By Rory D. Sweeney

PJM is experiencing an “unprecedented” switch from coal- to gas-fired generation while also managing the replacement of aging transmission infrastructure, staff concluded in the RTO’s annual transmission planning report.

The RTO received deactivation notices for 4,588 MW of generation in 2017, bringing the total since the end of 2011 to 34,967 MW. Deactivation requests in the eight years prior totaled 11,000 MW.

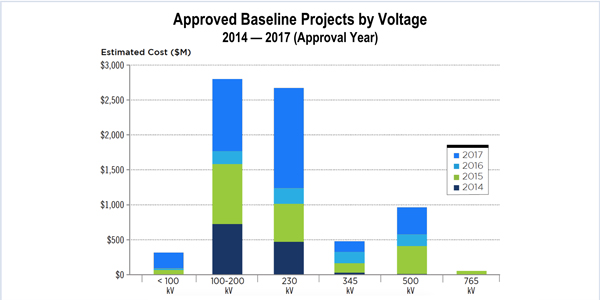

PJM greenlit $5.8 billion in transmission spending last year. That paid for 198 “baseline” projects to ensure compliance with NERC, regional and local transmission owner planning criteria, and 341 “network” projects to interconnect new generating stations. According to the RTO’s figures, that comes out to about $16 million per baseline project and about $8.6 million per network project.

On Feb. 14, PJM’s Board of Managers authorized another $397 million in transmission projects, dominated by TOs’ supplemental projects that are triggered by their own planning criteria. Transmission customers have complained about the uptick in such projects, which don’t require PJM board authorization but are included in the Regional Transmission Expansion Plan, because they believe TOs are using them to pad revenues. (See AMP Presses AEP, PSE&G on Transmission Projects.)

The recent approvals include two such efforts in the Public Service Electric and Gas and Dominion Energy territories. PSE&G plans to spend $115 million to construct a 230/69-kV substation with 69-kV ties to the Paramus and Dumont substations, and $98 million to convert the Kuller Road substation to 69/13 kV and construct a 69-kV network between the Kuller Road, Passaic, Paterson and Harvey stations. Dominion will replace existing infrastructure for a total of $50 million.

The remainder of the approvals consist of another Dominion project — $100 million to install three STATCOM dynamic reactive devices at two substations — and $29.5 million in spending spread across projects in the Baltimore Electric and Gas, PPL and Duke Energy Ohio/Kentucky territories.

Last month, FERC ordered PJM’s TOs to change their process for handling supplemental projects after finding the current approach does not comply with Order 890. TOs worked with PJM on the issue and last week proposed a plan to address the commission’s concerns (See related story, PJM, TOs Propose FERC Order 890 Compliance Plan.)

The PJM board has authorized $35.4 billion in transmission infrastructure spending since 1999. Baseline projects represent $27.9 billion of the total, with $7.2 billion authorized to interconnect 84,200 MW generation. Those figures include $181 million in cost overruns for 48 previously approved baseline projects and $540 million authorized for 336 network projects that were canceled after 257 generator interconnection requests were withdrawn, which reduced expenditures below authorized levels.

But the numbers also provide some insight into development trends. PJM said the 2017 projects address market efficiency congestion and solve local reliability issues, and recent history shows a trend toward smaller lines rather than large, backbone-sized construction.

“Flat load growth, energy efficiency, generation shifts and aging infrastructure drivers — among others — continue to shift transmission need away from large-scale, cross-system backbone projects at 345 kV, 500 kV and 765 kV voltage levels,” the report states.

The generation interconnection queue is dominated by gas-fired facilities, and the deactivation list is littered with coal plants, but the fleet won’t be changing too much any time soon. PJM estimates that oil, wind, hydro and solar will all look about the same five years from now in 2023: slightly more than 10% of the total generation fleet.

Nuclear will drop slightly from somewhat less than 20% today to about 18% in 2023. Coal will also be down from around 31% today to about 28%. Gas increases significantly from roughly 40% today to more than 45%. PJM has said it can remain reliable with upward of 86% gas. (See PJM: Increased Gas Won’t Hurt Reliability, Too Much Solar Will.)