FERC issued the following orders at its open meeting Thursday.

CAISO/WECC

Rehearing Denied in Asset Management Cases

FERC denied rehearing of two 2018 orders that concluded that Order 890’s transparency provisions do not apply to “asset management” projects that provide only “incidental” increases in transmission capacity.

One case involved Southern California Edison’s Transmission Owner Tariff amendment implementing an annual transmission maintenance and compliance review process (ER18-370-002). The other concerned Pacific Gas and Electric (EL17-45-001). (See ‘Asset Management’ not Subject to Order 890, FERC Rules.)

Sempra Affiliate Sale Approved

The commission approved Sempra Gas & Power Marketing’s request to sell resource adequacy capacity at market-based rates to its affiliate, San Diego Gas & Electric (ER19-2422).

FERC said that a competitive solicitation and benchmark evidence filed by the companies ensured there was no affiliate abuse.

Refund Report OK’d

FERC accepted a refund report filed by Panoche Valley Solar to address its unauthorized wholesale sales of electric power made before receiving commission approval (ER18-855). The commission authorized CAISO to distribute the $58,107 refund on a pro rata basis to all market participants that paid its grid management charge during the refund period, Oct. 31, 2017, through April 14, 2018.

206 Proceeding in Idaho Power Market Power Case

The commission ordered a proceeding under Federal Power Act Section 206 to determine whether Idaho Power may continue to charge market-based rates in the Idaho Power balancing authority area (ER10-2126-005).

The company’s updated market power analysis passed the pivotal supplier and wholesale market share indicative screens in the Avista, Bonneville Power Administration, Nevada Power, NorthWestern Corp., PacifiCorp-East, and PacifiCorp-West BAAs and in CAISO’s Energy Imbalance Market.

But it failed the wholesale market share indicative screen in one season in its own BAA.

FERC said Idaho Power must show cause within 60 days why the commission should not revoke the company’s market-based rate authority in its BAA. “In addition to the previously filed delivered price test, Idaho Power may present alternative evidence, such as historical sales and transmission data, to rebut the presumption that it has the ability to exercise horizontal market power in the Idaho Power balancing authority area,” the commission said.

As an alternative, Idaho Power may file a mitigation proposal to eliminate its ability to exercise market power or agree to accept cost-based rates, the commission said.

TEP Rebuffed on Tx Cost Recovery

FERC rejected Tucson Electric Power’s request for 100% recovery of prudently incurred costs on the abandoned 345-kV Sahuarita-Nogales transmission project, saying it is entitled to only 50% (ER19-2023).

The project was delayed for years over siting issues, and in 2012, the Arizona Corporation Commission found it was no longer economically justified because of reduced load forecasts and UNS Electric’s improvements to its electric system, including a proposal to upgrade an existing 115-kV line to 138 kV to address reliability issues in Santa Cruz County.

The commission rejected the 100% request authorized by FERC Order 679, saying that the company’s work on the transmission project “largely took place prior to” the issuance of the order in 2006.

Instead, FERC said the company can recover 50% of its prudently incurred abandonment costs. The commission established a hearing and settlement procedure to determine the costs to be included and the appropriate amortization period.

ISO-NE

New Brunswick Energy Clears Market Power Review

FERC ruled that New Brunswick Energy Marketing satisfied its standards for market-based rate authority in the New Brunswick System Operator balancing authority area, terminating a Federal Power Act Section 206 proceeding (ER14-225-005).

The commission initiated the review in May after the company’s parent, NB Power, purchased a 290-MW generation facility in the province of New Brunswick.

NB Energy Marketing told FERC it passed the pivotal supplier and wholesale market share screens in the ISO-NE market and the pivotal supplier screen in the NBSO BAA. But it said it failed the wholesale market share indicative screen in that area in all four seasons. The company filed a delivered price test to rebut the presumption of horizontal market power.

“After weighing all of the relevant factors, we find that, on balance, NB Energy Marketing has rebutted the presumption of market power for the New Brunswick balancing authority area,” the commission said.

MISO

SWEPCO Settlement Approved

FERC approved a settlement on a power supply agreement (PSA) between Southwestern Electric Power Co. and the city of Minden, La., over the objections of the city of Prescott, Ark. The commission ruled that the benefits of the settlement for the settling parties outweighed Prescott’s objections (ER18-1225-001, EL18-122-001).

SWEPCO supplies all of Minden’s capacity and energy requirements above the city’s allocation from the Southwestern Power Administration. Minden alleged that after Entergy’s integration into MISO, it began seeing markedly higher congestion charges and that SWEPCO failed to effectively hedge them as required under its contract.

Prescott said it has a contract with SWEPCO that includes provisions identical to that in the Minden PSA and argued that because it was excluded from participation in the proceeding, the settlement should not be accepted. The commission disagreed, saying “Prescott’s interests [are] too attenuated and that the benefits of the settlement outweigh the nature of the objections.”

SWEPCO will pay Minden $400,000 under the settlement.

Extra Time for Wabash Valley 205 Filing

FERC gave the Wabash Valley Power Association up to 90 days to make an FPA Section 205 filing proposing rates, terms and conditions for the early termination of its contracts with Tipmont Rural Electric Member Cooperative, which serves 21,000 members in west-central Indiana (EL19-2).

Last October, Tipmont asked the commission to allow it to terminate its all-requirements wholesale power supply contracts with Wabash on Jan. 1, 2020, in return for paying any stranded costs incurred by Wabash.

