SPP’s Board of Directors and Members Committee met virtually Tuesday outside of their normal quarterly schedule to consider a number of pressing issues and learn more about the planned joint transmission study with MISO.

Unfortunately, as happens during the new normal, technology got in the way.

MISO CEO John Bear was among those calling in to the meeting, returning the favor after his SPP counterpart, Barbara Sugg, attended his Board of Directors’ webinar on Sept. 17. (See “Teamwork with SPP,” MISO Readying Intensive Transmission Planning.)

“Happy to be here,” Bear said after Chair Larry Altenbaumer, waiting on a quorum, noted his presence.

Altenbaumer and Sugg both praised Bear in introducing him when it came time to discuss the RTOs’ study. The grid operators said earlier this month they will collaborate on a yearlong transmission study designed to identify projects with comprehensive, cost-effective and efficient upgrades as they look for solutions to “historical challenges” facing their generator interconnection customers along their seams. (See MISO, SPP to Conduct Targeted Transmission Study.)

SPP’s board last year set an objective to improve the relationship with MISO, Altenbaumer said. The appointments in January of Sugg as CEO and Lanny Nickell as COO have given SPP a “fresh start” with its neighbor, he said. The détente with MISO comes after a merger attempt in the early 2000s ended in acrimony.

“John’s leadership has been front and center on this collaborative approach we’ve seen over the last few months” between SPP and MISO, Altenbaumer said. “We have far more success where we share common interests and challenges. Hopefully, the joint study will be an example of that.”

“He’s never hesitated to take a call from me, and he’s been very, very open with sharing information,” Sugg said. “He’s been very responsive to my inquisition of things and how to improve operations and coordination between the two organizations.”

But when it came time for Bear to speak, his words went unheard. After an uncomfortable silence, Sugg spoke for him.

“I know John is excited, and I know John would say the same things I’ve said,” she said. Spying Bear on one of the webinar’s video windows, Sugg said, “He’s giving a thumbs-up.”

Bear later sent an email to Sugg, who shared it with those still involved in the meeting. Bear, she said, thanked SPP and its members for their help as MISO “navigated” two hurricanes and a tropical storm this year.

“He’s looking forward to working with you on seams projects that bring value to all of our members,” Sugg said.

Technology was otherwise effective during the meeting. SPP changed its meeting registration practices to reduce the number of “nefarious” callers who have been bedeviling the RTO’s meetings in recent weeks. IT Vice President Sam Ellis said “anywhere from a few dozen to a few 100 people have been infiltrating the [webinars] and flooding the channels with weird audio.

“We’re not sure if they’re trying to be disruptive, but we’re hopeful this meeting goes smoothly because of the changes we made,” Ellis said.

ERCOT encountered similar disruptions in late August and early September but has since resolved the problem.

SCRIPT to Address Transmission Planning

The board formally approved the Strategic & Creative Re-Engineering of Integrated Planning Team (SCRIPT), a 15-person group comprising directors, members and state regulators tasked by the Strategic Planning Committee to evaluate SPP’s transmission planning and applicable cost-allocation processes. (See “SPC Takes Look at Tx Planning,” SPP Briefs: Week of Aug. 31, 2020.)

The RTO has seven different transmission planning processes that use various cost-allocation structures for transmission upgrades. The SCRIPT will evaluate options to strategically re-engineer those processes and write a final report with high-level recommendations for the board and Members Committee. The report will be conducted separately from the joint study with MISO.

“This will help us strategically address the growing number of transmission requests we are facing and have been dealing with for a number of years,” Nickell said. “I don’t want to say the planning process is broken or staff isn’t doing a good job. They’re doing a tremendous job performing the processes that are required of us in our Tariff, but the challenges facing us are ripe for a tremendous opportunity to re-engineer them going forward.”

SPP’s generator interconnection queue currently contains more than 75 GW of wind, nearly 38 GW of solar and almost 9 GW of battery storage, all under some form of study. The grid operator says expected generation growth will likely create financial pressures on older conventional generation, leading to increased future retirements.

The “unprecedented” amount of generation and SPP’s “very iterative” interconnection process has “significantly” delayed processing the queue, Nickell said.

“The outrageously high volumes of [generator interconnection] requests has created stress on our staff and customers, given it takes four to five years [to process studies] and the uncertainty over costs,” he said. “As customers drop out, we have to restudy, and as they drop out, the cost allocation changes. We have a tremendous opportunity to export energy, but without enough transmission capacity and the incentive to do so, we haven’t been capitalizing on this as well as we could.”

John Stephens, with the city of Springfield, Mo., pointed out that the Holistic Integrated Tariff Team’s (HITT) recommendations haven’t yet been acted upon and said he was concerned about overlap. Five of the HITT’s recommendations were related to planning processes.

“There’s been discussion in the membership that instead of doing everything at the same time, let’s wait and see the effect of those [recommendations] on these processes,” Stephens said.

