Senators Ask ISO-NE to Heed States on Clean Energy.)

In his Nov. 21 response, van Welie noted the region’s efforts to integrate energy efficiency and demand response into the wholesale markets and addressed the senators’ concern that the Energy Security Improvement (ESI) market design project “further delays market reforms that recognize and facilitate state public policies to grow clean energy and address climate change.”

Van Welie said that although the ESI would benefit generators with stored fossil fuel, it could also provide opportunities for solar facilities with battery storage “or an offshore wind farm that operates at a high capacity factor during winter.”

“Rather than delaying the transition to a renewable future, ESI may actually accelerate the transition to reliable, zero-carbon renewable resources and storage technologies by recognizing and compensating these resources for the reliability attributes they provide,” van Welie wrote.

PC Chair Nancy Chafetz cut short the ensuing discussion, assuring stakeholders that they would have ample opportunity to voice their opinions at NEPOOL Technical Committee meetings over the coming months.

The PC also received a briefing from ISO-NE Director Brook Colangelo on the RTO’s cybersecurity work and its participation in last month’s GridEx V exercise. (See GridEx V Throws New Tech Curveball.)

COO Vamsi Chadalavada apologized for a computer glitch on Nov. 3 that caused the submission window for external transactions to close at 9 a.m. instead of 10 a.m.

The problem was due to a software error related to the daylight saving time transition, he said.

A new eMarket application had been placed in service Oct. 23, and a few participants could not enter or modify external transactions after 9 a.m. on Nov. 3, though the application performed as expected for all other supply offers and demand bids.

The day-ahead market was cleared with the offers and bids as of 10 a.m., per normal schedule, and the issue was fixed by early afternoon, Chadalavada said.

One stakeholder suggested that the RTO have extra staff on hand when transitioning to new software, just in case customers need service.

Natural Gas Prices Double from October

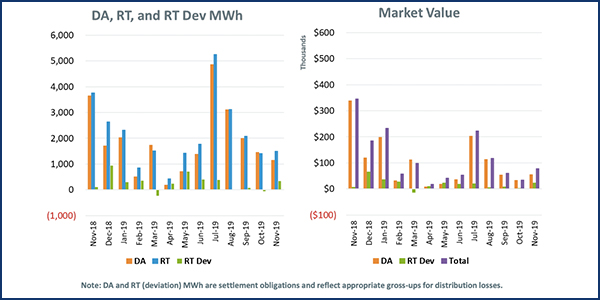

Chadalavada reported the energy market value for last month was $284 million, through Nov. 25, up $82 million from October 2019 and down $319 million from the same month a year ago.

Natural gas prices doubled from October to November, helping push average real-time hub LMPs to $35.52/MWh, up 74% from the prior month.

However, natural gas prices and LMPs were down 46% and 36%, respectively, from November 2018.

Average day-ahead cleared physical energy during the peak hours as a percentage of forecasted load was 99.6% during November, up from 98.8% during October, with the minimum value for the month of 95.7% posted on Nov. 8.

Daily uplift, or net commitment period compensation (NCPC) payments, in November totaled $3.3 million through the 25th, up $600,000 from October and down $1.3 million from the same month last year.

NCPC payments over the period were 1.2% of the energy market value.

Committee Officers Elected, Appointed

The Participants Committee re-elected Chafetz (Customized Energy Solutions); Vice Chairs Calvin Bowie (Eversource Energy), David Cavanaugh (Energy New England), Douglas Hurley (Synapse Energy Economics) and Tom Kaslow (FirstLight Power Resources); Secretary David Doot (Day Pitney); and Assistant Secretary Sebastian Lombardi (Day Pitney). In addition, Michael Macrae, energy analytics manager for Harvard Dedicated Energy, was elected vice chair representing End Users. He replaces Liz Delaney, who stepped down after leaving the Environmental Defense Fund to become director of wholesale market development for Borrego Solar.

ISO-NE appointed Mariah Winkler to serve as the new chair of the NEPOOL Markets Committee. Winkler has 10 years of experience in the Forward Capacity Market and led the Reliability and Transmission committees through discussions on issues such as FCM fuel security reliability reviews and competitive transmission solicitations.

The RTO appointed Emily Laine to replace Winkler as the new chair of the Reliability and Transmission committees. Laine also serves as secretary of the Demand Resources Working Group.

After 17 years serving the MC, most recently as chair, Alex Kuznecow will now serve as chair of the NEPOOL Working Groups.

2020 Budget

The PC unanimously approved a 2020 budget of $6,365,000 for NEPOOL, up $90,000 (1.4%) from 2019’s spending plan. NEPOOL expects to spend $6,625,000 by the end of this year, $350,000 above the approved budget. Most of the increase stems from $340,000 in above-budget spending for Day Pitney’s counsel fees, an 8.6% exceedance. Independent financial adviser fees and disbursements were $5,000 over budget (12.5%), and committee meeting fees were $30,000 more than planned (4.4%). They were partially offset by $25,000 in savings on the Generation Information System (-2.9%).

Consent Agenda

The PC unanimously approved the Reliability Committee’s recommendation to revise ISO-NE Operating Procedure No. 2 to incorporate a new reference document and clarify the RTO’s role in approving the scheduling of planned equipment maintenance and outages.

It also approved the Markets Committee’s recommendation to change Market Rule 1 to sunset the fuel security reliability review provisions following Forward Capacity Auction 14, one year earlier than currently planned. The RTO said the review will not be necessary for FCA 15, when the ESI design is expected to be in place.

Litigation Report

Doot highlighted a few items from the monthly litigation report, including that Storage Plans Clear FERC with Conditions.)

That compliance filing is due Jan. 21. Requests for rehearing of FERC’s order are due by Dec. 23.

Doot also mentioned the commission’s Notice of Inquiry in March for comments on whether it should change its method of calculating returns on equity for electric transmission and natural gas and oil pipelines (PL19-4). The proceeding has produced splits between transmission owners and load interests, as well as calls for new policies to increase the efficiency of existing lines and mandates on interregional planning. (See Tx Incentives NOI Brings Calls for Broader Reforms.)

He also drew attention to the D.C. Circuit Court of Appeals’ ruling Thursday indicating it will reconsider its precedent that allows FERC to issue “tolling” orders to indefinitely delay action on requests for rehearing. (See related story, DC Circuit to Reconsider FERC Tolling Orders.)

— Michael Kuser