When historians write about the power industry’s efforts to reach net-zero carbon emissions decades from now, chances are good that hydrogen will be a big part of the story, speakers told the Energy Bar Association’s annual Fall Conference last week.

Hydrogen is currently used in fertilizer, petroleum refining and other industrial applications, as well as in fuel cells for vehicles and on-site power generation. Supporters see it being increasingly used as a fuel for power generation, transportation and energy storage paired with renewable power.

Panel moderator James Bowe, a partner with King & Spalding, told attendees that hydrogen’s use as a fuel and storage medium got 21 mentions in first-quarter earnings calls of Uniper and eight other European utilities pioneering the technology. For the companies’ second-quarter earnings calls, he said, there were 210 mentions — a tenfold increase. “In a couple of decades, hydrogen could be as important for the world as oil was in the past,” Andreas Schierenbeck, CEO of Düsseldorf-based Uniper, said in his company’s second-quarter call.

No Longer Just Talk

“The talk around hydrogen is no longer really just talk,” said Michael Ducker, a vice president with Mitsubishi Power. “We really are making some substantive moves.”

In March, Ducker’s company — formerly Mitsubishi Hitachi Power Systems — announced the first sale of its hydrogen-capable gas turbines, to Utah’s state-owned Intermountain Power Agency. The 840-MW project will use so-called “green hydrogen,” which is produced from water through electrolysis with no carbon emissions — powered by renewable sources.

“This project is under contract, moving forward. And in 2025 this facility will operate on a blend of 30% green hydrogen and 70% natural gas. And by 2045 it will have to operate on 100% green hydrogen,” Ducker said. “So, this really represents the world’s first true application of green hydrogen at scale supporting the overall integration of renewables — in this case, helping California and parts of Utah achieve their [climate] goals.”

Adjacent to the Intermountain power project is a salt cavern with capacity for enough hydrogen to store 150,000 MWh of dispatchable energy. Mitsubishi and partner Magnum Development say it will be the biggest renewable energy storage project in the world.

“To put that in perspective, the entire United States right now has just over 1,000 MWh of lithium ion batteries installed,” Ducker said. “So, just with this one project, we have about 150 times the entire installed base of batteries in the U.S. And by the way, we’ve got upwards of 100-cavern capability at the site.

“This project really encompasses that opportunity to achieve scale, help get costs down and really help drive the value proposition behind bringing hydrogen into the market,” he added.

The company recently also announced several gigawatts worth of power projects in employing green hydrogen:

- Balico’s 1,600-MW Chickahominy Power Project in Virginia; EmberClear’s 1,084-MW Harrison Power Project in Cadiz, Ohio; and Danskammer Energy’s 600-MW plant in Newburgh, N.Y., will spend $3 billion on Mitsubishi’s green hydrogen technology in projects expected to go into operation in 2022 and 2023.

- Entergy will collaborate with Mitsubishi on projects in Arkansas, Louisiana, Mississippi and Texas to create hydrogen-capable combined cycle facilities, green hydrogen production powered by Entergy’s nuclear fleet and storage and transportation.

“We’ve been storing hydrogen in salt caverns in the Gulf Coast since the 1980s, and at the scales we’re talking about here,” Ducker said. “People don’t realize we’ve been doing this already for decades. There’s a good reason why: because luckily, we haven’t had any incidents.”

Comparison with Fuel Cells, Lithium Ion

Hydrogen faces several chief challenges, however. The cost of producing it is currently much higher than the fossil fuels it would replace. In addition, its energy density is lower than natural gas, and efficiency is lost in conversion.

Nevertheless, Ducker said he is confident hydrogen will take a growing role alongside fuel cells, which also convert the chemical energy in hydrogen to electricity without combustion.

And while lithium ion batteries can provide short-duration intraday storage, hydrogen can provide interday and seasonal storage that will be needed to maintain system reliability in an all-renewable world, he said.

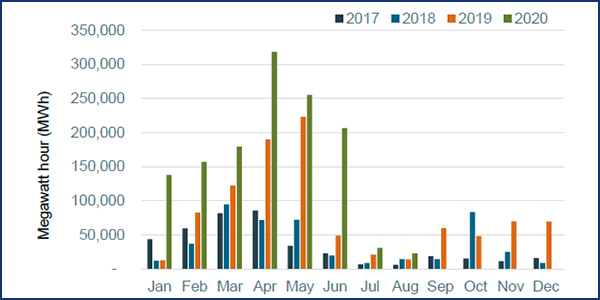

California, with 30% renewable integration, is facing increasing renewable curtailments in the late winter and spring. Yet during a heat wave this summer, the state was hit with rolling blackouts because it was short on energy late in the day. “So, we’re literally throwing away energy in the spring and then [in] the summer, we’re hitting some of these peak demand periods and shortages of renewables,” Ducker said. “We’re no longer looking to address the proverbial duck curve. … This is really starting to signal that we need longer-duration, more seasonal storage capabilities if we’re truly going to achieve 100% decarbonized grids and do that affordably and reliably.”

Ducker said hydrogen also makes more sense than heavy lithium ion batteries for freight-hauling trucks that travel hundreds of miles daily, quoting one expert: “I can either haul cargo, or I can haul batteries. I can’t haul both.”

West Coast States

Buck Endemann, a partner with K&L Gates, gave a presentation on West Coast states’ regulation of hydrogen in transportation, utility cost recovery and resource planning.

California, Oregon and Washington each have made hydrogen vehicles eligible for zero-emission vehicle funding and rebates.

Oregon in 2019 enacted SB 98, which will allow utilities to add hydrogen infrastructure and the higher cost of the commodity to their rate bases. Washington’s Substitute SB 5588 authorized utilities to produce, distribute and sell hydrogen produced from renewable resources.

Washington officials “really want to develop hydrogen into a long-duration energy storage technology … to take some of the pressure off of those large hydro[power] plants that Washington relies upon,” Endemann said.

He noted that a “high hydrogen” future is one of the three scenarios the California Energy Commission and Public Utilities Commission are considering in their planning toward 2045, along with high electrification and high biofuels.

Bryn Karaus, of counsel to Van Ness Feldman, discussed safety regulation of hydrogen operations.

The U.S. has 1,600 miles of low-pressure hydrogen pipelines, most used for industrial purposes. Hydrogen also is transported as a liquid in insulated cryogenic tanker trucks.

Hydrogen gas is regulated under the Pipeline Safety Act and the Pipeline and Hazardous Materials Safety Administration’s (PHMSA) Part 192, but the regulations were not written with hydrogen in mind. As a result, Karaus said, “there is still significant enforcement risk if the industry does not meet the Part 192 performance standards.”

Hydrogen has been found to cause pipeline steel and welds to become brittle. The National Institute of Standards and Technology found that hydrogen pipeline costs could be reduced by allowing higher-strength steel without requiring thicker pipe walls, but this would require changes to industry codes and PHMSA’s adoption of those codes into Part 192.

Another puzzle is finding an “odorant” like that used in natural gas to detect leaks before an emergency. There is no known odorant light enough to “travel with” hydrogen, she said.