“There is some of this effort that we will need to consider and be aware of as [the HITT recommendations] move forward,” Nickell said. “I do believe those won’t have any impact on this bigger, more holistic, strategic effort. We need to develop policies and propose policies that result in the consolidation of the [planning] process.”

Board Lifts Suspension on Competitive Upgrade

SPP’s second competitive project took another step toward reality when the board approved staff’s recommendation to lift the suspension of the 345-kV Wolf Creek-Blackberry project and authorized the Oversight Committee to create an industry expert panel (IEP) to evaluate responses to a request for proposals.

The competitive upgrade, SPP’s first with a nonmember, Associated Electric Cooperative Inc. (AECI), was approved last year. The board in April suspended the project while staff worked with AECI to complete a cost-and-use agreement. That agreement has since been filed with FERC, where it received no protests during the required 20-day period. (See “Directors Suspend Competitive Upgrade,” SPP Board/Members Committee Briefs: April 28, 2020.)

Lifting the suspension means the project is once again considered approved for construction. Staff have seven days following the board’s approval to issue an RFP.

The project involves a 105-mile transmission line from Kansas into Missouri and is estimated to cost $152 million. Part of the project is on the AECI system and will be constructed by the cooperative. SPP needs FERC approval to allocate funds to AECI.

Oklahoma Gas & Electric’s Greg McAuley abstained from the Members Committee vote. He noted the utility is protesting several generator interconnection agreements at FERC related to a separate Wolf Creek project that has been canceled.

“We have a fundamental disagreement with staff over how that occurred. We think it was done contrary to the Tariff,” McAuley said. “We’ve elected not to protest [Wolf Creek-Blackberry] at FERC because we recognize there are reliability issues that need to be resolved that way, even though we think there are better and more economical options than this.”

SPP’s first competitive project under FERC Order 1000, awarded to Mid-Kansas Electric in 2016, was subsequently canceled because load projections dropped over time. (See SPP Cancels First Competitive Tx Project, Citing Falling Demand Projections.)

A third competitive project has already been evaluated by an IEP and will be brought before the board for its consideration in October.

WEIS Tariff to be Refiled with FERC

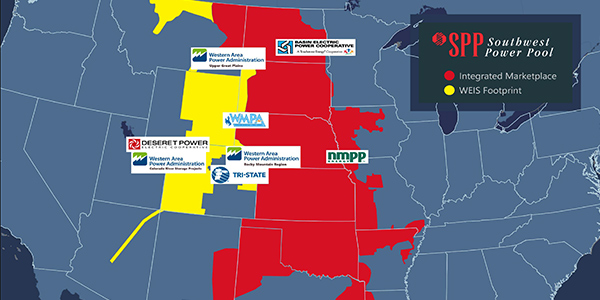

Bruce Rew, SPP’s vice president of operations, said the RTO plans to refile with FERC its Western Energy Imbalance Service (WEIS) tariff and other related documents by the end of the month. The WEIS remains on track to go live on Feb. 1, he said.

The commission rejected SPP’s first attempt to secure approval for the WEIS in July. FERC said the RTO failed to respect nonparticipants’ transmission rights and could improperly burden reliability coordinators. It also cited shortcomings on supply adequacy, market power protections and line-loss calculations (ER20-1059, ER20-1060). (See FERC Rejects SPP’s WEIS Tariff.)

“FERC did recognize the benefits of the WEIS market and what it could bring to the region,” Rew said.

WEIS stakeholder groups met several times before approving in early September the last of four revision requests addressing FERC’s concerns. (See SPP Expands its Western RC Footprint.) The board approved those changes Tuesday, allowing SPP to refile the Tariff.

Rew said a couple concerns outside the Tariff’s scope remain to be resolved — congestion management in the WECC region and the Northwest Power Pool’s reserve-sharing program — but that SPP is committed to working with those entities.

Of more concern to SPP is its Market Monitoring Unit’s recent determination of “significant structural market power concerns” for WEIS energy and imbalance energy that should be addressed before the market’s implementation. The MMU recommended SPP and market participants consider developing a systemwide mitigation measure and using cost-based offers if the mitigation measures cannot be implemented before the market goes live.

Rew said SPP is developing language to address those concerns and ensure pivotal suppliers don’t have excess market power.

“The ISO-NE market had a similar issue,” he said. “We’re modeling our approach to market power mitigation after theirs.”

Revisions to Rate Schedules

The board approved revisions to the cost-recovery mechanism from market participants who use and benefit from SPP’s services as the RTO prepares to move to an unbundled rate schedule in 2021.

The revision request (RR413) clarifies the formula rate template to include the net financial impact of contracts in its overhead calculation and to include a prior period’s over- or under-recovery in the rates’ calculation for rate-cap purposes.

The board last year approved subdividing SPP’s Schedule 1-A into four rate schedules, including a mix of demand and energy charges. Current 1-A charges for transmission service will become Schedule 1-A1 charges, and three market-related charges would be recovered through three energy charges. (See “Board Approves Modernized Cost-recovery Structure,” SPP Board of Directors/Members Committee Briefs: Jan. 29, 2019.)