By Michael Kuser

ISO-NE will file two versions of its Energy Security Improvements market design with FERC later this month after the New England Power Pool Participants Committee on Thursday approved a modified version of the RTO’s plan that seeks to reduce its cost to consumers.

ESI would allow the RTO to procure energy call options for three new day-ahead ancillary service products to improve the region’s energy security, particularly in winter when natural gas shortages can leave generators without fuel. Option awards will be co-optimized with all energy supply offers and demand bids in the day-ahead market.

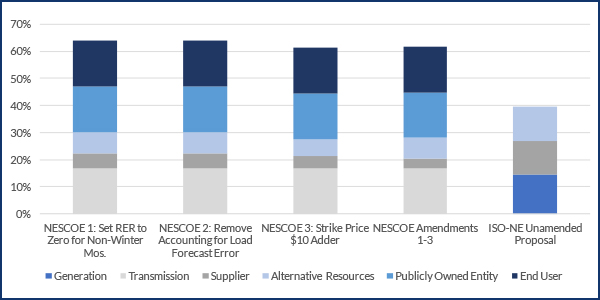

The PC approved three amendments by the New England States Committee on Electricity (NESCOE) by a 61.7% sector-weighted vote, with unanimous support from the Transmission, Publicly Owned Entity and End User sectors and unanimous opposition from the Generators. ISO-NE’s unamended proposal received only 39.6% support, with support from Generators, Suppliers and Alternative Resources and unanimous opposition from the other sectors.

ISO-NE said that although FERC has found that certain compliance filings are not covered by the “jump ball” provisions of the NEPOOL Participants Agreement, it “has committed nonetheless to include in its April 15 filing the same information it would include were the filing a jump ball.”

The RTO said it will include a description of the NESCOE proposal “in detail sufficient to permit reasonable review by the commission, explain [ISO-NE’s] reasons for not adopting the proposal and provide an explanation as to why [ISO-NE] believes its own proposal is superior to the proposal approved by the Participants Committee.”

The result of more than a year of stakeholder meetings, the ESI proposal was prompted by FERC’s July 2018 finding that ISO-NE’s Tariff is not just and reasonable because the RTO lacks a way to address fuel security concerns that it said could result in reliability violations as soon as 2022. The Tariff currently allows cost-of-service agreements only to respond to local transmission security issues (EL18-182, ER18-1509). (See FERC Denies ISO-NE Mystic Waiver, Orders Tariff Changes.)

NEPOOL’s Transmission, Publicly Owned and End User sectors unanimously backed three NESCOE amendments to ISO-NE’s ESI proposal, and a fourth vote that combined all three amendments, while the Generation sector uniformly opposed all the changes. ISO-NE’s unamended proposal had strong support from Generators, Suppliers and Alternative Resources but was unanimously rejected by the three other sectors. | NEPOOL

FERC last August granted the RTO an extension to file the plan by April 15.

In March, the RTO’s unamended proposal failed in the NEPOOL Markets Committee with 42.4% in support, while a proposal including NESCOE’s amendment to set the value of replacement energy reserves (RER) to zero for non-winter months — essentially eliminating it except for three months — only received 51.77% support. (See NEPOOL Markets Committee Briefs: March 24, 2020.)

Mathematics Exercise

The PC approved three amendments proposed by NESCOE before approving the amended ESI package.

Jeff Bentz, NESCOE director of analysis, proposed the amendments “because the concerns we raised as early as April 2019 and even before haven’t been addressed to our satisfaction, and we believe that puts consumers at great risk, especially during extended cold snaps.

“As we sit here today, the only commitment from ISO-NE is to consider increasing the quantities through a yet-to-be determined addition for load forecast error and to add even more consumer cost through some type of forward market concept that likely will increase costs and not add much additional reliability benefit,” Bentz said. “NESCOE brings forward these three amendments to help bring the cost-versus-benefits inequities closer in balance.”

The first amendment to set the RER value to zero for non-winter months passed with 63.76% in favor, as did the second NESCOE amendment, which was to remove the RTO’s ability to adjust reserve levels to account for load forecast errors.

