By Rich Heidorn Jr.

PJM began to sketch out how it will respond to FERC’s order expanding the minimum offer price rule (MOPR) Wednesday, suggesting that it may compress the schedule for the delayed 2022/23 Base Residual Auction and subsequent auctions.

At a special meeting Wednesday morning of the Market Implementation Committee, PJM also said it was considering eliminating two of three Incremental Auctions.

PJM will develop a schedule “that meets everyone’s needs to the best of our abilities,” said Adam Keech, vice president of market services, who added that the schedule will ultimately depend on how quickly FERC rules on the RTO’s compliance with its Dec. 19 order. PJM has said it will not schedule a capacity auction until after FERC rules on its compliance filing due March 18.

On Tuesday, FERC issued a tolling order giving it more time to respond to the requests filed last month for rehearing and clarification of its December order (EL16-49-002, EL18-178-002). (See PJM MOPR Rehearing Requests Pour into FERC.)

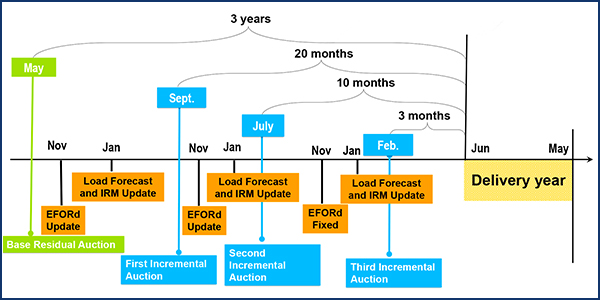

Keech said the RTO could compress the normal nine-month schedule into six months by shifting three deadlines that normally occur in months nine through six: nominations for winter capacity interconnection rights (CIRs); submission of seller peak-shaving adjustment plans; and preliminary must-offer exemptions for deactivations.

Keech said leaving the schedule as is could mean those deadlines would come for a given delivery year before PJM had results of the previous auction.

Greg Carmean, executive director of the Organization of PJM States Inc. (OPSI), said his members need time to evaluate FERC’s compliance ruling to see if they need to make changes in state policy. OPSI sent the Board of Managers a letter last week asking for at least 12 months after FERC’s compliance order before the next BRA but to cap the schedule so the auction is held no later than May 31, 2021.

“That’s crazy,” Tom Hoatson of LS Power said of such a delay. “There’s business decisions, there’s investment decisions currently on hold. … I think you could run an auction as early as this fall for 2022/23.”

Richard Seide of Apex Clean Energy asked how PJM would respond if Maryland pulls out of the capacity market and adopts a fixed resource requirement (FRR).

But Marji Philips of LS Power called it a “gross exaggeration to say the world has changed.”

“I think it’s time we stop talking about a house on fire. It’s not on fire. … At least for the upcoming auction, there isn’t a lot that has changed.”

“All these ‘what ifs’ are not compelling,” said Bob O’Connell of Panda Power Funds. “PJM needs to set a schedule that includes all preliminary activity. We can always find reasons to push it off.”

Carl Johnson of the PJM Public Power Coalition asked PJM and the Independent Market Monitor whether they expected to have to review more units going through the unit-specific exemption process under the new rules.

“I expect it will be more. How much more, I don’t know,” Keech said, adding that it will depend on the values set for the net cost of new entry (CONE) and avoidable-cost rate (ACR).

“It will be more — probably significantly more,” Monitor Joe Bowring said. But he said the Monitor is trying to streamline its review process. “We don’t want to be the thing that slows us down,” he said. “We’re happy to move as quickly as people need us to.”

Exelon’s Jason Barker said shortening the schedule from nine to six months “seems reasonable” but that it would be disruptive to have overlapping auctions because it could put unit owners in a position of having to make retirement decisions for a subsequent delivery year without knowing if it cleared in a prior delivery year.

“You can put all the caveats in the world around that. It has real-world implications,” he said, noting that a plant could see an exodus of its staff after announcing its retirement, even if it is later rescinded.

Incremental Auctions

Keech said PJM is discussing canceling some first and second Incremental Auctions, noting that the postponed BRA for delivery year 2022/23 will likely be after the September date scheduled for the first IA for that period.

He said the RTO may recommend canceling such IAs any time the BRA is later “because you’ve always got the next [IA] coming up.”

If the RTO were to try to reshuffle the IAs, he said, “the logistics around the auction schedule gets extremely complicated.” Such a change would require FERC approval.

IMM to Estimate Cost Impact

In his own presentation on MOPR floor prices, Bowring presented a template for unit-specific exemption requests and an analysis of net ACR costs for nuclear plants.

Barker challenged Bowring’s estimates, saying they fail to account for the plants’ market and operating risks, which should increase prices by $7/MW-day to $18/MW-day. “Risk should be accounted for. It’s not accounted for in these numbers,” he said.

Other speakers questioned using a 20-year asset life for determining the costs of solar generation, saying it is too short.

“We’re not saying it has to be 20 years; that’s what the order is now,” Bowring said. “We think it serves everyone’s interests to have that clarified.”

Bowring also said the Monitor will be publishing “fairly soon” an analysis that will show that the expanded MOPR will not increase capacity clearing prices — contrary to others’ predictions of large increases. In his dissent on the order, Commissioner Richard Glick offered a “back of the envelope” estimate that capacity costs will increase by $2.4 billion annually. (See FERC Extends PJM MOPR to State Subsidies.)

“We’ll point out why that’s not accurate,” Bowring said of Glick’s estimate. But he said the Monitor will not forecast prices for individual locational deliverability areas because that could reveal confidential information and influence bidding behavior. “We don’t want to get out ahead of the market,” he said.

‘Death Penalty’

Seide challenged PJM for changing its interpretation of what he called the “death penalty” for resources that claim the competitive exemption but later accept a state subsidy.

Paragraph 162 of the order says an existing resource that claims the competitive exemption for a capacity delivery year, but later accepts a state subsidy for any part of that delivery year, will be denied capacity market revenues for any part of that year.

The commission said a new resource that claims the competitive exemption in its first year and later accepts a subsidy “may not participate in the capacity market from that point forward for a period of years equal to the applicable asset life that PJM used to set the default offer floor in the auction that the new asset first cleared.”

“Absent this change, PJM’s proposed language would allow gaming and incent the creation of subsidy programs timed to avoid the qualification window,” the commission said.

MIC Chair Lisa Morelli acknowledged that PJM had considered a narrower interpretation of the ban that would bar new resources for just the delivery year in question. But she said the RTO now agrees with Bowring that FERC intended such a circumstance to result in a lifetime ban.

“If FERC sees that [in PJM’s compliance order] and says that was not what the intent was, then they can correct us,” Morelli said.

“You’re accepting the death penalty,” Seide said.

“We prefer asset life ban,” Morelli responded, prompting laughter.

In their request for rehearing, trade groups representing wind and solar generators said the commission’s proposed rule is “unduly punitive and not proportional to the alleged harm caused.”

Additional MOPR Discussions

In a response to questions from stakeholders, Morelli said PJM won’t publish an “exhaustive list” of what it considers subsidies under the FERC order but will list those on which it agrees with the Monitor in the interest of transparency.

Morelli also released an updated schedule of MOPR discussions, including another special MIC session from 9 a.m. to 12 p.m. on Feb. 28. The MOPR will also be on the agenda for the MIC’s next regular meeting March 11. The Demand Response Subcommittee, which discussed the impact of the expanded MOPR on demand response and energy efficiency Wednesday afternoon, will resume its talks from 9 to 12 on March 12.