By Christen Smith

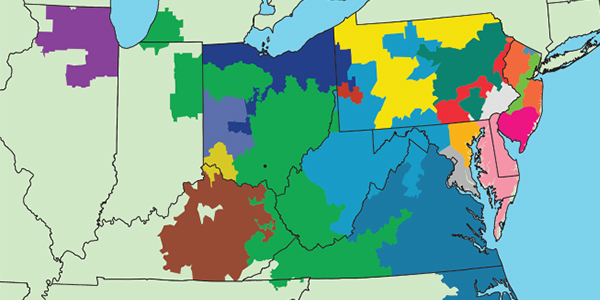

Record low energy prices persisted for the first nine months of the year in PJM, and so too did rumblings from legacy generators losing money over it.

But the loud grievances of some shouldn’t outweigh the benefits to the many, the Independent Market Monitor said in its quarterly State of the Market report, urging stakeholders to be wary of sweeping changes to the markets.

“There is no reason to overturn the key components of the PJM capacity and energy markets,” the Monitor wrote in its report, published Nov. 14. “There is no reason to create convoluted capacity market rules to exclude any competitive offer from any technology including renewable and nuclear technologies. There is no reason to artificially increase energy prices to benefit nuclear and coal plants.”

The sentiments echo the Monitor’s warning in August that PJM’s markets “remain under attack” from those who think its outcomes shortchange them. (See Monitor: PJM Markets Remain Under Attack.)

Instead, the Monitor said, stakeholders should focus on the “refinement of market rules” to “ensure the continued effectiveness of PJM markets in providing customers wholesale power at the lowest possible price, but no lower.”

The Monitor also said that a market-based carbon price — such as that of the Regional Greenhouse Gas Initiative — would serve PJM better than unit-specific subsidies or “inconsistent” renewable portfolio standard rules.

“Implementation of a carbon price using RGGI or a similar market mechanism by the states would mean that the states control the carbon price and that no FERC approval would be required and no PJM rule changes would be required,” the Monitor said. “The carbon price would become part of the marginal costs of power plants, and the impacts on production and consumption decisions would be market based. States would control the resulting revenues. This is the case regardless of the number of PJM states that join RGGI or a similar market.”

In the interim, natural gas plants will continue displacing coal-fired resources, and some nuclear units will lose money while sellers’ efforts to artificially control those elements will keep PJM’s capacity market uncompetitive, the Monitor said.

“The fact that some plants are uneconomic does not call into question the fundamentals of PJM markets. Many generating plants have retired in PJM since the introduction of markets, and many generating plants have been built since the introduction of markets. The level of potential retirements of coal and nuclear units does not imply a reliability issue in PJM and does not imply a fuel security issue in PJM.”

Energy Prices, Congestion Trending Down

Energy prices dropped 30% compared with the same time frame a year earlier, and congestion decreased by two-thirds, the Monitor said.

LMPs dipped from $39.43/MWh in the first nine months of 2018 to $27.60/MWh through September. Lower fuel costs contributed to nearly half the decline, the Monitor said.

As a result of the record low prices, many generators — including FirstEnergy Solutions’ two Ohio nuclear plants — won’t recover costs. (See related story, Ohio Supreme Court Dismisses FES Nuke Lawsuit.) The Monitor’s analysis concludes that average energy market net revenues decreased by 52% for new combustion turbine units; 32% for combined cycle; 82% for new coal plants; 32% for a new nuclear plant; 74% for a new diesel units; 29% for a new onshore or offshore wind installation; and 19% for a new solar installation.

New Recommendations

The Monitor’s highest priorities center around ensuring effective market power mitigation and updates to PJM’s real-time security-constrained economic dispatch (RT SCED) methodology, which stakeholders are exploring through a special session of the Market Implementation Committee. (See “5-Minute Dispatch and Pricing,” PJM MIC Briefs: July 10, 2019.)

To address market power issues, the Monitor said PJM should commit units based only on their parameter-limited schedules when the three-pivotal-supplier test is failed or during high-load conditions, such as cold- and hot-weather alerts or more severe emergencies.

PJM should also approve one RT SCED case for each five-minute interval to send dispatch signals and calculate prices using the same approved SCED case.

Other new recommendations:

- PJM should model generators’ operating transitions and peak operating modes.

- PJM should revert to the method for the calculation of implicit balancing congestion charges used prior to April 1, 2018.

- Fleetwide cost-of-service rates used to compensate resources for reactive capability should be eliminated and replaced with compensation based on unit-specific costs.

- The market efficiency process used to calculate the cost-benefit ratio of reliability-based regional transmission expansion projects should be eliminated because it is not consistent with a competitive market design.