Massachusetts Assistant Attorney General Christina Belew said her office supported the first amendment “because we don’t think the RER product is required under the [Northeast Power Coordinating Council] Directory 5. We think it has a tenuous link to fuel security, and it is disproportionately expensive.” Directory 5 sets minimum requirements for “the amount, availability, distribution and activation of reserve in addition to those specified in applicable NERC standards.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article amplified their remarks afterward to clarify their presentations.]

“This whole effort was built around the Analysis Group’s assessment of a way to pay for a very minor, 10-day LNG contract, so it was all about 10 days of LNG,” said Brett Kruse of Calpine, who voted against all the amendments but supported the RTO’s proposal. “For the record, none of the folks that voted against in the Markets Committee, nor any of the folks who’ve spoken out against it today, have offered an alternative to secure winter fuel security for New England.

“If you look at this as a mathematics exercise, the numbers don’t add up without the entire ISO New England package, and even then, it’s marginal,” he said. “Second, we’ll make prudent business decisions year over year, and if that means going into a winter where we don’t think we’re going to be able to recoup the costs of an LNG contract we probably won’t buy it.”

NESCOE’s third amendment, to include a $10/MWh adder to the strike price in all hours, passed with 61.27% in favor. NESCOE said it would reduce the cost and risk of the energy call option for providers without materially affecting resources’ incentives under the program.

Down, not Out

Bentz said NESCOE’s objections to the unamended ESI proposal fell into two categories.

“First of all, the ISO’s proposal is an unpredictable, year-round call option approach,” Bentz said. “We think it exceeds the scope of the FERC’s order in 2018, and instead of just addressing winter fuel security, the ISO creates this novel, untested and potentially very expensive program for pricing reserves in the day-ahead market.

“Secondly, ISO-NE’s proposal is going to produce an unjust and unreasonable rate,” Bentz continued. “The ISO’s approach is highly vulnerable to producing uncompetitive outcomes due to the inability to effectively mitigate market power. It procures substantially more reserves than the system needs, and at an excessive cost to customers.

“The ESI design is not good value for the money, and collectively, the six New England states are not in favor of this design as being presented here today,” Bentz said.

ISO-NE COO Vamsi Chadalavada offered the grid operator’s perspective on ESI.

“In our view, we are working to balance energy security concerns, not just for the immediate time frame, but for the longer term, and think a more complete design will accomplish that,” Chadalavada said. “We are mindful and sensitive to consumer costs, and it’s certainly been one of the considerations as we built the risk-responsive design.”

The regional electric power system is evolving fast and the RTO has sometimes been reactive, he said.

“This design positions us better as New Englanders because it allows us to be more proactive in terms of the uncertainties that we face,” Chadalavada said.

OKs Early EIP Sunset

The committee also approved Tariff revisions to sunset the RTO’s interim Inventoried Energy Program (IEP) after capacity commitment period 2023/24, one year earlier than the end date in the current Tariff. The early sunset would be conditioned on FERC’s approval of the ESI proposal for implementation no later than June 1, 2024.

FERC in February rejected a request by ISO-NE and NEPOOL to roll back the sunset date for a Tariff provision that allows the RTO to retain a resource for fuel security reasons. The RTO said it plans to refile the Tariff revision when it files its ESI proposal. (See FERC Rejects ISO-NE Fuel Security Sunset Rollback.)

Other Actions

The PC also approved as part of its consent agenda revisions to Market Rule 1 relating to energy efficiency resources’ capacity supply obligations during scarcity conditions, as proposed by NESCOE and recommended by the MC in March.

The committee also unanimously approved revisions to Market Rule 1 to address FERC’s March 10 order rejecting provisions governing how ISO-NE’s Internal Market Monitor calculates the economic life of resources that want to retire or permanently leave the capacity market. The provisions were intended to correct calculations that ISO-NE said overstated the true economics of some resources and could result in improperly high delist bids. But the commission said the rules’ effective date would upset market participants’ “settled expectations” after the Forward Capacity Auction 13 qualification process for delist bids had begun (ER18-1770-002). (See FERC Reverses Ruling on ISO-NE ‘Economic Life’ Rules.)

The proposal asks FERC to make the changes apply prospectively beginning with FCA 16.