By Rich Heidorn Jr.

The Long Island Power Authority’s proposal to exempt “beneficial electrification” from carbon charges received a mixed reaction Monday at a meeting of the Integrating Public Policy Task Force (IPPTF).

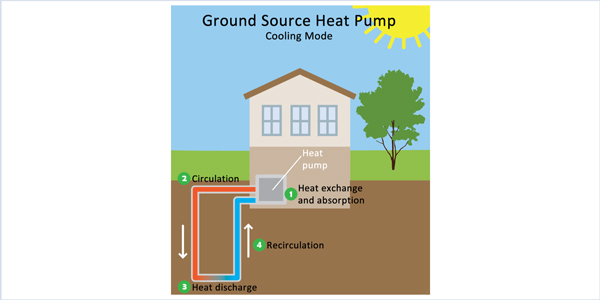

LIPA’s David Clarke said beneficial electrification (BE) — load growth that improves load factors and results in net reductions in carbon emissions — could increase generator margins while reducing fixed costs and should be supported by policymakers. Clarke cited as examples vehicle electrification and switching from oil-fired boilers to ground source heat pumps.

Clarke acknowledged the complexity of carving out BE loads for separate rate treatment but said it could be accomplished without skewing dispatch. He proposed treating BE load growth as having no marginal carbon impact, meaning it would not pay the carbon component of the LBMP.

“I think the question here is: Is there a consensus … around the idea of trying to include beneficial electrification in this proposal?” Clarke asked. “I’m willing to at least try to illustrate that it might benefit large groups of stakeholders.”

Kevin Lang, representing New York City, said Clarke had proposed an “interesting concept.”

But other stakeholders indicated no appetite for including the issue in their current deliberations, saying it should be delayed or handled by retail regulators rather than in the wholesale market.

One stakeholder who asked not to be named said the proposal raised numerous issues. “If you include extensive switching to heat pumps, a utility can very quickly become a winter peaking operation rather than a summer peaking operation. This then raises the question of forward capacity markets and so forth. How much does it cost to have the extra capacity in place for winter weather?”

Because thermal loads tend to be very “peaky,” resulting in more start-up operations, adding such loads raises issues of environmental justice, the stakeholder said.

“Any policy maker who gets into the subject of electrification should be able to stand up in front of a crowd of people like this and draw a curve of carbon monoxide, unburned … carbon emissions during the startup of even a natural gas turbine, and be able to comprehend how ugly that start-up process is during the first hours of operation and where that exhaust is going. We need to be very careful about increasing peaky types of grid loads.”

Mark Younger, of Hudson Energy Economics, said measuring carbon savings from beneficial electrification is very complicated.

“We would be going through a huge amount of complication to try and address something that realistically should lower the average carbon cost … fairly little,” he said. “I look at this and I say this seems like a perfect thing to not try and address at all at the wholesale level. … If someone wants to put together a retail rate design that is targeted to beneficial electrical uses and therefore has some degree of savings on maybe some of the fixed costs, the distribution costs … that’s a perfectly appropriate thing certainly for DPS [Department of Public Service] to consider.”

Clarke recommended awarding the social cost of carbon offsets through load-serving entities, which he said would allow for continued funding of LSE carbon abatement programs and incent LSEs to encourage BE load growth. The state Public Service Commission would retain its jurisdiction over how offset revenues are treated at the retail level.

Erin Hogan, director of the state Utility Intervention Unit, agreed with Younger, saying “it’s premature to try and address this now.”

She said the issue could be revisited once policymakers develop criteria for BE and once the NYISO develops its bottom-up forecast.

“The issue that I take issue with is that all beneficial electrification is good. To the extent there’s low penetration, the fixed costs could be spread over more megawatt hours. However, if the penetration is so high that the utilities then have to revamp their systems, all those little transformers in neighborhoods might have to be resized. Those costs could go up exceptionally high,” she said, noting that her office filed comments in the “New Efficiency New York” docket asking the PSC to develop criteria for defining BE.

Under Clarke’s proposal, loads qualifying as BE would have to improve load factors and prevent increases in regulated natural gas customers’ fixed costs. Policymakers should consider offsetting increases in fixed costs to electric customers resulting from load growth at sub-transmission feeders and distribution lines, he said.

Lang said New York City “is looking closely” at beneficial electrification, predicting it “will be bigger” than Younger suggested.

“If [the impact is] tiny, it’s tiny,” said Clarke. “That’s not the issue. I’m thinking down the road this is going to be big. Beneficial electrification, especially if [carbon emissions] were only monetized in the electric sector, is going to be a huge thing. And we’re going to be penalizing — if we keep doing what we’re doing — load growth that reduced carbon … by charging it a carbon charge even though its net effect on carbon is negative.”

Import Carbon Pricing

Clarke also gave a presentation on addressing imports from grid operators that already incorporate carbon prices. NYISO staff have suggested treating imports as if New York had no carbon policy, saying it may be too complicated to use the actual hourly marginal energy rate [MER] of external RTOs.

Clarke said the ISO’s proposal “gives neither an efficient carbon-free dispatch nor efficient dispatch when damage costs are considered” using the social cost of carbon.

Under Clarke’s proposal, the ISO would back out the price of carbon in each external zone and compare it to the New York price, less its carbon price based on the New York MER. “If MERs are similar, why not get more power from ISOs/RTOs where the cost of power absent carbon charges is lowest?” he asked.

ISO Draft

The handling of imports also came up earlier in the meeting as stakeholders questioned ISO staff on details of its draft proposal released Aug. 2. (See Stakeholders Annoyed by NYISO Carbon Price Draft.)

The draft assumes the status quo — known as Option 1 — of treating imports as if New York had no carbon policy.

NYISO’s Mike DeSocio said, “I haven’t heard compelling arguments” for considering ways to value clean resources outside New York, known as Option 2.

Pallas LeeVanSchaick, of the ISO’s Market Monitoring Unit, challenged the “premise that Option 2 is complicated and hard to implement, and Option 1 is straightforward. … I don’t think it’s as straightforward as you think it is.”

Jordan Grimes, of Morgan Stanley, said beginning with Option 1 and later switching to Option 2 would be “untenable for markets.”

He asked whether the ISO had considered how the decision would be viewed under the U.S. Constitution’s Interstate Commerce Clause.

“The courts could say … you guys looked at two options, and Option 2 was the less discriminatory option — and that’s on record — and the ISO decided to go with Option 1 because it was easier.”

He said NYISO could learn from CAISO. “The way they tax imports largely works,” he said.

ISO attorney James Sweeney responded, “We haven’t identified anything from the interstate commerce area that would be a deal breaker for either option.”

Mike Mager, representing the Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers, said the draft is missing many details that must be decided before NYISO stakeholders vote on any proposal. “It’s problematic to expect people to [vote] to implement one of the most significant market rule changes in the history of the NYISO without any clarity on what the social cost of carbon would be and how and when it would be updated,” he said.

NYISO’s DeSocio said “it’s difficult to foreshadow the kind of process the Public Service Commission would undertake” to set the cost of carbon. “We would hope they would be consistent with other [PSC] programs. From an efficiency standpoint, having different costs of carbon doesn’t seem like a good path forward.”