By Rory D. Sweeney

Public Service Electric and Gas appears to be out of targets to help it pay for its $1.2 billion Bergen-Linden Corridor (BLC) project. FERC last week denied a complaint from the New Jersey Board of Public Utilities to reallocate the project’s costs, leaving PSE&G to pay for most of the project meant to support the “wheeling” arrangement Consolidated Edison terminated in April 2017 (EL18-54).

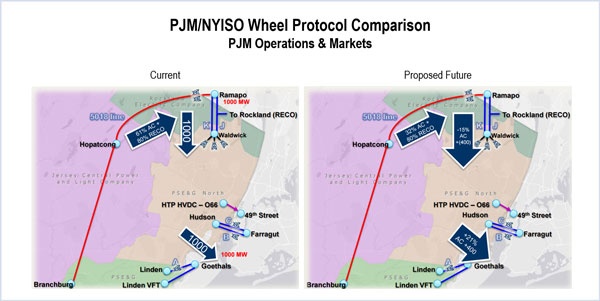

For decades, Con Ed paid to wheel 1,000 MW of power through PSE&G’s facilities in northern New Jersey for delivery to New York City. But Con Ed terminated the deal after PJM attempted to allocate $720.4 million of the project’s costs to it through the RTO’s Regional Transmission Expansion Plan. Two merchant transmission facilities that connect northern New Jersey to New York City — Hudson Transmission Partners and Linden VFT — were allocated $103.2 million and $9.6 million, respectively, and PSE&G was assigned $88.4 million.

FERC initially approved reassigning $530.8 million of Con Ed’s allocation to Hudson and $122 million to Linden. But that was nixed after the merchants successfully petitioned FERC to amend their interconnection service agreements and reduce their responsibility. (See NJ Merchant Tx Operators Win Relief on Upgrade Costs.)

The BPU filed its complaint just days after FERC allowed the ISA changes, arguing that PJM’s Tariff and its joint operating agreement with NYISO don’t properly allocate the costs of some RTEP projects to merchant transmission facilities and other transmission customers.

After the “wheel” was canceled, PJM and NYISO agreed to maintain a smaller 400-MW version, called the operational baseflow (OBF), until the separate systems were stabilized to operate without the flow. The BPU argued that the way the grids interact provides a benefit to NYISO for which PJM customers, specifically those in New Jersey, aren’t being compensated.

“NYISO continues to model flows over the lines previously used for the Con Edison wheeling arrangement for purposes of determining its resource adequacy requirement, while PJM models its system with little or no support from NYISO,” the BPU told FERC.

Therefore, NYISO doesn’t need to maintain as much capacity while New Jersey must procure more. PSE&G’s zone often clears separately from the rest of the RTO in PJM capacity auctions. In last week’s Base Residual Auction for the 2021/22 delivery year, for example, it cleared at $204/MW-day versus $140/MW-day for much of the RTO. (See Capacity Prices Jump in Most of PJM.)

The BPU complaint said that without the relief the regulators requested, the PSE&G locational deliverability area’s capacity costs will jump by as much as 78.6%, “or an increase of $275 million in a single year and reoccurring annually for the foreseeable future.”

Because the Bergen-Linden project was meant to address reliability issues created by the “wheel,” it’s only fair those beneficiaries should pay for them, the BPU said.

“Parties have sought to escape those costs by terminating or otherwise amending contracts,” the BPU told FERC.

NYISO responded that costs can’t be allocated in New York because the project is fully within PJM’s boundaries, and that it no longer relies on the facilities for reliability. PJM said that “it is the physical features of the transmission system in northern New Jersey that are driving the need for the BLC project.”

Con Ed, Linden, Hudson, the New York Power Authority and several other New York stakeholders argued against the complaint. PSE&G, the New Jersey Division of Rate Counsel, the Public Power Association of New Jersey, PJM’s Independent Market Monitor and other RTO stakeholders supported the complaint.

The commission agreed with opponents of the complaint that the BLC was planned solely through PJM’s RTEP, that NYISO never agreed to pay for any of it and that the PJM-NYISO JOA “does not preclude the sharing of these benefits without compensation, even if those benefits are not equal at a given point in time.”

It also said the merchant transmission facilities can have their service curtailed for reliability or economic reasons now, so they can’t effectively replicate the firm priority benefits they had before and therefore shouldn’t be held accountable for any upgrades that support that priority.

FERC declined to rule on whether those facilities should be eligible to sell capacity in NYISO, saying that was out of the scope of the complaint.