By Rich Heidorn Jr.

FERC’s ruling last week that “resilience” is not simply a matter of onsite fuel supply won nearly universal praise outside the coal and nuclear industries.

Foley | American Council on Renewable Energy

On Tuesday, a coalition of clean energy advocates and trade groups for the wind, natural gas, solar and storage industries held a celebratory press conference where they praised the ruling as a win for consumers and a sign that the new commission — including three Republicans appointed by President Trump — will remain independent.

“FERC continues to demonstrate that it takes its independence very seriously,” said Todd Foley, senior vice president for policy and government affairs for the American Council on Renewable Energy.

Woolf | © RTO Insider

“The professionalism of the [staff and commissioners] — in looking at the question posed by the secretary based on the record before them and thoughtfully determining a path forward — I think is encouraging,” agreed Malcolm Woolf, senior vice president of policy for Advanced Energy Economy.

But while the coalition found unity in opposing Energy Secretary Rick Perry’s price supports for coal and nuclear plants, their interests may diverge in the new docket the commission ordered.

FERC directed RTOs and ISOs to answer questions on how they assess and obtain resilience. The initiative could result in proceedings that pit renewables, natural gas and storage against each other — as well as nuclear and coal — in seeking compensation for their resiliency attributes. (See FERC Rejects DOE Rule, Opens RTO ‘Resilience’ Inquiry.)

Seeking Market Solutions, Fair Competition

FERC made clear in its ruling that it did not agree with Perry’s embrace of onsite fuel storage as a resiliency panacea.

“That’s maybe one element, but it’s certainly not the only element,” Woolf said. “What really matters is overall system reliability and resilience. We saw from the bomb cyclone of the last week that a nuclear plant — Pilgrim, otherwise perfectly reliable — was forced to shut down because of transmission issues.

“We’re confident [that] as they do this, [FERC] will recognize that advanced energy technologies, including distributed energy resources, energy efficiency, demand response, storage, renewables [and] natural gas … all have a role to play in making a robust system and that the market needs to value the attributes of all of those different technologies.”

Burwen | © RTO Insider

Jason Burwen, vice president of policy for the Energy Storage Association, said at the press conference that his group will be watching “whether there will be an opportunity for market mechanisms to be employed such that the full range of resilience attributes — not just a single one like fuel assurance — can be valued and compensated. … Additionally, we look forward to seeing whether there will be a discussion of the infrastructure component of this — not simply the generator resources or demand resources side of this.”

Wiggins | U.S. Energy Association

The California Public Utilities Commission in 2013 ordered the state’s three large investor-owned utilities to add 1.3 GW of energy storage by 2024. The order implemented Assembly Bill 2514, in which the legislature ordered procurement of storage to reduce investments in new fossil fuel plants, integrate renewables and minimize greenhouse emissions.

Dena Wiggins, CEO of the Natural Gas Supply Association, said her group was “relieved” by FERC’s decision. “What we were looking for all along was a robust discussion that would value the attributes of all of the fuels. All of the fuels … bring something to the conversation.”

Whitten | SEIA

“It’s not only valuing those essential reliability services but … making sure there’s no discrimination as to who can actually compete to provide those services,” said Amy Farrell, senior vice president of government and public affairs for the American Wind Energy Association. “The market should reward the desired resilience attributes in a resource-neutral manner, with every provider being paid the same price for providing the same unit of service,” she added afterward.

“I think we’re all in violent agreement,” said Dan Whitten, vice president of communications for the Solar Energy Industries Association. “What we want is the opportunity to compete, and we think the FERC decision … presents that opportunity.”

Essential Reliability Services: Who’s in? Who’s out?

