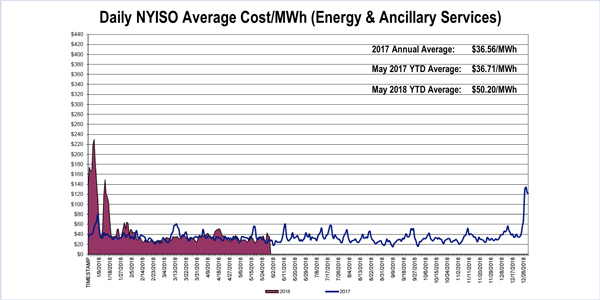

RENSSELAER, N.Y. — NYISO power prices dropped in May but are up 37% year-to-date, Nicole Bouchez, ISO principal economist, told the Business Issues Committee on Wednesday.

Prices averaged $28.78/MWh in May, lower than $35/MWh in April and $31.74/MWh the same month a year ago.

Year-to-date monthly energy prices averaged $50.20/MWh through May, up from $36.54/MWh a year earlier. May’s average sendout was 397 GWh/day, compared with 390 GWh/day in April and 383 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $2.55/MMBtu for the month, down 9.4% compared with last month and 8.8% year-over-year.

Distillate prices gained 6.4% compared to the previous month but were up 49.7% year-over-year. Jet Kerosene Gulf Coast and Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $15.96/MMBtu and $15.92/MMBtu, respectively.

Total uplift costs and uplift per megawatt-hour rose from April with the ISO’s local reliability share 22 cents/MWh in May, up from 12 cents/MWh the previous month, while the statewide share climbed from -57 cents/MWh to -17 cents/MWh.

ISO Reviewing Rules on PJM Imports

Reviewing the Broader Regional Markets report, Bouchez described the ISO’s work on item 26, an effort to clarify the minimum deliverability requirements for capacity from PJM, the subject of three joint meetings of the Installed Capacity (ICAP) Working Group and Market Issues Working Group since February.

The ISO has prepared a detailed overview of the supplemental resource evaluation (SRE) process for external resources, the existing nonperformance penalties for external ICAP suppliers, and a draft proposal regarding SRE process improvements for external capacity resources.

Bouchez also reviewed item 28, a complaint filed with FERC in December by the New Jersey Board of Public Utilities challenging PJM’s and NYISO’s implementation of the mutual benefits provisions of their joint operating agreement and requesting amendments to the JOA.

FERC rejected the complaint on May 24 (EL18-54). The commission found that because the Bergen-Linden Corridor Project was planned by PJM, and without a voluntary commitment to share cost responsibility by NYISO, “it is just and reasonable for the costs of the project to be allocated solely within PJM.” (See PSE&G on the Hook for Bergen-Linden Costs.)

Proposal to Extend TCCs Advances

The BIC voted to recommend that the Management Committee approve Tariff revisions to provide extensions of historic fixed-price transmission congestion contracts (HFPTCCs), following a presentation by Gregory R. Williams, manager for TCC market operations.

FERC Order 681 requires that long-term firm transmission rights be made available to allow load-serving entities to support long-term power supply arrangements.

The HFPTCCs initiated by NYISO in 2008 allow LSEs to obtain such contracts for up to 10 years, with some service grandfathered for up to 12 years; 1,748 MW of HFPTCCs are currently active. Those offered in 2008 are now approaching the end of their 10-year term and will expire after Oct. 31.

As part of developing the HFPTCCs, the ISO had committed to explore an option to renew the contracts after the initial term.

Contract extensions would be made available to LSEs that convert existing transmission agreements to HFPTCCs and continued to purchase them throughout the entire 10- or 12-year term.

The ISO is required to make all transmission capacity not used to support existing TCCs available for sale in its centralized TCC auctions. The bidding and offering period for the first round of the fall 2018 centralized TCC auction is expected to begin in mid-August.

Assuming the current proposal is accepted by FERC, the ISO would need to seek a waiver for permission to reserve 256 MW of transmission capacity from the upcoming auction to support the potential award of HFPTCC extensions that would begin on Nov. 1, 2018, and ensure feasibility issues do not arise from offering such extensions to qualifying LSEs.

— Michael Kuser