By Patrick McGarry

A few years ago, during my EMBA program at the University of Florida, I visited my Managerial Statistics professor one weekend. As I approached his office, I noticed a large sign taped to his door that declared:

“In God we trust. All others must bring data.”

The message basically summed up the main point of our program, which is that critical thinking requires the objective analysis and evaluation of an issue devoid of gut feeling and cognitive biases. Utilizing reliable and accurate data offers the best option to understanding today in order to predict tomorrow.

As I listen to all the futurists make COVID-19 pandemic impact predictions, I remind myself of that sign on the professor’s door.

Behavior during market disruptions is historically a poor indicator of longer-term expectations. During the Great Recession, notable economists predicted the end of the age of overconsumption. The SUV would become a relic of the past, and $4/gallon gasoline would be a death knell. If you didn’t understand that prediction, then you certainly would once gasoline reached $8/gallon.

Of course, neither happened, and today, SUVs comprise nearly half of all the automobiles in the U.S., while the fracking revolution has flooded the global market in cheap and abundant oil.

People struggle to predict the future because disruptive events arise spontaneously, with little notice, and tend to be highly influential.

When Rosa Parks decided not to give up her seat on a Montgomery, Ala., school bus, how many people predicted the beginning of the civil rights movement?

None.

The future is always more unforeseeable than it seems.

However, the recent COVID-19 shelter-in-place orders have provided utility data scientists with some reliable and accurate data to gain insight into changing residential and commercial load demand profiles. Predicting them as accurately as possible will be critical for planning the most economically efficient electricity grid operations and for designing rates.

What Do the Data Say?

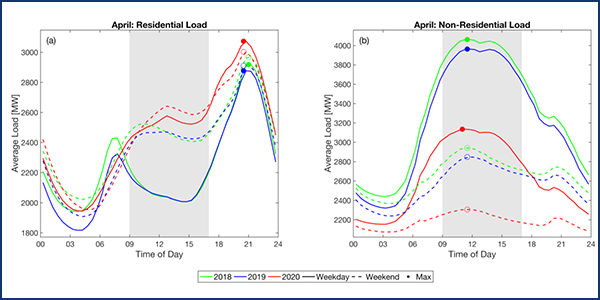

The Pacific Northwest National Laboratory (PNNL) recently released a study assessing the first full month (April 2020) of COVID-19 impacts to residential and nonresidential load. “Changes in Electricity Load Profiles Under COVID-19: Implications of ‘The New Normal’ for Electricity Demand” examined two years of observed electricity consumption data from more than 3.8 million residential and nonresidential customers of Commonwealth Edison in Illinois.

In comparing load demand pre-COVID-19 to data following the national shelter-in-pace environment, the researchers discovered that the onset of the pandemic shifted weekday residential load profiles to closely resemble weekend profiles from previous years. (See Figures 1 and 2.)

PNNL observed that the April 2020 residential load profile demonstrated a correlation consistently over 0.95 with the 2019 Mean Weekend Profile.

The U.S. Energy Information Administration reported that residential electricity sales were 6% higher in April 2020 than in any April from the previous five years, while commercial and industrial sales decreased 9% and 10%, respectively.

While much more research will be needed this fall to determine a “new normal,” we do know that weekday changes in residential loads have the potential to significantly change the total load profile.

The load data utilized in the PNNL study came from two extremely different environments: the pre-COVID-19 setting with rich data from many years, and the national emergency shelter-in-place order setting during April 2020.

PNNL’s ComEd study data set covered customers that had deployed advanced metering infrastructure devices. Anonymous end-use electricity data are classified by class (four residential and 11 non-residential classes) and a zip code.

The main components of the PNNL study were:

- demonstrating how load profiles shifted as the U.S. transitioned to widespread shelter-in-place orders during March-April 2020 based on 30-minute aggregate loads for residential and nonresidential sectors; and

- a sensitivity analysis to explore how historical weekday total load profiles may have shifted if shelter-in-place conditions or widespread teleworking had occurred in prior months and years.