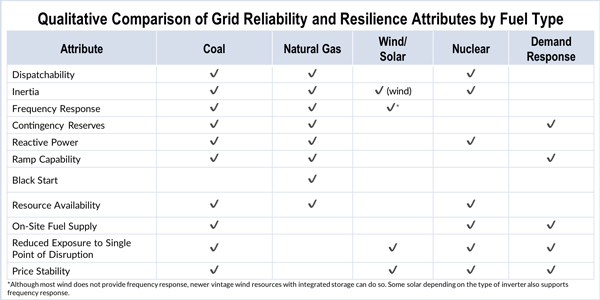

The new proceeding ordered by FERC will require the RTOs to show how they are obtaining what NERC has named “essential reliability services,” including frequency and voltage support, ramping capability, operating reserves and reactive power. (See NERC Report Urges Preserving Coal, Nuke ‘Attributes’.)

| PA Consulting Group analysis

Last August, the American Coalition for Clean Coal Electricity (ACCCE) released a PA Consulting Group study it commissioned that ranked generation resources on 11 attributes, giving coal high marks in all but black start capability. (See Echoing DOE Report, Industry Study Touts Coal ‘Resiliency’.)

The report followed a study done by The Brattle Group for the American Petroleum Institute (API), which concluded that gas-fired generation is “relatively advantaged” in all but one of the 12 attributes it identified. (See NG Lobby Goes on Offensive vs Coal, Nukes.)

The next best alternative source, according to Brattle, was pumped hydro with 10. Nuclear and coal, the potential beneficiaries of policies favoring traditional “baseload” generation, fared far worse at five and four respectively, as did wind (one) and solar (two).

| The Brattle Group

The API-Brattle report ranked coal as “neutral” on two categories for which ACCCE claimed a full score — frequency response and ramp rates (referred to as “ramp capability” by ACCCE). API did not score three categories in which ACCCE said coal had an advantage over gas: onsite fuel supply, reduced exposure to a single point of disruption and price stability.

AWEA said the API-Brattle findings are “largely consistent” with those of the Analysis Group in a report the organization commissioned. But the wind group disputed Brattle’s designation of wind as “relatively disadvantaged” in frequency response, saying wind turbines “can provide frequency response that is an order of magnitude faster than conventional power plants.”

The Nuclear Energy Institute (NEI) responded that “the Brattle study reinforces the conclusion that grid reliability would be hopelessly compromised without nuclear energy.”

NEI CEO Maria Korsnick said last week that RTOs must take “prompt and meaningful action, including on issues such as price formation.”

“The status quo, in which markets recognize only short-term price signals and ignore the essential role of nuclear generation, will lead to more premature shutdowns of well-run nuclear facilities,” she said.

GHG Emissions and Resilience

Some say resilience efforts also should consider the impact of fossil fuel generators’ emissions.

In his concurring opinion last week, new Democratic Commissioner Richard Glick noted the “irony that the [Department of Energy’s] proposed rule would exacerbate the intensity and frequency of … extreme weather events by helping to forestall the retirement of coal-fired generators, which emit significant quantities of greenhouse gases that contribute to anthropogenic climate change.”

Last month, fellow Democratic Commissioner Cheryl LaFleur said FERC’s environmental reviews of natural gas pipeline applications should consider “the downstream impacts on greenhouse gases.”

None of the three Republicans on the commission has publicly indicated they agree with the Democrats’ concerns, however. As a member of the Pennsylvania Public Utility Commission, Commissioner Robert Powelson was a strong supporter of the state’s shale gas development. Commissioner Neil Chatterjee, of Kentucky, is an unapologetic booster of coal.

“The fact is that we need an electric grid regulatory agency which prioritizes a rapid shift from dirty and dangerous fossil fuels to renewable energy and energy efficiency,” Ted Glick (no relation to Commissioner Glick), an organizer with the anti-gas group Beyond Extreme Energy, said after FERC’s rejection of the NOPR. “We doubt that FERC can become such an agency.”

Coal interests are certain to resist any new FERC rules that speed the erosion of their generation market share.

| Department of Energy, Staff Report to the Secretary on Electricity Markets and Reliability, August 23, 2017

Robert E. Murray, CEO of coal producer Murray Energy, said FERC’s ruling was a “bureaucratic cop-out” that exposed consumers to high costs and service interruptions.

“If it were not for the electricity generated by our nation’s coal-fired and nuclear power plants, we would be experiencing massive brownouts and blackouts,” he said, citing power prices that peaked at more than $500/MWh and natural gas prices that hit $175/MMBtu during the cold snap in early January. “At least 37,000 MW of supposedly natural gas-powered electricity were entirely unavailable due to the priority for home heating use and the inability of natural gas to flow at cold temperatures.”