By Rich Heidorn Jr.

Unilever, which sells Breyers ice cream, Dove soap and hundreds of other consumer products, plans to eliminate coal from its energy mix by 2020. It hopes to become “carbon positive” by 2030, by supporting the generation of more renewable energy than it consumes.

Thus far, the company has used onsite solar and power purchase agreements for Texas wind power. But the company has been frustrated in its inability to do more. “If we’re buying wind in Texas and trying to get it to my plant in Virginia, in Tennessee, in Missouri … right now we’re just not able to do that,” Stefani Millie Grant, the company’s senior manager for external affairs and sustainability, said last week.

“If we’re going to actually get [renewables] … actually running our facilities, instead of just being out there buying the [renewable energy credits], we’ve got to really focus on transmission.”

Even as President Trump has moved to undo the Obama administration’s climate initiatives, large corporate energy buyers such as Unilever have accelerated their commitments to purchase carbon-free electricity. But their efforts may be frustrated because of insufficient transmission to move Midwest wind power to load centers, according to a study released by the Wind Energy Foundation. The study was the subject of a webinar last week by Americans for a Clean Energy Grid (ACEG), a coalition whose members include the Natural Resources Defense Council, WIRES, ITC Holdings and American Electric Power.

15 States Hold Most Onshore Wind

The study concluded that transmission expansions currently planned will likely be insufficient to support large corporate energy buyers’ renewable energy goals because most of the solar and wind power potential is in 15 Midwestern states, far from load centers. The 15 states hold 88% of the country’s wind technical potential and 56% of its utility-scale solar photovoltaic potential, but they are home to only 30% of projected 2050 electricity demand.

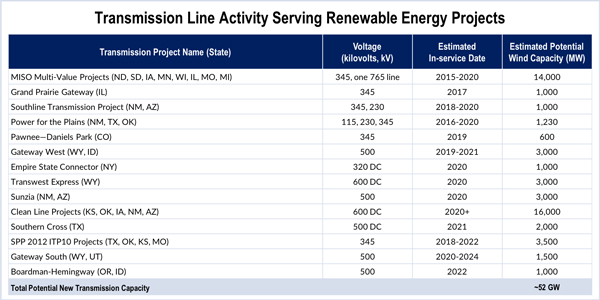

This is based on the Renewable Energy Buyers Alliance (REBA) goal of obtaining 60 GW of new renewables by 2025 and the 52 GW of new transmission capacity planned in 14 near-term projects in advanced development in MISO, SPP, PJM and NYISO (see table).

In three of the four scenarios studied, transmission would be insufficient to meet corporate renewable demand. With 9 GW of renewables procured by corporate purchasers since 2013, about 51 GW remain to meet the goal. If RTOs build 90% of the capacity in the 14 projects, only 70% of the corporate demand would be filled, the study said. If corporate procurements fall short at only 20 GW, the transmission projects would meet the corporate needs, the study said.

According to the study, one of the biggest obstacles to bringing more renewable energy online is “the absence of transmission planning across RTOs and other regional planning authorities.”

Not Counting All the Benefits

“I think that current [transmission] planning process doesn’t do an adequate job of really counting up all of the benefits, and then it doesn’t think about it … in a … broader geographic scale,” said David Gardiner, president of David Gardiner and Associates, which conducted the study for the foundation.

“We’ve built the interstate highway system in this country not because the highway system went from point A to point B, and the people along point A and point B paid for it, but because we recognized that it provides national benefits, and therefore everybody contributed nationally. We need to be thinking about how we assess the benefits and think about how we want to pay for things more along those lines than we currently are.”

The study recommends that corporate and institutional energy buyers participate in regional and interregional transmission planning and urges FERC and RTOs to improve interregional planning under Order 1000. It said RTOs should incorporate voluntary, large customer demand in transmission planning.

“While we highlight a few examples in the report of companies like Stefani’s that have engaged in some of the planning for transmission lines, it’s been limited, and we’re going to need to step up the kinds of engagement in the transmission planning process as we go forward,” Gardiner said.

Gardiner’s study found that while transmission planners “in rare instances” account for voluntary goals, such as statements by governors, they do not account for growing voluntary demand from large corporate purchasers. “Instead, RTOs typically only focus on mandatory renewable energy requirements prescribed by [renewable portfolio standards].

“If a governor issues a voluntary goal to develop 1 GW of renewable energy in the state, some RTOs would typically include assumptions to meet that 1-GW target in transmission planning models. Although the goal may not be a mandate … other RTOs do only what FERC requires, which is to ‘consider’ public policy and may ultimately opt not to include state RPSs or other policies in their plans.”

RTOs Respond

Officials of MISO, PJM and SPP told RTO Insider last week they are adding transmission for renewables as best they can under FERC transmission planning and cost allocation rules.

“Lack of transmission expansion to facilitate renewable deliveries across regions is not due to inadequate transmission planning between the regions,” said SPP Vice President of Engineering Lanny Nickell in a statement. “Rather, the lack of expansion primarily derives from the difficulty in achieving agreement among multiple groups of customers as to who receives the benefits and, thus, who should pay for transmission upgrades.”