According to PNNL research scientist Casey Burleyson, “This paper was only possible because ComEd chose to make this unique data set available to the community. There is no shortage of eager scientists and engineers asking interesting questions. When you combine researchers with utilities willing to embrace the open-data movement, you enable real-time value-adding studies like we’ve done with this COVID-19 work.”

What is the New Normal for Load Profiles?

We could talk forever about potential future impacts of COVID-19, but the topic of teleworking is of extreme interest to the energy industry. Up until the pandemic struck, most long-term planning discussions relative to the grid, generation and rate design did not really consider any evolution in how the U.S. workforce would be deployed. Now, however, those obvious changes will dramatically affect both residential and commercial load profiles.

While “gut feel” would indicate big changes ahead, we don’t yet have all the data — or a vaccine — to help draw precise conclusions on the full impact of the pandemic. However, we do know they’ll be felt differently in different parts of the U.S., which never has (nor ever will) have a one-size-fits-all load profile.

The unprecedented magnitude and length of pandemic-related disruptions raise the probability of lasting telework changes in our workforce. As a result, utilities need to be studying the current load patterns extremely closely in order to perform scenario planning.

With respect to shelter-in-place residential weekday load profiles, the PNNL study found:

- a more gradual morning ramp;

- higher mid-day loads; and

- smaller, less steep ramping during the evening peak.

Interestingly, PNNL’s conclusions are consistent with the initial load profile observations from NYISO.

As mentioned earlier, PNNL used data historical load profiles versus a COVID-19 profile in analyzing different scenarios around increased teleworking along with reduced commercial loads. It determined that in the long term, increased teleworking could potentially lead to 5 to 7% higher spring and summertime peak hourly loads occurring up to 2.5 hours earlier.

It also found that the flattened daily load profile could potentially lower ramping needs, reduce oversupply risks and change market prices.

Rate Design and Budget Impacts

If some as-yet-unknown percentage of the workplace switches to teleworking for the longer term, one could logically deduce that residential power bills will go higher and that commercial/industrial bills will go lower. In an economy facing headwinds not seen since the Great Depression, this development could present significant rate design and budgetary challenges for utilities across the country.

Prior to the COVID-19 pandemic, the utility industry was beginning a discussion about reforming electric rate designs based in part on the fact that fixed costs are increasing. Grid modernization and investments to meet sustainability goals come at a significant capital cost, and utilities are struggling to cover these fixed costs, especially in the area of generation.

In a world in which some residential customers have the capacity to invest in distributed energy resources at home to potentially protect themselves from future, higher bills, others do not have that ability. Key questions in this area include:

- Will the consumer be able to shoulder higher power bills, and, if not, how badly will the economy be impacted?

- How will this impact “the electrification of everything”?

- Could COVID-19 workforce developments be the impetus for utilities to change from a single volumetric rate to a fix charged component with a set monthly fee?

While we can’t yet fully answer these questions, we can assume that budgetary pressures will continue to be substantial while portfolio optimization dollars will become much more valuable.

Reliability and affordability will continue to be the two major challenges facing utilities in a post-COVID world. As always, operational effectiveness and efficiency will continue to be more important than ever.

Conclusion

Conjecture often makes a podcast interesting but does very little for the utility industry to predict the future. Fortunately, data scientists and research engineers utilize powerful, increasingly precise methodologies in forecasting realistic future scenarios.

There are things we know.

There are things we do not know.

There are things we do not know that we do not know.

COVID-19 is a “known unknown” and will clearly impact the future composition of residential and commercial load profiles, though the degree of the virus’s influence is still coming into focus. Considering all the disruption now at hand in the energy industry, clearly understanding likely future loads will be a necessary and critical first step in scenario planning.

We have some of the data we need to begin this process. But during the next few months, one of the most important new normal planning tasks for individual utilities will be to collect, store and examine in fine detail their own meter data.

Patrick McGarry is senior director of Power Costs Inc.