A CAISO resource adequacy workshop Thursday was part of an initiative that started nearly two years ago, but it could not have been more timely following the heat waves and energy emergencies of mid-August and Labor Day weekend.

During those periods, the ISO had to compete for strained energy resources across the West, scrambling last-minute and paying sky-high prices for imports to cover peak demand. California was criticized by some for relying too heavily on imports that grew scarce as other states tried to meet heavy demand amid record temperatures.

The Resource Adequacy Enhancements Initiative, launched in October 2018, deals in large part with securing imports to cover such situations without the uncertainty that plagued the state and led to rolling blackouts Aug. 14-15. (See Theories Abound over California Blackouts Cause.)

“Our challenge, in this RA imports policy, is how do we strike that right balance between ensuring that our imports, which we rely on heavily, are reliable and dependable, and yet we understand we are competing for this supply broadly across the West?” said John Goodin, the ISO’s senior manager for infrastructure and regulatory policy. “How do we not make it so onerous that others reject the California market as too rigorous and go sell somewhere else?”

The CAISO market needs to be “liquid and able to trade and transact imports,” he said.

The authors of the initiative’s issue paper wrote that CAISO’s must-offer obligations, RA substitution rules and resource availability incentive mechanisms together “create a very complicated system of processes that differ vastly from other ISOs/RTOs.” Part of the initiative involves addressing those “overly complicated” processes.

Goodin spoke Thursday about the need for the ISO to ensure that it has dedicated generation and transmission capacity for RA imports.

“You not only have to lock up the source, but you have to lock up the transmission as well,” he said.

The ISO’s “perennial concerns” are that “speculative” supply and double-counted resources are clouding its RA import estimates, Goodin said. CAISO wants out-of-state suppliers to dedicate specific generation resources, including pooled resources, to serving California load so that CAISO is not relying on supply that doesn’t materialize, he said.

The ISO prefers resources come from a seller’s capacity reserves and that non-delivery be subject to fines.

“That’s the key point,” Goodin said. “It’s backed by capacity reserves, and it pays damages if it’s not delivered. Those are the two requirements we’re very interested in.”

Firm Transmission

More recently, the ISO has been worried about not having the means to bring in energy from out of state.

The “hotter topic is the delivery assurance,” the transmission side of RA imports, Goodin said.

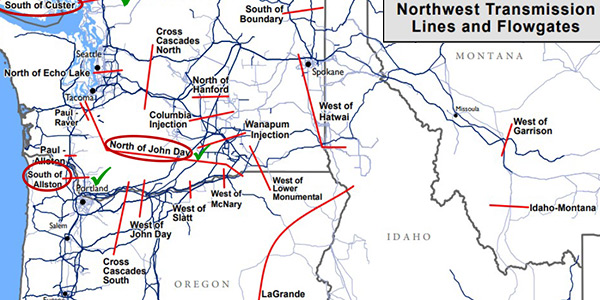

During the “heat storms” of August and September, vital transmission lines linking Southern California to the Pacific Northwest were pushed to their limits and sometimes beyond, he said in his presentation to the RA Enhancements Working Group. Slides showed the strained situation at the California-Oregon Intertie (COI).

The COI and Pacific DC Intertie were at or near maximum capacity during the mid-August Western heat wave. | CAISO

Goodin argued the situation underscored the need for firm transmission service that’s guaranteed, especially in times of crisis.

“RA import capacity must be dependable and deliverable on high-priority transmission service,” one of his slides said.

Some stakeholders — such as the Bonneville Power Administration, Calpine and LS Power — back the proposal for firm point-to-point, source-to sink transmission.

However, the plan is unpopular with other stakeholders who contend it isn’t necessary and could even prove harmful.

Opponents include California’s community choice aggregators, represented by the California Community Choice Association, and the state’s three large investor-owned utilities: Pacific Gas and Electric, Southern California Edison and San Diego Gas & Electric.

The publicly owned Sacramento Municipal Utility District also opposes firm transmission, arguing there’s no supporting data demonstrating the need for it. Though at or near maximum capacity, the COI’s 500-kV lines retained some transfer capacity during the crises in August and September, opponents contended.

Financial services firm Morgan Stanley argued that firm point-to-point transmission will do more harm than good.

“The CAISO should reject the arguments promoting source-to-sink firm requirements,” Ali Yazdi, a head energy trader with Morgan Stanley Capital Group in Canada, said in his written comments on the ISO’s fifth revised straw proposal, now under discussion. “These stringent rules will only serve to squeeze out competition, reduce diversity of supply and, in fact, harm reliability.”

The plan could lead to long-term hoarding of transmission rights by entities that stand to gain the most, Yazdi said. He reiterated his comments during Thursday’s workshop.

Morgan Stanley and others favor an alternative proposal by CAISO that requires firm transmission delivery only on the last line of interest, the last leg to the CAISO balancing authority area. Goodin said the alternative remains a viable option.

Thursday’s meeting was one of two held last week by the RA working group; the first dealt mainly with unforced capacity evaluations. Comments on the sessions are due Oct. 1, and a draft final proposal is due Nov. 3. The CAISO Board of Governors is expected to take up the plan in the first quarter of 2021.