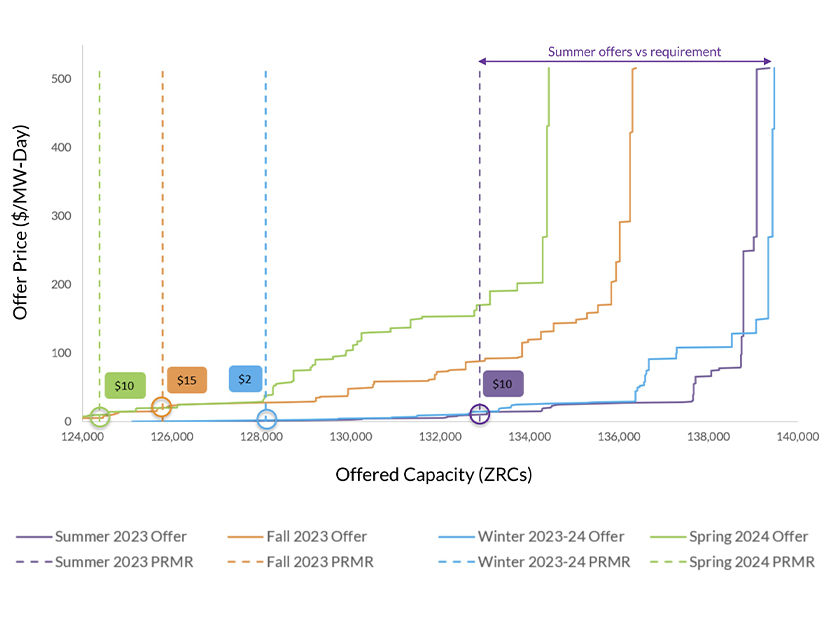

The results of MISO’s inaugural seasonal capacity auctions, released late Wednesday, showed sufficient supply for the 2023/24 planning year, with prices ranging from $2/MW-day in winter, to $10/MW-day in summer and spring, and $15/MW-day in fall.

The RTO’s first set of concurrently conducted seasonal capacity auctions is a far cry from last year’s annual auction, which cleared all of MISO Midwest at the nearly $240/MW-day cost of new entry (CONE), signifying a critical need to build resources. (See MISO’s 2022/23 Capacity Auction Lays Bare Shortfalls in Midwest.)

This year, all zones were shown to have enough capacity on their own. Even MISO’s external resources zones followed suit. However, Zone 9 in Louisiana and southeast Texas experienced price separation to meet its requirements and cleared at $59.21/MW-day in fall and $18.88/MW-day in winter, the only departure from the otherwise uniform clearing prices.

The RTO said the mostly flat prices were a function of adequate supply this year. It entered the auctions with a 133-GW summer planning reserve margin requirement systemwide. The Midwest region was able to turn its previous deficit around through a combination of “lower demand, new generation, delayed retirements, additional imports and higher accreditation.”

While wind, gas and solar units in the Midwest were able to increase their accredited capacity values by nearly 2 GW, the region’s coal resources lost 924 MW in accredited capacity owing to MISO’s new availability-based accreditation process that assigns thermal units value based on past performance and anticipated availability during predefined risky periods. (See FERC OKs MISO Seasonal Auction, Accreditation.)

2023-24 Planning Resource Auction clearing prices by zone and season | MISO

2023-24 Planning Resource Auction clearing prices by zone and season | MISO

The grid operator said members offered capacity in the Midwest that exceeded the summer planning reserve margin by 4,760 MW, compared to the 1.2-GW deficit uncovered in last year’s auction.

On the other hand, MISO South offerings declined this year. Though the subregion still beat its summer requirement by 1,723 MW, it was not as robust as last year’s 2.8-GW surplus. MISO said the South’s natural gas, nuclear and other generating units lost a little more than 1 GW in accredited capacity through the new accreditation process.

MISO’s Independent Market Monitor has reviewed and certified the auction results, finding no exercise of market power.

The RTO said the adequate supply this year is not indicative of “continued risks posed by the portfolio transition.” It said its move to seasonal requirements reduced the summer planning reserve margin. It also said its lower load forecast this year might become an anomaly, so members cannot postpone their planned generation retirements indefinitely. Projects continue to show a “continued decline in accredited capacity even as installed capacity increases,” MISO said.

Since last year, MISO Midwest has retired almost 1.2 GW worth of coal, while MISO South has retired about the same amount from its natural gas fleet.

The grid operator said it continues to need “urgent reforms” to its resource adequacy and market design to ensure reliability.

Entergy’s operating companies have challenged MISO’s seasonal capacity market at the D.C. Circuit Court of Appeals (22-1335). They are asking the court to review FERC acceptance of MISO’s availability-based capacity accreditation for thermal resources, the timeline to move to the seasonal market and the 120-day advance notice requirement for planned outages, among other elements of the commission’s order.