Tipmont said Wabash is citing a “buyout policy” that requires Tipmont to give Wabash 10 years’ notice of termination of service and to pay stranded costs at a rate set unilaterally by Wabash. Tipmont contends the policy is unenforceable because Wabash never filed it with the commission.

Both parties told FERC the issues related to the termination could be addressed in a Section 205 filing by Wabash. As a result, the commission said it would hold the complaint in abeyance pending further action.

NYISO

PSE&G Denied Rehearing in Con Ed Dispute

FERC denied Public Service Electric and Gas’ request for rehearing of the commission’s September 2018 order dismissing its complaint against Consolidated Edison over the latter’s termination of the “wheel” it used to move power from upstate New York to New York City via northern New Jersey (EL18-143-001).

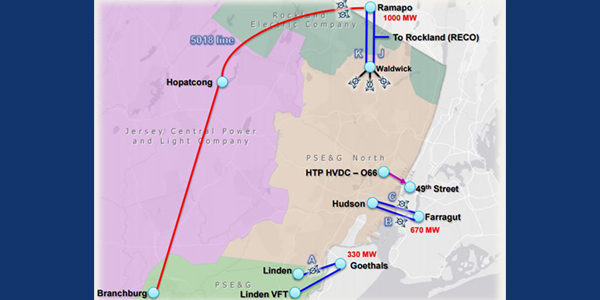

Con Edison and PSE&G jointly own the B and C transmission lines under the Hudson River. | PJM

PSE&G said Con Ed violated the NYISO Tariff by failing to cooperate with PSE&G to remove dielectric fluid and transmission cables from the B and C Lines, two 345-kV lines co-owned by the companies that run under the Hudson River to connect NYISO and PJM.

The commission had ruled that it lacked exclusive jurisdiction to determine the validity of PSE&G’s claim, saying the issue should be resolved in federal court. The commission affirmed that the line agreements between the companies will terminate on Dec. 31, 2020. (See FERC Dismisses PSE&G Complaint Against Con Edison.)

PJM

NJ Gas Plant Granted More Efficiency Waivers

FERC approved two waivers for a New Jersey cogeneration plant last week that will exempt it from having to meet qualifying facility operating and efficiency standards in 2018 and 2019 (EL19-72).

Kenilworth Plant — a 29-MW dual-fuel combined cycle unit that supplies electricity and steam to Merck’s international headquarters in Union County — has been struggling to meet the Public Utility Regulatory Policies Act standards since 2016, when the company converted the property from a manufacturing and processing facility to a corporate campus, reducing its need for steam.

FERC granted waivers for the plant 2016 and 2017 but held off on approving one for 2018 in hopes that a scheduled overhaul of its combustion turbine would improve efficiency. Kenilworth told the commission in June that although the turbine’s efficiency rating improved after the maintenance, it still fell short of the minimum qualifying efficiency standard of 42.5% for several months afterward. Further repairs and increasing on-site load at the campus, however, will eventually bring the plant back into full compliance with the QF standards.

FERC granted the waivers for 2018 and 2019 but dismissed the request for 2020, saying that a combination of the plant’s investments and the anticipated growth at the Merck campus make a waiver unnecessary.

Calpine Reactive Service Settlement Approved

The commission approved a settlement that lowers reactive service rates for Calpine generating units in PJM (ER14-874).

Calpine’s Bethlehem Energy Center | Calpine

The settlement between Calpine, Old Dominion Electric Cooperative and PJM’s Independent Market Monitor includes an annual revenue requirement (ARR) of $10.1 million for Calpine units in Pennsylvania, New Jersey, Delaware, Maryland, Virginia and Illinois. PJM, the Monitor and ODEC had filed motions questioning whether Calpine’s rates were justified.

Calpine’s Bethlehem, Pa., plant will have an ARR of $2.02 million, a 25% reduction from the $2.6 million Calpine had proposed. Since the ARRs are now lower, Calpine agreed to refund the difference.

SPP

NPPD Rehearing Request v. Tri-State Denied

FERC last week denied Nebraska Public Power District’s request for rehearing of the commission’s order dismissing its complaint against SPP and Tri-State Generation and Transmission Association over Tri-State’s annual transmission revenue requirement (EL18-194, ER16-204).

Sunflower Electric Power has acquired Mid-Kansas Electric, prompting SPP to combine them into a single Sunflower zone. | Sunflower Electric, Mid-Kansas Electric

NPPD filed a complaint under Section 206 of the Federal Power Act last year asking the commission to determine that the inclusion of certain costs in Tri-State’s ATRR and failure to credit certain revenues to its revenue requirements for network integration transmission service under SPP’s Tariff are unjust and unreasonable.

FERC denied the complaint, finding that each of the disputed cost components were covered by a settlement agreement that included NPPD and that the utility failed to demonstrate that its proposed modifications to the ATRR satisfy the heightened “public interest” standard.

Commission Accepts Sunflower, Mid-Kansas Merger

The commission conditionally granted Sunflower Electric Power’s request for a 50-basis point adder to its return on equity to reflect its acquisition of Mid-Kansas Electric (ER19-2273).

The commission also set for hearing and settlement procedures SPP’s proposed revisions to Sunflower’s formula rate template and implementation protocols to combine the existing Mid-Kansas and Sunflower zones into a single Sunflower zone under the Tariff.

— Rich Heidorn Jr., Christen Smith and Tom Kleckner