The New Jersey Board of Public Utilities received dozens of comments Wednesday on whether to leave the PJM capacity market in response to the expanded minimum offer price rule (MOPR).

Forty filings were made by the May 20 deadline set by the NJBPU, which initiated the investigation in March to determine if staying in the capacity market will increase consumer costs or impede Gov. Phil Murphy’s goals of 100% clean energy sources by 2050 (Docket No. EO20030203). (See N.J. Investigating Alternatives to PJM Capacity Market.)

Some stakeholders said the state should adopt the fixed resource requirement (FRR) because the expanded MOPR would hamstring its support for emission-free generation. Opponents said leaving the capacity market could end up costing state ratepayers millions, leaving them at the mercy of monopolistic generators.

PJM’s Independent Market Monitor released a report May 13 that concluded a statewide FRR would increase costs by almost 30% if prices were at the PJM offer cap of $235.42/MW-day but only 2.4% if prices equaled the $186.16/MW-day weighted average price for the state in the most recent Base Residual Auction. (See PJM Monitor Finds Capacity Exit Costly for NJ.)

Two clean energy advocates responded Wednesday with a report criticizing the Monitor’s analysis, saying it was skewed by assumptions that FRR regions would choose more expensive resources within their jurisdictions rather than cheaper imports. (See Report: Imports Key to Successful FRR.)

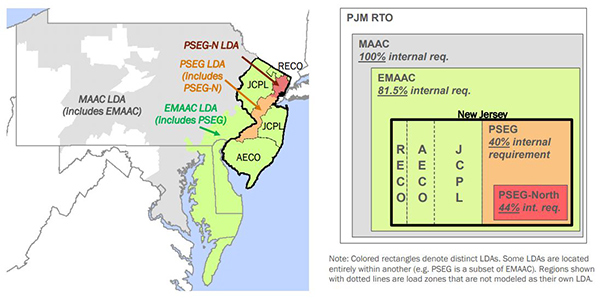

A fixed resource requirement for the JCPL locational deliverability area would mandate that at least 81.5% of its capacity be located in the EMAAC zone, with any remaining capacity located in MAAC (outside of EMAAC), according to PSEG and Exelon. | PSEG and Exelon

PJM also weighed in Wednesday, noting that New Jersey is a capacity-importing state with more peak demand than unforced capacity within its service territories. If all capacity resources in New Jersey agreed to serve the state in an FRR, PJM said, the state would still require slightly more than 5,000 MW of additional capacity.

The RTO said it would not judge the cost of an FRR for New Jersey, but it urged regulators to closely examine claims that an FRR would lower costs.

“PJM does not comment with respect to the cost of an FRR for New Jersey,” the filing said. “Instead, PJM cautions the BPU to look critically at any outright claims offered at this point in the proceeding that an FRR will prove less expensive for New Jersey consumers.”

Supporters

Perhaps the strongest endorsement for the FRR option came in a joint filing by Public Service Enterprise Group and Exelon, whose state-subsidized nuclear generators would be subject to the expanded MOPR. They said the FRR would allow New Jersey “to exert greater control over how their load-serving entities meet resource adequacy requirements.”

PSEG CEO Ralph Izzo said earlier this month it would be “logical” for the state to choose the FRR option. (See PSEG Turns Bullish on NJ FRR Option.)

The PSEG/Exelon filing said the FRR alternative could better support the clean generation goals in the state’s 2019 Energy Master Plan (EMP) by integrating with other programs like the Regional Greenhouse Gas Initiative (RGGI).

The filing also suggested integrating the procurement of capacity with the procurement of environmental attributes in the FRR “to standardize the state’s support for clean electricity resources and encourage competition among different types of clean resources.”

“Offshore wind projects qualifying for ORECs, new grid-connected solar resources qualifying for state support, and the nuclear plants selected to receive ZECs would compete to sell their capacity and attributes, bundled together, for an all-in price fixed at the outset of a long-term contract, less forecasted energy revenues (based on futures prices for energy at a liquid trading hub) and ancillary services revenues determined in advance of each delivery year,” the companies said.

“An integrated FRR procurement will allow New Jersey to fully and timely achieve its EMP goals at a lower cost for consumers than they would otherwise pay, by avoiding the inefficiencies that will result from FERC’s new bidding rules in the PJM capacity auction,” the filing said. “An integrated FRR procurement could also provide renewable developers with greater long-term certainty, reducing development costs.”

Also coming out in support of an FRR was Ørsted, which was selected by the BPU last June to develop the state’s first offshore wind project. (See Orsted Wins Record Offshore Wind Bid in NJ.)

Ørsted said current floor price estimates indicate its 1,100-MW Ocean Wind project, expected to be in service by 2024, will not clear future PJM capacity auctions and “may not be able to contribute to the state’s capacity needs.”

The FRR could provide a model for incorporating clean energy generation, the filing said, and the board should continue evaluating the impacts of other clean energy market mechanisms like carbon pricing.

“New Jersey should continue to be a national leader in clean energy development,” the filing said. “Any mechanism pursued by the board should appropriately value clean energy resources for both their reliability and environmental benefits, minimize costs to ratepayers and encourage economic development.”

The American Council on Renewable Energy (ACORE) requested that the NJBPU consider an “enhanced retail electric market” that could adequately procure resources aligned with the EMP’s clean energy objectives through modifications to its Basic Generation Service (BGS) default procurement program. The BGS auctions are held by New Jersey’s four distribution utilities to provide service to customers not served by a competitive retailer.

“New Jersey can ensure [that] enhanced retail electric markets are consistent with the EMP when coupling these reforms with a high-penetration renewable energy standard to directly drive deployment of carbon-free electricity and economy-wide carbon pricing to avoid carbon leakage,” the filing said.

Detractors

Critics of the FRR appeared to outweigh supporters. Among those opposing the FRR were Calpine, the Independent Energy Producers of New Jersey, Natural Gas Supply Association, PJM Power Providers Group and the Retail Energy Supply Association.

The Electric Power Supply Association encouraged the BPU to “play a leading role” in developing regional solutions to meet environmental goals by working with PJM to consider adapting ISO-NE’s Competitive Auctions for Sponsored Policy Resources (CASPR) market design. Under CASPR, ISO-NE will clear the Forward Capacity Auction after applying the MOPR to new capacity offers to prevent price suppression. In the second Substitution Auction, generators nearing retirement that cleared in the primary auction could transfer their obligations to subsidized new resources that did not clear because of the MOPR.

The New Jersey Division of Rate Counsel’s comments focused on PJM’s Independent Market Monitor study, citing the estimates that a statewide FRR could increase capacity costs for New Jersey ratepayers by 29% on the low end.

The Rate Counsel discouraged making changes to the BGS auction, saying it was created to “ensure a stable and affordable supply of energy for residential and small commercial customers who do not wish to or cannot shop for their electricity from third-party suppliers.” It said the program has been a success in its current state by bringing customers the benefits of competition and a less volatile market.

The Rate Counsel urged the board to “proceed with caution” when considering the FRR because the option could bring “unwanted and expensive consequences,” including lack of competition and market oversight.

“Our aims should be to foster competition, avoid enhancing market power and protect New Jersey ratepayers from excessive rates,” the filing said. “While the FERC orders have certainly created roadblocks for the state to achieve its goals, we must make sure that our citizens continue to have safe, adequate and affordable service and that any action we take does not undermine that important, fundamental principle.”