By Christen Smith

PJM’s Independent Market Monitor said the RTO should resume its efforts to close loopholes that allow demand response resources to sell high and buy low in its capacity auctions.

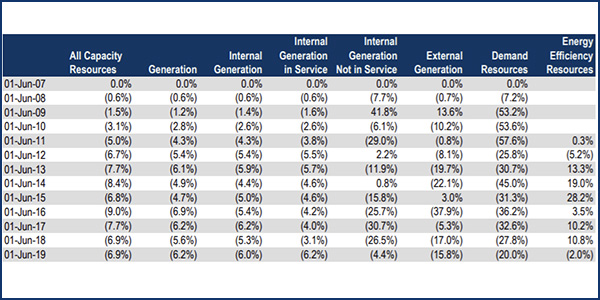

In an analysis published earlier this month, the Monitor concluded that DR sellers bought the highest amount of replacement capacity between 2007 and 2019 — more than internal or external generation sources, both in and out of service, and energy efficiency resources. The Monitor said that statistics support its conclusion that DR market sellers base their offers on speculation, at best, and later buy replacement capacity for a “substantial portion” of those commitments at a discounted price.

“There is no reason for further delay on this matter,” the Monitor wrote. “The evidence has been and continues to be quite clear. The incentives have been and continue to be quite clear. The lack of an enforced specific requirement that all capacity resources be demonstrably specific physical assets when offered into PJM capacity auctions continues to provide strong incentives to offer speculative paper capacity.”

According to the Monitor’s analysis, which focused on June 1 of each year, the share of net replacement capacity for DR commitments exceeded 50% from 2009 to 2011. Between 2012 and 2019, the rate exceeded 20%. The Monitor attributed the decline to PJM’s discontinuation of the Interruptible Load for Reliability (ILR) program.

In 2014, PJM implemented a rule that required DR sellers to submit a plan ahead of the capacity auction, but the Monitor said that didn’t go far enough. Under existing rules, sellers must only provide site-specific and customer-specific information if their resources are located within a zone of concern that is also in excess of a curtailment service provider’s (CSP) defined sell threshold. Only three zones of concern have been identified — ATSI, Penelec and MetEd — for delivery years 2017/18 through 2022/23.

The Monitor said that without identified customers or clear plans for implementing DR, CSPs can make speculative offers in the Base Residual Auction that do not represent what may be physically available during the actual delivery year.

“The risks to the markets associated with the sale of DR without any supporting information on the plausibility of the underlying assets include the risk that multiple CSPs could be assuming that they will win the same customers and the risk that sellers are taking speculative positions with a low probability of fulfilling them,” the Monitor wrote. “The result in both cases is that the system is less reliable than it might otherwise be because the full amount of DR that cleared the [Reliability Pricing Model] auction is not actually available, the price to other capacity resources has been suppressed by the sale of the speculative DR, new entry of other capacity resources could have been forestalled by the sale of speculative DR, and there may not be adequate replacement resources available with short notice prior to the delivery year.”

The Monitor said physical generation assets become displaced in the BRA and then have an incentive to offer at lower prices in the Incremental Auctions to recover capacity revenues. Those lower prices permit the buyback of “speculative DR” at lower prices, encouraging the bidding cycle to continue and “creating an unfair advantage … and self-fulfilling dynamic that incents more of the same behavior.”

The problem hasn’t been lost on PJM. The RTO filed Tariff revisions in 2014 to address the issue, but FERC rejected the filing and initiated a proceeding under Section 206 of the Federal Power Act and held technical conference to sort the problem out. In August of that same year, PJM stalled the proceeding in order to collect additional data under its new Capacity Performance construct. In 2018, PJM filed Tariff revisions for its IA procedures in tandem with another deferral on its earlier capacity replacement docket. FERC rejected the auction Tariff filing and terminated the 2014 docket, leaving the issue unresolved.

PJM is reviewing the Monitor’s report, spokesman Jeff Shields told RTO Insider on Wednesday.

“The IMM is correct that PJM has taken steps to further solidify the requirements for demand response to substantiate its physical nature as part of the DR sell offer plans, and additional PJM proposals in this regard have been rejected by FERC. PJM would need to evaluate whether further restrictions are appropriate,” Shields said.

The Monitor urged PJM to pick back up with the docket and change existing rules so that DR sellers must provide evidence of physical commitment from specific and identified customers in the form of a contract signed six months prior to the appropriate capacity auction. It also encouraged limiting replacement capacity transactions to those resources with physical issues.