable energy production goals. In December, Congress and the IRS provided additional financial incentives for OSW development that include a 30% investment tax credit for projects that commence construction before January 2026, with a 10-year safe harbor for eligible projects.

“Taken together, these changes add more certainty to the tax benefits available for offshore wind and underscore the federal government’s support for these projects,” Judge said.