Nickell noted that SPP and other RTOs consider varying amounts of renewable transfers between regions in their interregional transmission planning studies. “RTOs have largely addressed this issue within their regions due to FERC-approved cost allocation mechanisms for service contained in their areas. However, customers in other regions are sometimes challenged to deliver renewable energy from regions like SPP’s because they are unwilling to bear the costs of required infrastructure upgrades or because it is difficult to find other customers willing to share the costs of those upgrades that they don’t believe benefits them,” he said.

“We believe our transmission planning process does adequately address large customers’ increased demand for renewable energy,” said Eli Massey, MISO’s senior adviser for policy studies, in a statement. “MISO’s top-down transmission planning examines regional economics, and its bottom-up planning examines local load growth and reliability issues in order to optimize the transmission system. MISO’s transmission planning process already facilitates the study’s recommendation that large customers engage in the transmission planning process through the industry sector mechanism of the Planning Advisory Committee.”

PJM spokesman Ray Dotter said the RTO accounts for transmission for renewables through its markets and interconnection process.

“We do not plan or build transmission lines on speculation alone,” he said “The developers of new generation of any type are required to pay for the transmission upgrades necessary to deliver the output of their projects. The principle has been that consumers should not pay for transmission required because of generation developers.”

He noted that PJM’s state agreement approach allows states to take responsibility for the costs of transmission expansions addressing their public policy requirements. FERC approved the state agreement approach in a 2015 ruling as part of the RTO’s plan to integrate multi-driver projects into the Regional Transmission Expansion Plan (ER14-2864). (See PJM Wins OK on Multi-Driver Tx Projects.) PJM said the multi-driver concept could lower the cost of states’ public policy transmission projects by incorporating them in upgrades that address market efficiency or reliability.

Nickell said SPP considers voluntary and mandatory renewable goals in its planning assumptions. “If a wholesale customer, under the SPP Tariff, desires to buy from a new or existing renewable resource to supply the needs or goals of its customers and submits a request for transmission service from SPP, we are obligated to plan the system to accommodate the requested service, as long as the customer agrees to fund any requisite upgrades. SPP will consider any and all requests for transmission service made to deliver energy from existing or future renewable resources to prospective buyers and will direct construction of transmission upgrades on the SPP system needed to accommodate those requests in accordance with the respective customers’ service agreements.”

RPSs — which currently represent 10% of MISO’s load — are considered the base level of renewable penetration in its transmission planning modeling futures. “Large customer demand for renewable energy is included in alternative modeling futures on an additive basis that range up to 30% penetration of MISO system load,” Massey said. “We believe that level of penetration fully captures the stated goals of large customers and still leaves room for additional growth.”

Massey, who also spoke at the webinar, said it is the scheduling of transmission to deliver power under a PPA that signals load growth to MISO.

The RTO also learns of PPAs from stakeholders. “But because MISO is not a signatory to the power purchase agreement, we don’t always know about these power purchase agreements, so it’s difficult to plan in that context.”

ACEG Executive Director John Jimison, who moderated the webinar, noted that “it only takes a couple of years” to bring a wind farm or central solar plant into operation, shorter than the timeline for developing new transmission. “How do you anticipate the need for transmission so that you don’t expect people to put up a wind farm and then wait five years before they can actually transmit the power?” he asked.

Massey said MISO accounts for that disparity through its multi-value projects (MVPs). He cited the wind-rich Buffalo Ridge area of southwest Minnesota, northwest Iowa and eastern South Dakota. “We know that there’s a tremendous amount of wind capacity there, and in the current incentives regime with the production tax credit … and because the cost of wind generators is coming down rapidly, we know that there’s going to be wind locating there.”

MISO has about 37 GW of wind and 21 GW of solar in its interconnection queue. “The good news is that it takes a long time for even those plants to get through the generator interconnection process, and this gives us a little bit of lead time in the transmission planning process to identify projects that we’re going to need on a regional basis, that we can predict based on what the wind capacity is and where we know the load is,” Massey said.

Order 1000

Although Order 1000 requires RTOs to jointly plan transmission with their neighbors — and to “consider” whether needs identified in local and regional transmission plans could be addressed more cost-effectively through joint projects with a neighboring region — it does not require them to build anything.

Developers say another reason for the dearth of interregional transmission projects is disparities in regions’ competitive processes, cost allocation and means of valuing potential expansions. (See Developers Lament Lack of Tx Competition, Interregional Projects under Order 1000.)

FERC has attempted to address those concerns. In 2015, for example, it ordered MISO to adopt SPP’s cost allocation method for interregional transmission projects addressing reliability needs. (See FERC Orders MISO to Use SPP Cost Allocation Method in Reliability Projects.)

The commission will conduct a technical conference beginning Tuesday on how RTOs coordinate generator interconnection studies on projects near their seams, saying their practices may not be just and reasonable (EL18-26, AD18-8).

FERC called the conference to address issues raised in EDF Renewable Energy’s complaint against PJM, MISO and SPP last year, which contends that inconsistencies and a lack of clarity in the RTOs’ rules for “affected systems” interferes with developers’ ability to judge the commercial viability of proposed projects. An affected system is one that may be impacted by an interconnection in a neighboring “host” system.