By Jason Fordney

CAISO last week provided details on its plans for major changes to improve the alignment of its day-ahead market with real-time demand by introducing more scheduling granularity and other refinements.

Nearly 150 participants joined a conference call Wednesday at which the ISO discussed technical aspects of the revised straw proposal it issued April 13. CAISO has also proposed extending the proposed changes across the Western Energy Imbalance Market (EIM).

As currently proposed, the changes would address forecasting uncertainty in the day-ahead that is currently left to the real-time market to resolve, CAISO Senior Design Policy Developer Megan Poage said during a presentation.

The proposal would introduce 15-minute scheduling in the integrated forward market, which procures the generation needed to meet forecast demand. It would also create a day-ahead imbalance reserve market product and combine the integrated forward market and residual unit commitment. The third major prong in the initiative is to procure imbalance reserves with a must-offer obligation to submit economic bids in the real-time market.

“These three elements are dependent on each other. They must all be introduced at the same time,” Poage said, adding that “We’ll be moving toward a co-optimized day-ahead market run.”

The initiative, which was announced in December, is seen as a possible forerunner for a new Western RTO market structure by introducing a day-ahead market into the EIM, which is currently only a balancing market. (See CAISO Day-ahead Could be Tailored for West.)

“Grid infrastructure has advanced, the resource fleet has changed and the policies regulating operation of the grid have evolved (i.e. FERC-mandated 15-minute scheduling in real-time energy markets),” the ISO said in the straw proposal.

The proposal is intended to help manage excess solar generation in the middle of the day and make it possible to also reduce generation output. The current structure does not allow the ISO to decommit resources that were scheduled in the integrated forward market.

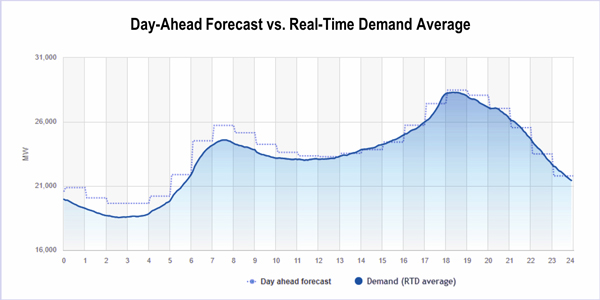

CAISO said the current hourly scheduling structure causes the day-ahead forecast to be higher than actual demand, resulting in “downward uncertainty,” in hours 1 to 12, and mismatches between day-ahead forecast and actual demand in hours 20 to 22.

Based on comments from market participants, CAISO changed the proposed 15-minute and five-minute imbalance reserves products in upward and downward directions into a single product for both directions. To address five-minute needs, CAISO would create sub-regions for the imbalance reserves product.

It also provided additional information explaining certain formulas it plans to use in the new day-ahead market, data analysis and proposed methodologies to determine imbalance reserves requirement, as well as a settlement and cost allocation worksheet for use by potential market players.

Overall, CAISO said, the changes will help decarbonize the electric grid, improve reliability as the system changes and create more market benefits across the region. The goal is to present the proposal to the EIM Governing Body in August and the ISO Board of Governors in September.