By Rory D. Sweeney and Rich Heidorn Jr.

FERC on Thursday rejected a request by PJM to allow Linden VFT to convert the 330 MW of firm transmission on its lines between PJM and NYISO to non-firm, but the commission acknowledged it is moving forward with an investigation of the rules that required it to deny the request (ER17-2267).

The ruling mirrors one the commission made Sept. 8 in response to a similar request by Hudson Transmission Partners, which owns lines that carry 673 MW across the PJM-NYISO border (ER17-2073).

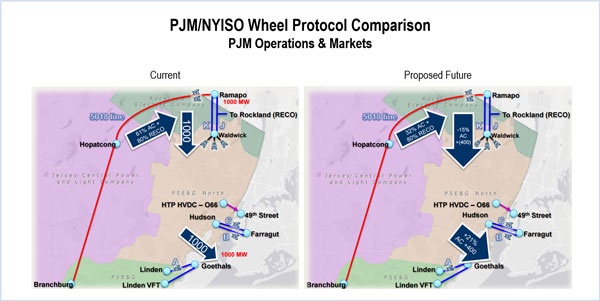

Those lines were part of a decades-old service agreement between Public Service Electric and Gas and Consolidated Edison that the latter company terminated in April. The service “wheeled” 1,000 MW from Upstate New York through PSE&G’s facilities in northern New Jersey and into New York City on the lines owned by Linden and Hudson.

A joint engineering analysis by PJM and NYISO found that continuing to wheel a 400-MW operational base flow (OBF) was the best option for maintaining system reliability. The OBF was implemented despite strong opposition from PJM stakeholders but is expected to be reduced to zero by 2021. (See NYISO Members OK End to Con Ed-PSEG Wheel.)

| PJM

In a separate order Friday, the commission approved changes to the PJM-NYISO joint operating agreement reflecting the new operational plan for the ABC and JK interfaces between New York and New Jersey, effective May 1, 2017 (ER17-905).

Linden and Hudson attempted to convert their firm transmission withdrawal rights to non-firm rights, but FERC denied both companies after PSE&G refused to accept the changes. Under the current rules, PSE&G has the right, as a party to the original interconnection service agreements (ISAs), to refuse them.

‘Preferential’ Rate

The New Jersey Board of Public Utilities, which supported PSE&G’s refusal, argued the requests are “an attempt to obtain a preferential rate for New York customers to the detriment of New Jersey ratepayers … because New York customers will continue to receive the same benefits … without any cost responsibility.” It also said the filings constitute “a collateral attack on PJM’s pending [Regional Transmission Expansion Plan] cost allocation methodology and its results in pending cost allocation proceedings” because the firm withdrawal rights are used in determining cost allocations. The changes would establish an alternative cost-allocation methodology “that would yield arbitrary results” compared to PJM’s current solution-based distribution factor (DFAX) method, the BPU said.

Following termination of the “wheel,” PJM asked FERC to reassign $533 million in costs related to the Bergen-Linden Corridor (BLC) project to Hudson, which the commission approved on April 25. The project upgrades facilities needed for the wheel. The New York Power Authority, which is contracted to use Hudson’s lines until 2033 and has taken control of the lines’ firm withdrawal rights, said the reassignment increased its allocation for the project to $645.42 million. It is seeking rehearing on the reassignment order (ER17-950).

FERC sided with PSE&G in both cases but acknowledged that the merchant transmission companies’ ISAs “may be unjust and unreasonable and unduly discriminatory” in not allowing the companies to unilaterally convert their firm transmission rights. The fact that the changes may impact PJM’s RTEP cost allocation “is a challenge to the justness and reasonableness of PJM’s RTEP cost allocation, not whether [the companies] should be able to relinquish [their firm transmission rights].”

In the Hudson case, FERC opened a separate docket (EL17-84). Linden, however, has already filed a complaint where FERC said it will address the issue (EL17-90).

Commissioner Cheryl LaFleur noted as part of the order rejecting Hudson’s request to convert its firm rights that she dissented in the order that applied the solution-based DFAX to the BLC. In certain situations, such as the short-circuit violations addressed in the BLC upgrades or the stability violations addressed by the Artificial Island project, “entities that use the lines may grossly overpay, while entities that benefit from resolution of the underlying violation underpay,” she said. (See Board Restarts Artificial Island Tx Project; Seeks Cost Allocation Fix.)

JOA Changes

In its order Friday, the commission approved revisions to interchange scheduling and market-to-market (M2M) coordination for the PJM-NYISO interfaces, finalizing a delegated order by FERC staff on March 31, when the commission lacked a quorum. The commission also rejected requests by PSE&G, the BPU and Linden to rehear the March 31 order.

The revised JOA combines the ABC and JK Interfaces with the 5018 line and the RTO’s Western ties into an aggregate PJM-NY AC proxy bus. The grid operators said the changes would make use of existing interchange scheduling constructs and support the phase angle regulators (PARs) on the interfaces. Pricing will reflect the impacts of imports and exports on the NYISO and PJM transmission systems, weighted by power flow distribution percentages.

In approving the changes, the commission:

- Rejected complaints by PSE&G that there is no reliability need for the OBF and that the changes infringe on transmission owners’ rights;

- Said Con Ed should not be charged for PJM RTEP projects, including the BLC project; and

- Rejected NRG Energy’s protest over establishing a single price for the PJM-NY AC proxy bus and its complaint that the OBF is a barrier to open access under FERC Order 888.